Correct Answer

verified

Correct Answer

verified

Multiple Choice

The IS curve represents the __________,while the LM curve represents the _________.

A) foreign exchange market; money market

B) foreign exchange market; bond market

C) goods and services market; foreign exchange market

D) goods and services market; money market

Correct Answer

verified

Correct Answer

verified

Multiple Choice

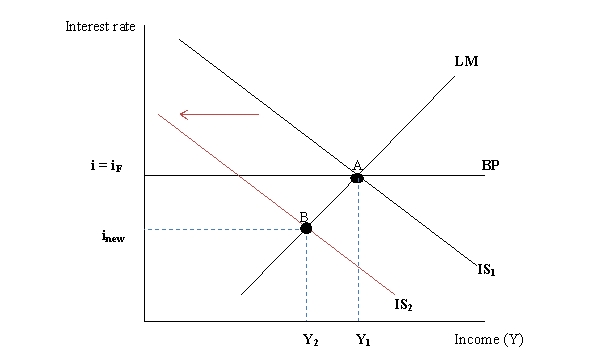

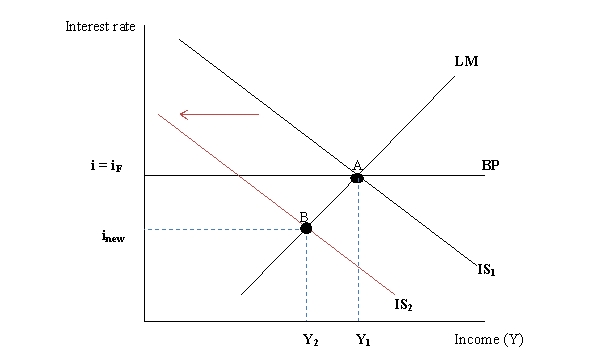

Figure 13.2  -Refer to Figure 13.2.Starting from an equilibrium point A,which of the following factors would cause the IS curve to shift to the left.

-Refer to Figure 13.2.Starting from an equilibrium point A,which of the following factors would cause the IS curve to shift to the left.

A) A tax cut

B) A decrease in money supply

C) An increase in money supply

D) A decrease in government spending

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the capital is perfectly immobile due to restrictions,then the BP curve is:

A) Horizontal

B) Vertical

C) Downward-sloping

D) Upward-sloping

Correct Answer

verified

Correct Answer

verified

True/False

"Under flexible exchange rate system,fiscal policy is ineffective,but monetary policy is effective in changing domestic income."

Correct Answer

verified

Correct Answer

verified

Multiple Choice

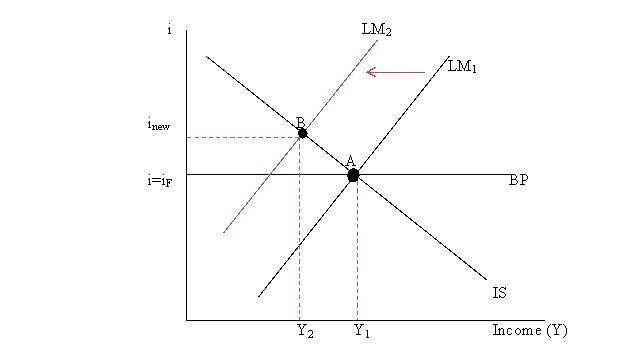

Figure 13.1  -Refer to Figure 13.1.In a fixed exchange rate regime,if an economy is experiencing external disequilibrium at point B,then to peg the exchange rate the central bank has to:

-Refer to Figure 13.1.In a fixed exchange rate regime,if an economy is experiencing external disequilibrium at point B,then to peg the exchange rate the central bank has to:

A) buy domestic currency, sell foreign currency, and shift the LM to the right.

B) buy foreign currency, sell domestic currency, and shift the LM to the right.

C) buy domestic currency, sell foreign currency, and shift the IS to the left.

D) buy foreign currency, sell domestic currency, and shift the IS to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A change in the riskiness of country's assets shifts the:

A) IS curve

B) LM curve

C) BP curve

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

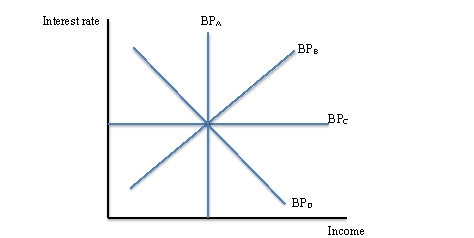

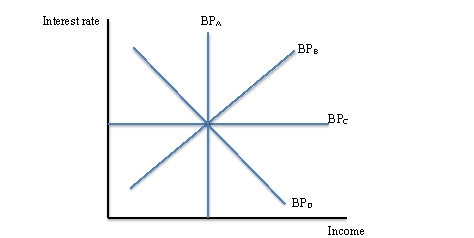

Use this graph to answer questions 21 and 22.

Figure 13.3:  -Using Figure 13.3,which of the following is correct about the BPC horizontal curve?

-Using Figure 13.3,which of the following is correct about the BPC horizontal curve?

A) It assumes perfect capital mobility.

B) It assumes perfect substitutability between domestic and foreign assets.

C) It represents equilibria in the balance of payment.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume perfect capital mobility and floating exchange rates.Then,if the central bank increases money supply,the domestic currency will _______ and cause the IS curve to ________.

A) Appreciate, shift to the right

B) Appreciate, shift to the left

C) Depreciate, shift to the right

D) Depreciate, shift to the left

Correct Answer

verified

Correct Answer

verified

True/False

The LM curve represents all the points where money supplied is equal to money demanded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A change in the monetary policy shifts the:

A) IS curve

B) LM curve

C) BP curve

D) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

With perfect substitutability and perfect capital mobility,the domestic interest rate is equal to the foreign interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A change in fiscal policy shifts the:

A) IS curve

B) LM curve

C) BP curve

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 13.2  -Refer to Figure 13.2.In a flexible exchange rate regime,if an economy is experiencing external disequilibrium at point B,then the domestic currency will:

-Refer to Figure 13.2.In a flexible exchange rate regime,if an economy is experiencing external disequilibrium at point B,then the domestic currency will:

A) depreciate, shifting the IS curve to the right.

B) depreciate, shifting the IS curve to the left.

C) appreciate, shifting the IS curve to the right.

D) appreciate, shifting the LM curve to the left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An economy starts in an equilibrium condition in three markets under flexible exchange rate regime and perfect capital mobility.If the central bank in a foreign country increases its interest rate,what would happen in the domestic country?

A) domestic currency depreciates and the IS curve shifts to the right.

B) domestic currency appreciates and the IS curve shifts to the left.

C) domestic currency depreciates and the LM curve shifts to the right.

D) domestic currency appreciates and the LM curve shifts to the left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use this graph to answer questions 21 and 22.

Figure 13.3:  -Using Figure 13.3,if a country experiences less than perfect capital mobility,the BP curve has a shape like:

-Using Figure 13.3,if a country experiences less than perfect capital mobility,the BP curve has a shape like:

A) BPA

B) BPB

C) BPC

D) BPD

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume perfect capital mobility and floating exchange rates.If the government runs a budget deficit,the domestic currency will _______ and cause the IS curve to ________.

A) Appreciate, shift to the right

B) Appreciate, shift to the left

C) Depreciate, shift to the right

D) Depreciate, shift to the left

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If,other things being equal,a country with a flexible exchange rate decreases its money supply,this will lead to _____ in the value of the country's currency,which will tend to _____ national income.

A) a depreciation; increase

B) a depreciation; decrease

C) an appreciation; increase

D) an appreciation; decrease

Correct Answer

verified

Correct Answer

verified

True/False

The internal and external equilibrium occurs when the IS curve crosses the LM curve above the BP curve.

Correct Answer

verified

Correct Answer

verified

True/False

"The balance of payment equilibrium implies that current account equals to zero."

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 54

Related Exams