Correct Answer

verified

Accounts receivable turnover =...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Carducci Corporation reported net sales of $3.6 million and beginning total assets of $0.9 million and ending total assets of 1.3 million.The average total asset amount is:

A) $2.3 million.

B) $2.7 million.

C) $0.25 million.

D) $0.36 million.

E) $1.1 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A component of operating efficiency and profitability,calculated by expressing net income as a percent of net sales,is the:

A) Acid-test ratio.

B) Merchandise turnover.

C) Price earnings ratio.

D) Accounts receivable turnover.

E) Profit margin ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market price of Shaw Corporation's common stock is $47.50.Shaw declared and paid cash dividends of $3.28 per share and had earnings per share of $6.89.The Dividend yield ratio is:

A) 14.5%.

B) 7.4%.

C) 6.5%.

D) 144.8%.

E) 6.9%.

Correct Answer

verified

Correct Answer

verified

True/False

The percent change of a comparative financial statement item is computed by subtracting the estimated period amount from the base period amount,dividing the result by the base period amount and multiplying that result by 100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ash Company reported sales of $400,000 for Year 1,$450,000 for Year 2,and $500,000 for Year 3.Using Year 1 as the base year,what is the revenue trend percent for Years 2 and 3?

A) 80% for Year 2 and 90% for Year 3.

B) 88% for Year 2 and 80% for Year 3.

C) 88% for Year 2 and 90% for Year 3.

D) 112.5% for Year 2 and 125% for Year 3.

E) 125% for Year 2 and 112.5% for Year 3.

Correct Answer

verified

Correct Answer

verified

True/False

Low expectations of future performance result in a low price-earnings (PE)ratio.

Correct Answer

verified

Correct Answer

verified

Short Answer

The comparison of a company's financial condition and performance across time is known as ________.

Correct Answer

verified

Correct Answer

verified

Essay

What is the purpose of a good financial statement analysis report? What are the key components?

Correct Answer

verified

A good financial statement analysis repo...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

When an item has a value in the base period and zero in the analysis period,the decrease is 0 percent.

Correct Answer

verified

Correct Answer

verified

True/False

The key factors section of a financial statement analysis report includes both quantitative and qualitative indicators of company performance.

Correct Answer

verified

Correct Answer

verified

Essay

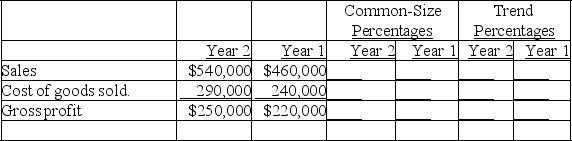

Express the following income statement information in common-size percentages and in trend percentages using Year 1 as the base year.

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis is the comparison of a company's financial condition and performance to a base amount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Texas Electronics.

-Compute the company's inventory turnover for Year 2.

-Compute the company's inventory turnover for Year 2.

A) 4.72.

B) 4.33.

C) 3.28.

D) 5.78.

E) 3.86.

Correct Answer

verified

Correct Answer

verified

Short Answer

The comparison of a company's financial condition and performance to a base amount is known as ________.

Correct Answer

verified

Correct Answer

verified

Essay

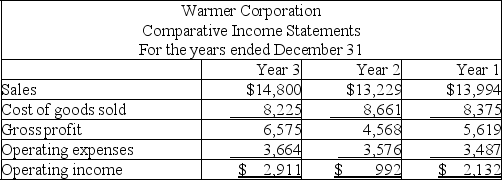

Comparative statements for Warmer Corporation are shown below:

Calculate trend percentages for all income statement amounts shown and comment on the results.Use Year 1 as the base year.Comment on the results.

Calculate trend percentages for all income statement amounts shown and comment on the results.Use Year 1 as the base year.Comment on the results.

Correct Answer

verified

During Year 2,sales declined,cost of sa...

During Year 2,sales declined,cost of sa...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Refer to the following selected financial information from Texas Electronics.

-Compute the company's working capital for Year 2.

-Compute the company's working capital for Year 2.

A) $232,700.

B) $220,600.

C) $147,200.

D) $111,700.

E) $142,700.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Texas Electronics.

-Compute the company's acid-test ratio for Year 2.

-Compute the company's acid-test ratio for Year 2.

A) 2.26.

B) 1.98.

C) 2.95.

D) 3.05.

E) 1.88.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

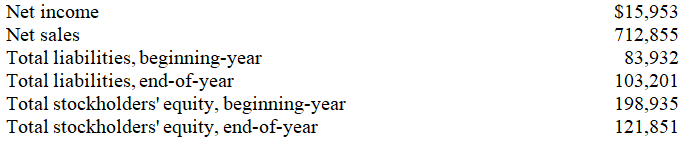

Selected current year company information follows:  The total asset turnover is:

The total asset turnover is:

A) 2.24 times

B) 2.81 times

C) 3.64 times

D) 4.67 times

E) 6.28 times

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three of the most common tools of financial analysis are:

A) Financial reporting,sensitivity analysis,transactional analysis.

B) Fair presentation,variance analysis,financial reporting.

C) Horizontal analysis,vertical analysis,ratio analysis.

D) Relativity analysis,financial reporting,fair value analysis.

E) Liquidation analysis,political analysis,fair value analysis.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 245

Related Exams