Correct Answer

verified

Correct Answer

verified

True/False

A decrease in the firm's discount rate (r) will increase NPV, which could change the accept/reject decision for a potential project.However, such a change would have no impact on the project's IRR, hence on the accept/reject decision under the IRR method.

Correct Answer

verified

Correct Answer

verified

True/False

Net supplemental operating cash flow is calculated by adding back the change in depreciation to the change in income after taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two projects being considered by a firm are mutually exclusive and have the following projected cash flows:  Based only on the information given, which of the two projects would be preferred, and why?

Based only on the information given, which of the two projects would be preferred, and why?

A) Project A, because it has a shorter payback period.

B) Project B, because it has a higher IRR.

C) Indifferent, because the projects have equal IRRs.

D) Include both in the capital budget, since the sum of the cash inflows exceeds the initial investment in both cases.

E) Choose neither, since their NPVs are negative.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a project has normal cash flows (i.e., the initial cash flow is negative, and all other cash flows are positive) .Which of the following statements is most correct?

A) All else equal, a project's IRR increases as the required rate of return declines.

B) All else equal, a project's NPV increases as the required rate of return declines.

C) All else equal, a project's IRR is unaffected by changes in the required rate of return.

D) Answers a and b are both correct.

E) Answers b and c are both correct.

Correct Answer

verified

Correct Answer

verified

True/False

In its most general sense, capital budgeting is concerned both with the demand for and the supply of funds for long-term investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stanton Inc.is considering the purchase of a new machine which will reduce manufacturing costs by $5,000 annually and increase earnings before depreciation and taxes by $6,000 annually.Stanton will use the MACRS method to depreciate the machine, and it expects to sell the machine at the end of its 5-year operating life for $10,000 before taxes.Stanton's marginal tax rate is 40 percent, and it uses a 9 percent required rate of return to evaluate projects of this type.If the machine's cost is $40,000, what is the project's NPV?

A) $1,014

B) $2,292

C) $7,550

D) $817

E) $5,040

Correct Answer

verified

Correct Answer

verified

Multiple Choice

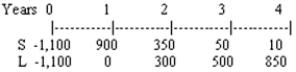

Ryngaert Industries uses the NPV method to establish its capital budget, and it is now considering two mutually exclusive projects whose after-tax cash flows are shown below:  If the required rate of return is below some rate, then Project L should be selected, whereas if the required rate of return is above that rate then Project S should be selected.What is the "crossover" rate at which the NPV profiles of these projects intersect?

If the required rate of return is below some rate, then Project L should be selected, whereas if the required rate of return is above that rate then Project S should be selected.What is the "crossover" rate at which the NPV profiles of these projects intersect?

A) 5.21%

B) 7.55%

C) 11.88%

D) 15.66%

E) 18.14%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Regarding the net present value of a replacement decision, which of the following statements is false?

A) The present value of the after-tax cost reduction benefits resulting from the new investment is treated as an inflow.

B) The after-tax market value of the old equipment is treated as an inflow at t = 0 (initial investment outlay) .

C) The present value of depreciation expenses on the new equipment, multiplied by the tax rate, is treated as an inflow.

D) Any loss on the sale of the old equipment is multiplied by the tax rate and is treated as an outflow at t = 0 (initial investment outlay) .

E) An increase in net working capital is treated as an outflow when the project begins (initial investment outlay) and as an inflow when the project ends (terminal cash flow) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In theory, the decision maker should view market risk as being of primary importance.However, within-firm, or corporate, risk is relevant to a firm's

A) Well-diversified stockholders, because it may affect debt capacity and operating income.

B) Management, because it affects job stability.

C) Creditors, because it affects the firm's credit worthiness.

D) All of the above are correct.

E) Only answers a and c are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Uncertainty regarding the domestic flows that result from converting foreign cash flows is what type of risk?

A) Repatriation

B) Expropriation

C) Exchange Rate

D) Political

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Capital budgeting analysis for expansion and replacement projects is essentially the same because the types of cash flows involved are the same.

B) The replacement decision involves an analysis of two independent projects where the relevant cash flows include the initial investment, additional depreciation, and the terminal value.

C) The change in working capital for a project is the difference between the required increase in current assets and the spontaneous increase in current liabilities and is always positive.

D) The supplemental operating cash flow for capital budgeting includes return on invested capital, which is net income, and return of part of invested capital, which is depreciation.

E) When a firm implements a project which requires an increase in working capital, both the increase in current assets and current liabilities must be financed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company is planning to open a new gold mine which will cost $3.0 million to build, with the expenditure occurring at the end of the year three years from today.The mine will bring year-end after-tax cash inflows of $2.0 million at the end of the two succeeding years, and then it will cost $0.5 million to close down the mine at the end of the third year of operation.What is this project's IRR?

A) 14.36%

B) 10.17%

C) 17.42%

D) 12.70%

E) 21.53%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a project's NPV exceeds zero,

A) The project will also be acceptable using payback criteria.

B) The IRR should be calculated to insure that the project's projected rate of return exceeds the required rate of return.

C) The project should be accepted without any further consideration, assuming we are confident that the cash flows and the required rate of return have been properly estimated.

D) Only answers a and c are correct.

E) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

True/False

When calculating the cash flows for a project, you should include interest payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

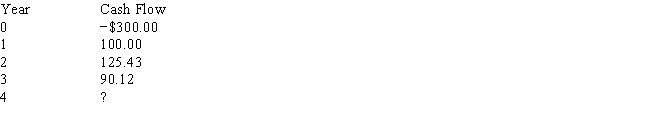

Foster Industries has a project which has the following cash flows:  What cash flow will the project have to generate in the fourth year in order for the project to have an internal rate of return of 15 percent?

What cash flow will the project have to generate in the fourth year in order for the project to have an internal rate of return of 15 percent?

A) $15.55

B) $58.95

C) $100.25

D) $103.10

E) $150.75

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An insurance firm agrees to pay you $3,310 at the end of 20 years if you pay premiums of $100 per year at the end of each year of the 20 years.Find the internal rate of return to the nearest whole percentage point.

A) 9%

B) 7%

C) 5%

D) 3%

E) 11%

Correct Answer

verified

Correct Answer

verified

True/False

It is possible with a replacement project that the incremental depreciation cash flows will be negative even if the actual depreciation on the new asset is positive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following capital budgeting methods might not consider the salvage value of a machine being considered for purchase?

A) Internal rate of return.

B) Net present value.

C) Payback.

D) Discounted payback.

E) Answers c and d are both correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below:  The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.)

The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.)

A) 13.09%

B) 12.00%

C) 17.46%

D) 13.88%

E) 12.53%

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 201

Related Exams