A) limited liability partnership

B) general partnership

C) limited liability company

D) corporation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accumulated depreciation is normally associated with which asset on the Balance Sheet?

A) Inventory

B) Accounts receivable

C) Land

D) Property,plant and equipment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Federal income taxes are paid by ________ in a limited liability company.

A) the company

B) limited partners only

C) general partners only

D) members

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The International Accounting Standards Board is responsible for establishing:

A) the code of professional conduct for accountants.

B) the Securities and Exchange Commission.

C) Generally Accepted Accounting Principles used in the United States.

D) International Financial Reporting Standards.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are true statements about the entity assumption EXCEPT for:

A) the entity assumption draws a sharp boundary around each entity.

B) the transactions of the business cannot be combined with the transactions of the owner.

C) the entity assumption ensures that the business will continue indefinitely.

D) under the entity assumption,the entity is any organization that stands apart as a separate economic unit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current assets as reported on the Balance Sheet do NOT include:

A) cash equivalents.

B) inventory.

C) prepaid insurance.

D) goodwill.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An entity's equity consists of two accounts,Amy Jones,Capital,and Mindy Lenz,Capital.This indicates the entity is a:

A) proprietorship.

B) corporation.

C) not-for-profit.

D) partnership.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a CORRECT statement about long-term assets?

A) Accumulated depreciation increases the cost of property,plant,and equipment on the balance sheet.

B) Intangible assets are long-term assets with no physical form.

C) Long-term investments can never be sold by the company.

D) Other long-term assets include supplies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owners' equity of any business is equal to:

A) revenues minus expenses.

B) assets minus liabilities.

C) assets plus liabilities.

D) paid-in capital plus assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advantages of a corporation include:

A) each stockholder can enter into agreements that legally bind all the stockholders.

B) the double taxation of distributed profits.

C) limited liability of the stockholders for the corporation's debts.

D) each stockholder can conduct business in the name of the corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The portion of net income that the company has kept over a period of years and not used for dividends is called:

A) common stock.

B) retained earnings.

C) revenue.

D) gross profit.

Correct Answer

verified

Correct Answer

verified

True/False

The two main components of stockholders' equity are paid-in capital and dividends.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

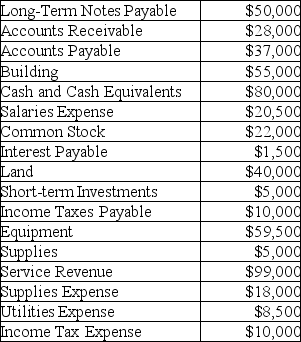

Potter Company reports the following line items:  What is net income?

What is net income?

A) $22,000

B) $42,000

C) $62,500

D) $99,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following line items are found on the income statement EXCEPT for:

A) cost of goods sold.

B) interest expense.

C) operating expense.

D) dividends declared.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's balance sheet:

A) is dated for a period of time.

B) has three main categories of assets.

C) has two main categories of liabilities.

D) lists liabilities before assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following line items are found on the Statement of Cash Flows EXCEPT for:

A) net cash used by investing activities.

B) net cash provided by operating activities.

C) net cash used by financing activities.

D) total stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

Since we live in a global economy,all countries have adopted the same accounting standards for business transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which financial statement reports cash payments and cash receipts over a period of time?

A) statement of retained earnings

B) income statement

C) balance sheet

D) statement of cash flows

Correct Answer

verified

Correct Answer

verified

True/False

Accounting is moving in the direction of reporting more and more assets and liabilities at their fair values.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major types of transactions that affect retained earnings are:

A) paid-in capital and common stock.

B) assets and liabilities.

C) revenues,expenses,and dividends.

D) revenues and liabilities.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 177

Related Exams