A) F$33,000: M $22,000

B) $.036 per sales dollar

C) F$.0611: M $.0917 per sales dollar

D) F$36,667: M $18,333

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost driver that is a volume based cost driver is:

A) labour hours

B) number of set-ups

C) number of employees

D) all are volume based cost drivers

Correct Answer

verified

Correct Answer

verified

True/False

As the number of cost pool increases the accuracy of the cost information decreases.

Correct Answer

verified

Correct Answer

verified

True/False

Support department cost allocations should never be made when the information is to be used to evaluate the performance of an operating department manager.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement concerning the step-down method of allocating support department costs is not correct?

A) The method allocates costs one department at a time

B) The cost object in the allocation exercise is the support departments and the operating departments

C) The method recognises that support departments provide support for other support departments

D) The allocation process begins with the support department that provides the least service to the other support departments

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these statements concerning the determination of the full cost of a cost object is not true?

A) direct costs are traced via source documentation

B) full cost includes only manufacturing costs

C) indirect costs are allocated via the use of a cost driver

D) none of the statements is untrue

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

When discussing costing the indirect cost rate is:

A) the rate used to assign indirect costs to the cost object

B) the total costs incurred for a cost object

C) the input or activity that causes changes in total costs for a cost object

D) the method used to allocate the costs of each support department to the operating departments

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The allocation method for support department costs that allocates fixed and variable costs separately is:

A) the direct method

B) the step-down method

C) the reciprocal method

D) the dual-rate method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The allocation method for support department costs that can manipulate the costs allocated by changing the order of the support department cost allocation is:

A) the direct method

B) the step-down method

C) the reciprocal method

D) the dual-rate method

Correct Answer

verified

B

Correct Answer

verified

True/False

The allocation of indirect costs to cost objects is likely to be inaccurate if the allocation base used is not a cost driver.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reason for allocating indirect costs is:

A) for pricing decisions

B) to comply with external reporting requirements

C) to remind departmental managers of the full impact of their decisions

D) all of the above

Correct Answer

verified

Correct Answer

verified

True/False

The allocation order of support department costs does not matter if the reciprocal method of allocation is used

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

The distinction between direct costs and indirect costs depends on their traceability to

A) a cost object

B) a manufacturing operation

C) an activity

D) a product

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales Smart allocates indirect labour costs to its two departments, F and M using number of employees per department as the cost driver. For the current year the number of employees in department F are estimated to be 80 and for M department 45 and total indirect labour costs for the departments are budgeted at $2,400,000. The amount allocated to the departments are:

A) F $1,536,000: M $864,000

B) F$800,000: M $1,600,000

C) F $1,920,000: M $1,080,000

D) F $1,600,000: M $800,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these cost drivers is not subjective?

A) benefits received

B) fairness

C) cause and effect

D) all are subjective

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the cost object is the payroll department in a large manufacturing firm which of these would be a direct cost?

A) The raw materials cost of the products produced

B) A share of the building space occupied based on percentage of floor space used

C) the payroll department manager's yearly bonus payment

D) The salaries of the shop floor employees that are paid by the payroll department staff

Correct Answer

verified

Correct Answer

verified

True/False

Support department cost allocation is necessary for the preparation of externally issued financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these departments would not be considered a support department for a manufacturer of bathroom fittings?

A) accounts

B) security

C) computing departments

D) none of the above, i.e. all would be considered support departments for a manufacturer

Correct Answer

verified

Correct Answer

verified

Multiple Choice

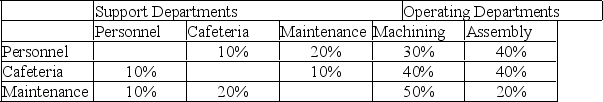

Trucker industries provides the following information about departmental consumption of allocation bases for its 3 support and 2 operating departments.  For the step-down method, what proportion of the Cafeteria's costs will be allocated to the Maintenance Department if the allocation order is Personnel, Cafeteria and Maintenance?

For the step-down method, what proportion of the Cafeteria's costs will be allocated to the Maintenance Department if the allocation order is Personnel, Cafeteria and Maintenance?

A) 11.1%

B) 10%

C) 8.1%

D) 30%

Correct Answer

verified

Correct Answer

verified

True/False

Direct costs are costs that can be directly linked to a cost object by physical tracking.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 45

Related Exams