Correct Answer

verified

Correct Answer

verified

Multiple Choice

A planned factory expansion project has an estimated initial cost of $800,000.Using a discount rate of 20%,the present value of future cost savings from the expansion is $843,000.To yield exactly a 20% internal rate of return,the actual investment cost cannot exceed the $800,000 estimate by more than which of the following? (Ignore income taxes in this problem. )

A) $1,075.

B) $20,000.

C) $43,000.

D) $160,000.

Correct Answer

verified

Correct Answer

verified

True/False

(Appendix 13B)The release of working capital at the end of an investment project is a taxable cash inflow.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13A) What is the approximate effective cost now of the working capital component of the investment decision? (Do not round your intermediate calculations and round your final answer to the nearest whole number. )

A) $0.

B) $987.

C) $2,000.

D) $3,014.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the total cash outlay needed to be made now?

A) $300,000.

B) $360,000.

C) $380,000.

D) $400,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

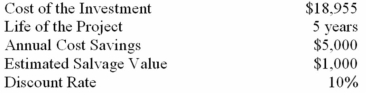

(Appendix 13A) The following data pertain to an investment:  What is the net present value of the proposed investment? (Ignore income taxes in this problem. ) (Do not round your intermediate calculations and round the final answer to the nearest whole dollar. )

What is the net present value of the proposed investment? (Ignore income taxes in this problem. ) (Do not round your intermediate calculations and round the final answer to the nearest whole dollar. )

A) ($3,430) .

B) $0.

C) $620.

D) $3,355.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

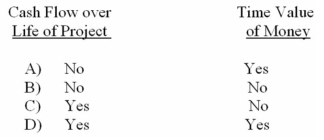

The net present value method takes into account which of the following?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Jason Company is considering the purchase of a machine that will increase revenues by $32,000 each year.Cash outflows for operating this machine will be $6,000 each year.The cost of the machine is $65,000.It is expected to have a useful life of five years with no salvage value.For this machine,what is the simple rate of return? (Ignore income taxes in this problem. )

A) 9.2%.

B) 20.0%.

C) 40.0%.

D) 49.2%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

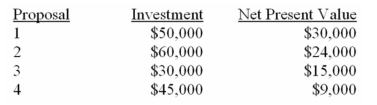

Information on four investment proposals is given below:  What are preference rankings of the four proposals according to the profitability index?

What are preference rankings of the four proposals according to the profitability index?

A) 3,4,1,2.

B) 1,2,3,4.

C) 1,3,2,4.

D) 2,1,4,3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13A and 13B) A company anticipates a tax-deductible cash expense of $10,000 in year 2 of a project.The company's tax rate is 30%,and its discount rate is 8%.What is the approximate present value of this future cash outflow? Do not round your intermediate calculations and round the final answer to the nearest whole dollar. )

A) $7,000.

B) $6001.

C) $3,000.

D) $2,572.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13B) The capital cost allowance (CCA) tax shield of a Class 7 asset with a maximum 15% CCA rate was $12,000 for Year 2.The income tax rate was 40%.What was the total CCA deduction for the asset for Year 2?

A) $12,000.

B) $20,000.

C) $30,000.

D) $80,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

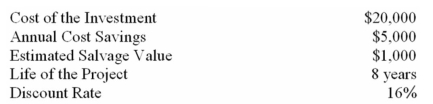

(Appendix 13A) The net present value of project Y is closest to which of the following? (Do not round your intermediate calculations. )

A) ($11,708) .

B) $11,708.

C) $20,066.

D) $30,280.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13B) What is the value of the incremental UCC (the "C" in the PV CCA formula) used in the calculation for the present value of CCA tax savings?

A) $20,000

B) $19,000

C) $18,000

D) $16,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13A) The following data pertain to an investment proposal:  What is the net present value of the proposed investment? (Ignore income taxes in this problem. ) (Do not round your intermediate calculations and round the final answer to the nearest whole dollar. )

What is the net present value of the proposed investment? (Ignore income taxes in this problem. ) (Do not round your intermediate calculations and round the final answer to the nearest whole dollar. )

A) $1,720.

B) $2,023.

C) $2,154.

D) $6,064.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13A and 13B) What was the present value of the tax savings from the CCA tax shield in year 3 to the nearest dollar?

A) $1,132.

B) $1,698.

C) $2,127.

D) $2,831.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13A and 13B) A company anticipates a capital cost allowance (CCA) deduction of $20,000 in year 2 of a project.The company's tax rate is 30%,and its discount rate is 12%.What is the approximate present value of the CCA tax shield resulting from this deduction? (Do not round your intermediate calculations and round the final answer to the nearest whole dollar. )

A) $4,783.

B) $6,000.

C) $11,161.

D) $14,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13A) The net present value of this investment is closest to which of the following? Do not round your intermediate calculations. )

A) $78,350.

B) $21,904.

C) $27,548.

D) $54,640.

Correct Answer

verified

Correct Answer

verified

True/False

(Appendix 13A)The present value of a cash flow decreases as it moves further into the future.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The simple rate of return on the investment is closest to which of the following?

A) 5%.

B) 10%.

C) 15%.

D) 20%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What would be the immediate cash outflow required for this project?

A) ($150,000) .

B) ($130,000) .

C) ($120,000) .

D) ($90,000) .

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 180

Related Exams