Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the weighted average method for inventory costing. At the beginning of a period the production department had 20,000 units in beginning Work in Process inventory which were 40% complete; the department completed and transferred 165,000 units. At the end of the period, 22,000 units were in the ending Work in Process inventory and are 75% complete. Compute the number of equivalent units produced by the department.

A) 165,000.

B) 181,500.

C) 187,000.

D) 145,000.

E) 173,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

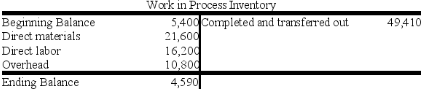

The following is an account for a production department, showing its costs for one month:  Assume that materials are added at the beginning of the production process and that direct labor and overhead are applied uniformly. If the started and completed units cost $41,850, what was the cost of completing the units in the beginning Work in Process inventory?

Assume that materials are added at the beginning of the production process and that direct labor and overhead are applied uniformly. If the started and completed units cost $41,850, what was the cost of completing the units in the beginning Work in Process inventory?

A) $54,000.

B) $2,160.

C) $12,150.

D) $37,260.

E) $7,560.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pitt Enterprises manufactures jeans. All materials are introduced at the beginning of the manufacturing process in the Cutting Department. Conversion costs are incurred uniformly throughout the manufacturing process. As the cutting of material is completed, the pieces are immediately transferred to the Sewing Department. Information for the Cutting Department for the month of May follows. Work in Process, May 1 (50,000 units, 100% complete for direct materials, 40% complete with respect to conversion costs; includes $70,500 of direct material cost; $34,050 of conversion costs) . Work in Process, May 31 (75,000 units, 100% complete for direct materials; 20% complete for conversion costs) . Costs incurred in May Direct materials $ 342,000 Conversion costs $ 352,950 - If Pitt Enterprises uses the weighted average method of process costing, compute the equivalent units for direct materials and conversion respectively for May.

A) 275,000 materials; 215,000 conversion.

B) 150,000 materials; 150,000 conversion.

C) 225,000 materials; 195,000 conversion.

D) 195,000 materials; 225,000 conversion.

E) 195,000 materials; 195,000 conversion.

Correct Answer

verified

Correct Answer

verified

True/False

In process costing, direct labor includes only the labor that is applied directly to individual units of product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During March, the production department of a process operations system completed and transferred to finished goods 25,000 units that were in process at the beginning of March and 110,000 units that were started and completed in March. March's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to labor. At the end of March, 30,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to labor. The production department incurred direct materials cost of $253,000 and its beginning inventory included materials cost of $93,500. Compute the direct materials cost per equivalent unit for the department using the weighted-average method.

A) $2.10.

B) $2.40.

C) $2.48.

D) $1.53.

E) $2.57.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andrews Corporation uses the weighted-average method of process costing. The following information is available for February in its Polishing Department: - The cost per equivalent unit of production for conversion is:

A) $4.97

B) $9.26

C) $5.05

D) $4.21

E) $5.85

Correct Answer

verified

Correct Answer

verified

True/False

In a process costing system, the entry to record cost of materials assigned to a production department requires a debit to the Work in Process Inventory account for that department and a credit to the Raw Materials Inventory account.

Correct Answer

verified

Correct Answer

verified

Essay

Sutton Company uses a process costing system. In May, 80,000 units were finished and transferred to finished goods. Ending Work in Process included 20,000 unfinished units 30% complete. Calculate the equivalent units of production for the year using the weighted average method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most accurate?

A) The FIFO method computes equivalent units based only on production activity in the current period, ignoring the percentage of completion in beginning Work in Process inventory.

B) It is not possible for there to be a significant difference between the cost of completed units between the weighted average and the FIFO methods.

C) The FIFO method includes the cost of the beginning Work in Process inventory account in calculating cost per equivalent units.

D) The FIFO method of calculating equivalent units of production merges the work and the costs of the beginning inventory with the work and the costs done during the current period.

E) In process costing, estimating the degree of completion of units is usually more accurate for conversion costs than for direct materials.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 230 of 230

Related Exams