Correct Answer

verified

Correct Answer

verified

True/False

Earnings per share is calculated as net income plus preferred dividends divided by the weighted average number of common shares outstanding.

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock is recorded at cost without reference to par value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following occurs when a 2-for-1 stock split is declared?

A) The balance in common stock remains the same.

B) The balance in common stock is reduced to half the original amount.

C) The balance in common stock doubles.

D) The balance in paid-in capital doubles.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

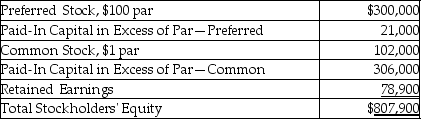

The following information is from the balance sheet of Tudor Corporation as of December 31,2015.  What was the total paid-in capital as of December 31,2015?

What was the total paid-in capital as of December 31,2015?

A) $606,000

B) $807,900

C) $729,000

D) $708,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peterson Inc.issued 4,000 shares of preferred stock for $240,000.The stock has a par value of $60 per share.The journal entry to record this transaction would ________.

A) credit Cash $240,000,debit Preferred Stock-$60 Par Value $4,000,and debit Paid-In Capital in Excess of Par-Preferred $236,000

B) debit Cash $240,000,credit Preferred Stock-$60 Par Value $4,000,and credit Paid-In Capital in Excess of Par-Preferred $236,000

C) credit Cash $240,000 and debit Preferred Stock-$60 Par Value $240,000

D) debit Cash $240,000 and credit Preferred Stock-$60 Par Value $240,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

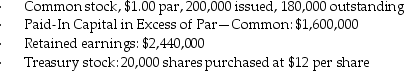

Assume the following information for Petra Sales Inc.:  If Petra Sales purchases an additional 5,000 shares of treasury stock at $14 per share,what number of shares will be shown as issued and outstanding?

If Petra Sales purchases an additional 5,000 shares of treasury stock at $14 per share,what number of shares will be shown as issued and outstanding?

A) 175,000 issued; 180,000 outstanding

B) 195,000 issued; 180,000 outstanding

C) 200,000 issued; 175,000 outstanding

D) 200,000 issued; 180,000 outstanding

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock dividends are declared by the ________.

A) chief financial officer of the company

B) board of directors of the company

C) chief executive officer of the company

D) stockholders of the company

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Osbourne Inc.issued 50,000 shares of common stock in exchange for manufacturing equipment.The equipment has a fair value of $1,000,000.The stock has par value of $0.01 per share.Which of the following is included in the journal entry to record this transaction?

A) debit Cash $5,000

B) credit Gain on Sale of Common Stock $1,050,000

C) credit Paid-In Capital in Excess of Par-Common $999,500

D) credit Common Stock-$0.01 Par Value $1,000,000

Correct Answer

verified

Correct Answer

verified

Essay

Peterson Inc.issued 4,000 shares of preferred stock for $240,000.The stock has a par value of $60 per share.Provide the journal entry for this transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Happy Holidays,Inc.has 100,000 shares of common stock issued and outstanding,with a par value of $0.01 per share.It declared a 15% common stock dividend; market value is $12 per share.Which of the following is the correct journal entry to record the transaction?

A) debit Retained Earnings $180,000 and credit Paid-In Capital in Excess of Par-Common $180,000

B) debit Retained Earnings $180,000,credit Common Stock Dividend Distributable $150,and credit Paid-In Capital in Excess of Par-Common $179,850

C) debit Retained Earnings $180,000 and credit Cash $180,000

D) debit Common Stock Dividend Distributable $150,debit Paid-In Capital in Excess of Par-Common $179,850,and credit Retained Earnings $180,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following occurs when a cash dividend is declared?

A) liabilities remain unchanged

B) stockholders' equity decreases

C) liabilities decrease

D) assets increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1,2015,Oster Inc.declared a dividend of $3.00 per share.Oster Inc.has 20,000 shares of common stock outstanding and no preferred stock.The date of record is November 15,and the payment date is November 30,2015.Which of the following is the journal entry needed on November 30?

A) debit Retained Earnings $60,000 and credit Dividends Payable-Common $60,000

B) debit Dividends Payable-Common $60,000 and credit Cash $60,000

C) debit Cash $60,000 and credit Dividends Payable-Common $60,000

D) debit Retained Earnings $60,000 and credit Cash $60,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct description of dividends in arrears,as it applies to cumulative preferred stock?

A) the cumulative amount of dividends that were not paid in previous years

B) the cumulative amount of dividends that were paid in previous years

C) the amount of dividends that were paid late

D) the amount of dividends that will be paid in the coming year

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Restrictions on retained earnings ________.

A) are reported on the cash flow statement.

B) are usually reported in the notes to the financial statements

C) are reported on the income statement

D) are designed to maximize dividends paid to shareholders

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stockholders receive a dividend preference over common stockholders.

Correct Answer

verified

Correct Answer

verified

True/False

The rate of return on common stockholders' equity shows the relationship between net income available to common stockholders and their average common equity invested in the company.

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock is a contra equity account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Saturn Corporation has 10,000 shares of 10%,$75 par noncumulative preferred stock outstanding and 20,000 shares of no-par common stock outstanding.At the end of the current year,the corporation declares a dividend of $180,000.How is the dividend allocated between preferred and common stockholders?

A) The dividend is allocated $5,000 to preferred stockholders and $115,000 to common stockholders.

B) The dividend is allocated $75,000 to preferred stockholders and $105,000 to common stockholders.

C) The dividend is allocated $60,000 to preferred stockholders and $120,000 to common stockholders.

D) The dividend is allocated $72,000 to preferred stockholders and $108,000 to common stockholders.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

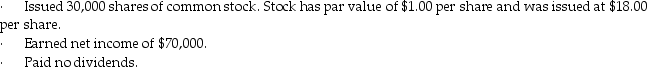

Moretown Inc.had the following transactions in 2015,its first year of operations.  - At the end of 2015,what is the total amount of stockholders' equity?

- At the end of 2015,what is the total amount of stockholders' equity?

A) $30,000

B) $610,000

C) $540,000

D) $70,000

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 158

Related Exams