Correct Answer

verified

Correct Answer

verified

Multiple Choice

Perfect Catering Company's ending inventory was $106,700 at historical cost and $113,500 at current replacement cost.Before consideration of the lower-of-cost-or-market rule,the company's cost of goods sold was $60,000.Following U.S.GAAP,which of the following statements reflect the correct application of the lower-of-cost-or-market rule?

A) The Ending Inventory balance will be $106,700,and Cost of Goods Sold will be $60,000.

B) The Ending Inventory balance will be $113,500,and Cost of Goods Sold will be $60,000.

C) The Ending Inventory balance will be $106,700,and Cost of Goods Sold will be $66,800.

D) The Ending Inventory balance will be $113,500,and Cost of Goods Sold will be $53,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

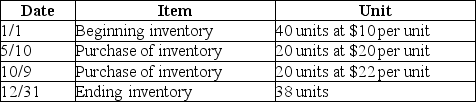

Given the following data,calculate the cost of goods sold using the average-cost method.Round your calculations to two decimal places.

A) $420.

B) $651.

C) $840.

D) $924.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If inventory costs are rising and a company is using LIFO,large purchases of inventory near the end of the year will:

A) increase income taxes paid.

B) decrease income taxes paid.

C) not change the amount of income taxes paid.

D) cannot be determined.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Speedy Corporation reported net income of $425,000 for the current year.After the financial statements had been prepared,it was discovered that ending inventory had been understated by $25,000.If the tax rate is 40%,after the error has been corrected,net income will:

A) increase by $15,000.

B) decrease by $15,000.

C) increase by $25,000.

D) decrease by $25,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the periodic inventory system,which of the following entries is prepared at the end of the accounting period?

A) debit Purchases and credit Cost of Goods Sold

B) debit Cost of Goods Sold and credit Inventory

C) debit Cost of Goods Sold and credit Purchases

D) B and C

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following costs would be included in the cost of inventory EXCEPT for:

A) insurance while in transit from seller.

B) costs to get inventory ready for sale.

C) taxes paid on the purchase price.

D) sales commission given to salesperson when the inventory is sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

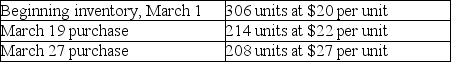

Summertime had the following data for the month of March:  At March 31,300 units are still on hand.Determine the cost of goods sold for March if Summertime uses the FIFO method.

At March 31,300 units are still on hand.Determine the cost of goods sold for March if Summertime uses the FIFO method.

A) $6,020

B) $7,525

C) $8,804

D) $10,434

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Postotnik Construction Company has ending inventory with a historical cost of $630,000.Assume the company uses the perpetual inventory system.The current replacement cost of the inventory is $608,000.The net realizable value is $650,000.Before any adjustments at the end of the period,the cost of goods sold account has a balance of $900,000.What journal entry is required under IFRS?

A) No journal entry is required.

B) debit Cost of Goods Sold $20,000 and credit Inventory $20,000

C) debit Inventory $20,000 and credit Cost of Goods Sold $20,000

D) debit Cost of Goods Sold $22,000 and credit Inventory $22,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ending inventory for the year ended December 31,2015,is understated by $8,000.How will this error affect net income for 2016?

A) Net income will be understated by $16,000.

B) Net income will be overstated by $16,000.

C) Net income will be understated by $8,000.

D) Net income will be overstated by $8,000.

Correct Answer

verified

Correct Answer

verified

True/False

In a perpetual inventory system,a business maintains a continuous record of the number of units purchased,sold and on hand for each inventory item.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Boston Company sells twenty items for $1,000 per unit,and has a cost of goods sold percentage of 70%.The gross profit to be reported for selling 20 items is:

A) $300.

B) $6,000.

C) $14,000.

D) $20,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Following IFRS,the lower-of-cost-or-market rule requires a company to report inventories at the lower of:

A) historical cost or current sales price.

B) historical cost or net realizable value.

C) current replacement cost or historical cost.

D) FIFO cost or LIFO cost.

Correct Answer

verified

Correct Answer

verified

True/False

The choice of an inventory costing method does not impact a company's balance sheet.

Correct Answer

verified

Correct Answer

verified

True/False

When inventory costs are rising,FIFO allows managers to manipulate net income by timing the purchases of inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 1,the Corrao Company purchased $1,000 of inventory on account with credit terms of 2/10,net 30.Corrao Company uses the perpetual inventory system.On July 5,the Corrao Company paid the amount due.What journal entry did they prepare on July 5?

A) debit Accounts Receivable for $1,000 and credit Cash for $1,000

B) debit Accounts Payable for $1,000,credit Inventory for $20 and credit Cash for $980

C) debit Purchase Discount for $20,debit Accounts Payable for $960 and credit Cash for $980

D) debit Accounts Payable for $980 and credit Cash for $980

Correct Answer

verified

Correct Answer

verified

Multiple Choice

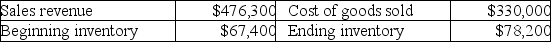

Marian Company has the following items for the month of July:  Inventory turnover is:

Inventory turnover is:

A) 3.96.

B) 4.22.

C) 4.53.

D) 4.90.

Correct Answer

verified

Correct Answer

verified

True/False

The Cost of Goods Sold Model can be used to estimate ending inventory.

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses LIFO for tax purposes,they must use LIFO for financial reporting purposes.

Correct Answer

verified

Correct Answer

verified

True/False

The weighted-average cost per unit is calculated as the cost of goods available for sale divided by the number of units sold.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 155

Related Exams