A) budgeted balance sheet.

B) budgeted income statement.

C) cash budget.

D) budgeted statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hatfield Company has the following budgeted credit sales for the last four months of the year-September, $13,000; October, $19,000; November $20,000; December, $24,000. Experience has shown that payment for the credit sales is received as follows: 10% in the month of sale, 60% in the first month after sale, 20% in the second month after sale, and 10% uncollectible. How much cash can Hatfield Company expect to collect in November as a result of credit sales?

A) $11,400

B) $13,400

C) $14,000

D) $16,000

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget may be used to determine whether a company will need additional financing for the coming period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

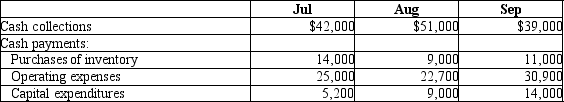

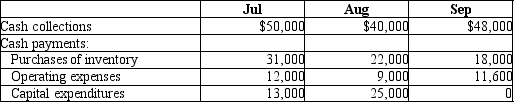

Chaterlain Company is preparing its budget for the 3rd quarter. Cash balance at June 30 was $11,000. Additional budgeted data is provided here:  What amount should be shown in the cash budget for the cash balance at the end of July?

What amount should be shown in the cash budget for the cash balance at the end of July?

A) $19,100

B) $8,800

C) $9,050

D) $2,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Argyle Company forecasts Sales of $50,000 in January, $60,000 in February, $70,000 in March, and $75,000 in April. The inventory balance at January 1 is $12,000. Cost of goods sold is budgeted at 40% of sales revenue. Argyle wishes to have inventory levels at the end of each month equal to 60% of the cost of goods sold for the following month, plus a "safety cushion" of $1,000. How much should be budgeted for inventory purchases in March?

A) $21,000

B) $22,100

C) $29,200

D) $23,400

Correct Answer

verified

Correct Answer

verified

Essay

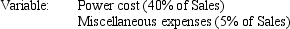

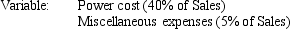

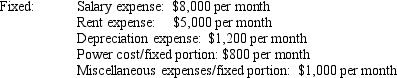

Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows:

How much is the total operating expense for January?

A)$38,500

B)$47,500

C)$41,700

D)$43,000

How much is the total operating expense for January?

A)$38,500

B)$47,500

C)$41,700

D)$43,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

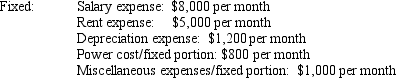

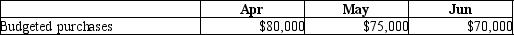

Della Company prepared the following purchases budget:  All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

What are the total cash payments made in October for purchases?

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

What are the total cash payments made in October for purchases?

A) $77,680

B) $79,480

C) $69,330

D) $74,290

Correct Answer

verified

Correct Answer

verified

True/False

A goal of the budgeting process is to communicate a consistent set of plans throughout the company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

AAA Company is preparing its 3rd quarter budget and provides the following data:  Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

How much will the company have to borrow at the end of August?

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

How much will the company have to borrow at the end of August?

A) $0

B) $5,000

C) $10.000

D) $15,000

Correct Answer

verified

Correct Answer

verified

Essay

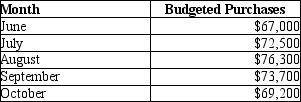

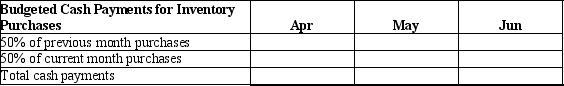

Mudbug International has budgeted inventory purchases as follows:

The budget assumes that 50% of a given month's purchases are paid in the month of purchase, and the remaining 50% is paid out one month later. Accounts payable to inventory suppliers at March 31 was $38,000. Please use the format below and prepare the budgeted cash payments for inventory purchases.

The budget assumes that 50% of a given month's purchases are paid in the month of purchase, and the remaining 50% is paid out one month later. Accounts payable to inventory suppliers at March 31 was $38,000. Please use the format below and prepare the budgeted cash payments for inventory purchases.

Correct Answer

verified

Correct Answer

verified

True/False

One of the key functions of responsibility accounting is to evaluate the performance of company managers and the units they manage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A department store has budgeted cost of sales of $36,000 for its men's suits in March. Management also wants to have $15,000 of men's suits in inventory at the end of March to prepare for the summer season. Beginning inventory of men's suits for March is expected to be $9,000. What dollar amount of men's suits should be purchased in March?

A) $42,000

B) $45,000

C) $51,000

D) $60,000

Correct Answer

verified

Correct Answer

verified

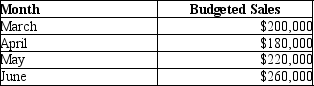

Multiple Choice

Norton Company prepared the following sales budget:  Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. What is the desired beginning inventory on June 1?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. What is the desired beginning inventory on June 1?

A) $36,000

B) $39,600

C) $43,200

D) $46,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

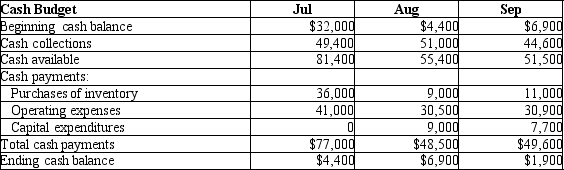

Pentangle Company has prepared a preliminary cash budget for the 3rd quarter as shown below:  Subsequently, the marketing department revised its figures for cash collections. New data are as follows: $52,000 in July, $50,000 in August, and $42,000 in September. Based on the new data, what is the new projected cash balance at the end of September?

Subsequently, the marketing department revised its figures for cash collections. New data are as follows: $52,000 in July, $50,000 in August, and $42,000 in September. Based on the new data, what is the new projected cash balance at the end of September?

A) $8,500

B) $2,400

C) $7,000

D) $900

Correct Answer

verified

Correct Answer

verified

Multiple Choice

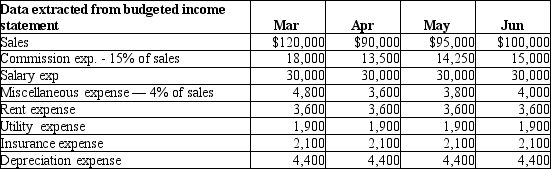

Craig Manufacturing Company's budgeted income statement includes the following data:  The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

How much is the total of the budgeted cash payments for operating expenses for the month of May?

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

How much is the total of the budgeted cash payments for operating expenses for the month of May?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

Correct Answer

verified

Correct Answer

verified

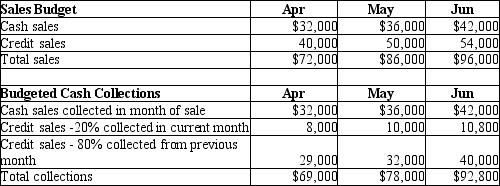

Multiple Choice

Beta Company is now preparing their budget for the 2nd quarter. The following data is provided:  For the budgeted balance sheet at June 30, what amount should be shown for Accounts receivable?

For the budgeted balance sheet at June 30, what amount should be shown for Accounts receivable?

A) $43,200

B) $54,000

C) $96,000

D) $40,000

Correct Answer

verified

Correct Answer

verified

Essay

Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows:

How much is the total operating expense for February?

A)$38,500

B)$47,500

C)$41,700

D)$43,000

How much is the total operating expense for February?

A)$38,500

B)$47,500

C)$41,700

D)$43,000

Correct Answer

verified

Correct Answer

verified

True/False

Budgets provide benchmarks that help managers evaluate performance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is TRUE about the capital expenditures budget?

A) It is a part of the financial budget.

B) It must be completed before the budgeted income statement is prepared.

C) It includes the sales budget.

D) It must be completed before the cash budget can be prepared.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to prepare a budgeted income statement, several other budgets need to be prepared first. Which of the following is NOT one of the budgets needed to prepare the budgeted income statement?

A) Capital expenditures

B) Sales

C) Operating expenses

D) Inventory, purchases and cost of goods sold

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 157

Related Exams