A) The year-end must be the same day of the week in all years.

B) The year cannot contain more than 366 calendar days.

C) Every four years, there will be only 51 weeks.

D) The year cannot end on a Sunday.

E) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the IRS requires a taxpayer to change accounting methods:

A) The taxpayer may be subject to penalties and interest.

B) The taxpayer generally is required to make the change as of the beginning of the earliest open year.

C) The adjustments due to the change cannot be spread over subsequent years.

D) Only a.and b.are correct.

E) a., b., and c.are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gray Company, a calendar year taxpayer, allows customers to return defective merchandise for a full refund within 30 days of the purchase.In 2012, the company refunded $400,000 for claims involving sales.The $400,000 consisted of $350,000 in refunds from 2012 sales and $50,000 in refunds from 2011 sales.All of the refunds from 2011 sales were for claims filed in 2011 and were paid in January and February 2012.At the end of 2012, the company had $12,000 in refund claims for sales in 2012 for which payment had been approved.These claims were paid in January 2013.Also in January 2013, the company received an additional $30,000 in claims for sales in 2012.This $30,000 was paid by Gray in February 2013.With respect to the above, Gray can deduct:

A) $350,000 in 2012.

B) $362,000 in 2012.

C) $392,000 in 2012.

D) $442,000 in 2012.

E) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

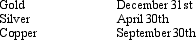

Gold Corporation, Silver Corporation, and Copper Corporation are equal partners in the GSC Partnership.The partners' tax year-ends are as follows:

A) The partnership is free to elect any tax year.

B) The partnership may use any of the 3 year-end dates that its partners use.

C) The partnership must use a September 30th year-end.

D) The partnership must use a April 30th year-end.

E) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Karen, an accrual basis taxpayer, sold goods in December 2012 for $20,000.The customer was unable to pay cash.So the customer gave Karen a note for $20,000 that was payable in April 2013.The note bore interest at the Federal rate.The fair market value of the note at the end of 2012 was $18,000.Karen collected $20,500 from the customer in April 2013, $20,000 principal plus $500 interest. Under the accrual method, Karen must recognize income of:

A) $20,500 in 2013.

B) $18,000 in 2012 and $2,500 in 2013.

C) $20,000 in 2012 and $500 in 2013.

D) $20,500 in 2013

E) None of the above.

Correct Answer

verified

Correct Answer

verified

True/False

Alice, Inc., is an S corporation that has been in business for five years.Its annual gross receipts have never exceeded $1 million. The corporation operates a retail store and also owns rental property.The sales from the retail store and the rental income may be reported by the cash method, unless Alice previously elected the accrual method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

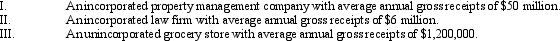

Which of the following must use the accrual method of accounting?

A) All of the above must use the accrual method.

B) None of the above must use the accrual method.

C) Only I and II must use the accrual method.

D) Only I and III must use the accrual method.

E) Only III must use the accrual method.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 87 of 87

Related Exams