Correct Answer

verified

11ea87ae_6166_d59f_8726_f931ff74079f_TB2662_00

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct for an investor company?

A) The balance in the Investment in Osprey Co. account can be reduced to represent a decline in the fair market value of the investment, but will not be adjusted if the fair market value increases.

B) Under the equity method, the balance in the Investment in Osprey Co. account can be negative if the investee corporation operates at a loss.

C) Once the balance in the Investment in Osprey Co. is reduced to zero, it will not be reduced any further.

D) Under the equity method, the balance in the Investment in Osprey Co. account will increase when cash dividends are received.

Correct Answer

verified

Correct Answer

verified

Essay

Shoreline Corporation had $3,000,000 of $10 par value common stock outstanding on January 1, 2009, and retained earnings of $1,000,000 on the same date.During 2009, 2010, and 2011, Shoreline earned net incomes of $400,000, $700,000, and $300,000, respectively, and paid dividends of $300,000, $550,000, and $100,000, respectively. On January 1, 2009, Pebble purchased 21% of Shoreline's outstanding common stock for $1,240,000.On January 1, 2010, Pebble purchased 9% of Shoreline's outstanding stock for $510,000, and on January 1, 2011, Pebble purchased another 5% of Shoreline's outstanding stock for $320,000.All payments made by Pebble that are in excess of the appropriate book values were attributed to equipment, with each block depreciable over 20 years under the straight-line method. Required: 1.What is the adjustment to Investment Income for depreciation expense for Pebble's investment in Shoreline in 2009, 2010, and 2011? 2.What will be the December 31, 2011 balance in the Investment in Shoreline account after all adjustments have been made?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bart Company purchased a 30% interest in Simpson Corporation on January 1, 2008, and Bart accounted for its investment in Simpson under the equity method for the next 3 years.On January 1, 2011, Bart sold one-half of its interest in Simpson after which it could no longer exercise significant influence over Simpson.Bart should

A) continue to account for its remaining investment in Simpson under the equity method for the sake of consistency.

B) adjust the investment in Simpson account to one-half of its original amount and account for the remaining 15% interest using the equity method.

C) account for the remaining investment under the cost method, using the investment in Simpson account balance immediately after the sale as the new cost basis.

D) adjust the investment account to one-half of its original amount (one-half of the purchase price in 2008) , and account for the remaining 15% investment under the cost method.

Correct Answer

verified

Correct Answer

verified

Essay

For 2010, 2011, and 2012, Squid Corporation earned net incomes of $40,000, $70,000, and $100,000, respectively, and paid dividends of $24,000, $32,000, and $44,000, respectively.On January 1, 2010, Squid had $500,000 of $10 par value common stock outstanding and $100,000 of retained earnings. On January 1 of each of these years, Albatross Corporation bought 5% of the outstanding common stock of Squid paying $37,000 per 5% block on January 1, 2010, 2011, and 2012.All payments made by Albatross in excess of book value were attributable to equipment, which is depreciated over five years on a straight-line basis. Required: 1.Assuming that Albatross uses the cost method of accounting for its investment in Squid, how much dividend income will Albatross recognize for each of the three years and what will be the balance in the investment account at the end of each year? 2.Assuming that Albatross has significant influence and uses the equity method of accounting (even though its ownership percentage is less than 20%), how much net investee income will Albatross recognize for each of the three years?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pinkerton Inc.owns 10% of Sable Company.In the most recent year, Sable had net earnings of $40,000 and paid dividends of $6,000.Pinkerton's accountant mistakenly assumed Pinkerton had considerable influence over Sable and used the equity method instead of the cost method.What is the impact on the investment account and net earnings, respectively?

A) By using the equity method, the accountant has understated the investment account and overstated the net earnings.

B) By using the equity method, the accountant has overstated the investment account and understated the net earnings.

C) By using the equity method, the accountant has understated the investment account and understated the net earnings.

D) By using the equity method, the accountant has overstated the investment account and overstated the net earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In reference to the determination of goodwill impairment, which of the following statements is correct?

A) The goodwill impairment test under FASB 142 is a three-step process.

B) If the reporting unit's fair value exceeds its carrying value, goodwill is unimpaired.

C) Under FASB 142, firms must first compare carrying values (book values) at the firm level.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Essay

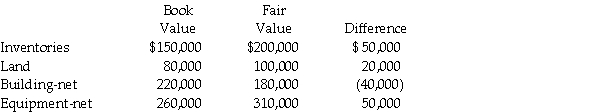

Paster Corporation was seeking to expand its customer base, and wanted to acquire a company in a market area it had not yet served.Paster determined that the Semma Company was already in the market they were pursuing, and on January 1, 2011, purchased a 25% interest in Semma to assure access to Semma's customer base.Paster paid $800,000, at a time when the book value of Semma's net equity was $3,000,000.Semma's book values equaled their fair values except for the following items:

Required:

Prepare a schedule to allocate any excess purchase cost to identifiable assets and goodwill.

Required:

Prepare a schedule to allocate any excess purchase cost to identifiable assets and goodwill.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income from an equity method investee is reported on one line of the investor company's income statement except when

A) the cost method is used.

B) the investee has extraordinary items.

C) the investor company is amortizing cost-book value differentials.

D) the investor company changes from the cost to the equity method.

Correct Answer

verified

Correct Answer

verified

Essay

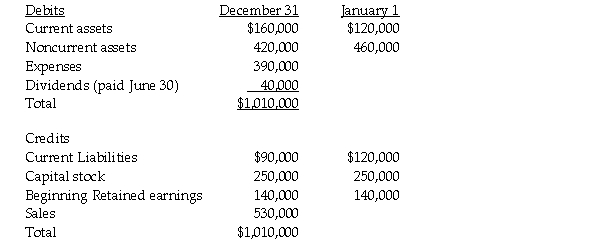

On January 1, 2010, Platt Corporation purchased a 30% interest in Sandig Company for $450,000.On this date, the fair values of Sandig's assets and liabilities are assumed to be the same as their book values.Platt will account for Sandig using the equity method.Sandig's adjusted trial balance at the date of acquisition and year end were as follows:

Required:

1.What is Platt's investment income from Sandig for the year ending December 31, 2010?

2.Calculate Platt's investment in Sandig at year end December 31, 2010.

Required:

1.What is Platt's investment income from Sandig for the year ending December 31, 2010?

2.Calculate Platt's investment in Sandig at year end December 31, 2010.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pyming Corporation accounts for its 40% investment in Sillabog Company using the equity method.On the date of the original investment, fair values were equal to the book values except for a patent, which cost Pyming an additional $40,000.The patent had an estimated life of 10 years.Sillabog has a steady net income of $20,000 per year and consistently pays out 40% of its net income as dividends to its shareholders.Which one of the following statements is correct?

A) The net change in the investment account for each full year will be a debit of $8,000.

B) The net change in the investment account for each full year will be a debit of $4,800.

C) The net change in the investment account for each full year will be a debit of $800.

D) The net change in the investment account for each full year will be a credit of $800.

Correct Answer

verified

Correct Answer

verified

Essay

On January 2, 2010, Slurg Corporation paid $600,000 to acquire 20% interest in Padwaddy Inc.At that time, the book value of Padwaddy's stockholders' equity included $700,000 of common stock and $1,800,000 of retained earnings.All the excess purchase cost over the book value acquired was attributable to a patent with an estimated life of 10 years.Padwaddy paid $6,250 of dividends each quarter for the next two years, and reported net income of $180,000 for 2010 and $220,000 for 2011.Slurg recorded all activities related to their investment using the equity method. Required: 1.Calculate Slurg's income from Padwaddy for 2010. 2.Calculate Slurg's income from Padwaddy for 2011. 3.Determine the balance of Slurg's Investment in Padwaddy account on December 31, 2011.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In reference to intercompany transactions between an investor and an investee, when the investor can significantly influence the investee, which of the following statements is correct, assuming that the investor is using the equity method?

A) There is the presumption of arms-length bargaining between the related parties.

B) As long as the investor recognizes the effects of the transaction in its financial statements, it is not required to provide any additional disclosures.

C) In reporting its share of earnings and losses of an investee, the investor must eliminate the effect of profits and losses on the intercompany transactions until they are realized.

D) None of the above is correct.

Correct Answer

verified

C

Correct Answer

verified

Essay

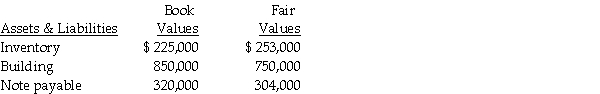

On January 1, 2010, Palgan, Co.purchased 75% of the outstanding voting common stock of Somil, Inc., for $1,500,000.The book value of Somil's net equity on that date was $2,000,000.Book values were equal to fair values except as follows:

Required:

Prepare a schedule to allocate any excess purchase cost to specific assets and liabilities.

Required:

Prepare a schedule to allocate any excess purchase cost to specific assets and liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor uses the cost method of accounting for its investment in common stock.During the current year, the investor received $25,000 in dividends, an amount that exceeded the investor's share of the investee company's undistributed income since the investment was acquired.The investor should report dividend income of what amount?

A) $25,000

B) $25,000 less the amount in excess of its share of undistributed income since the investment was acquired

C) $25,000 less the amount that is not in excess of its share of undistributed income since the investment was acquired

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Panda Corporation purchased 100,000 previously unissued shares of Skunk Company's $10 par value common stock directly from Skunk for $2,200,000.Skunk's stockholders' equity immediately before the investment by Panda consisted of $3,000,000 of common stock and $4,800,000 in retained earnings.What is Panda's book value of equity in the net assets of Skunk?

A) $2,200,000

B) $2,500,000

C) $3,000,000

D) $3,333,000

Correct Answer

verified

Correct Answer

verified

Essay

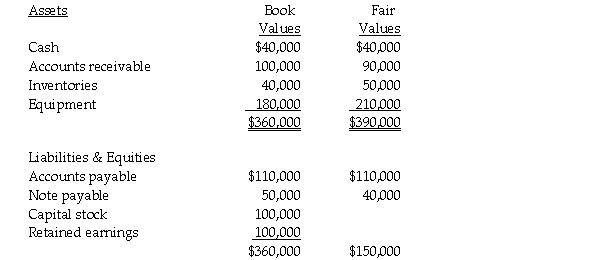

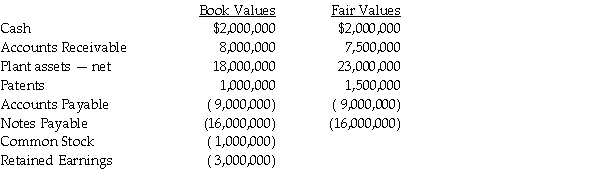

On January 1, 2011, Pendal Corporation purchased 25% of the outstanding common stock of Sedda Corporation for $100,000 cash.Book value and fair value of Sedda's assets and liabilities at the time of acquisition are shown below.

Required:

Prepare an allocation schedule for Pendal's investment in Sedda.

Required:

Prepare an allocation schedule for Pendal's investment in Sedda.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Griffon Incorporated holds a 30% ownership in Duck Corporation.Griffon should use the equity method under which of the following circumstances?

A) Griffon has surrendered significant stockholder rights by agreement between Griffon and Duck.

B) Griffon has been unable to secure a position on the Duck Corporation's Board of Directors.

C) Griffon has inadequate or untimely information to apply the equity method.

D) The ownership of Duck Corporation is diverse.

Correct Answer

verified

Correct Answer

verified

Essay

Keynse Company owns 70% of Subdia Incorporated.The Investment in Subdia qualifies as a business reporting unit under FASB 142, and Keynse has reported goodwill in the amount of $200,000 with respect to its acquisition of Subdia.Subdia's $10 par common stock is currently trading for $92 per share, Subdia's account book balances and related fair values at December 31, 2011 are shown below.

Required: Determine if Goodwill has been impaired, and if so, the amount of adjustment that would be required.

Required: Determine if Goodwill has been impaired, and if so, the amount of adjustment that would be required.

Correct Answer

verified

Step 1: Determine if goodwill is impaired.Compare book value of reporting unit to fair value of reporting unit.(Book value of reporting unit includes goodwill.)

11ea87ae_6167_4ad7_8726_09f47e1dcef1_TB2662_00 If the reporting unit's fair value exceeds its book value(with goodwill), goodwill is not impaired.In this case, the reporting unit's fair value exceeds its book value, so goodwill is not impaired.No adjustment is required.No further work is needed.

Correct Answer

verified

Multiple Choice

Which one of the following items, originally recorded in the Investment in Falcon Co.account under the equity method, would not be systematically used to reduce investment income on a periodic basis?

A) Amortization expense of goodwill

B) Depreciation expense on the excess fair value attributed to machinery

C) Amortization expense on the excess fair value attributed to lease agreements

D) Interest expense on the excess fair value attributed to long-term bonds payable

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 39

Related Exams