A) $16,000.

B) $5,000.

C) $2,000.

D) $10,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The breakeven point in sales dollars is closest to:

A) $137,500.

B) $40,000.

C) $120,000.

D) $60,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Green Company's variable expenses are 75% of sales.At a sales level of $400,000,the company's degree of operating leverage is 8.At this sales level,fixed expenses equal which of the following?

A) $87,500.

B) $100,000.

C) $50,000.

D) $75,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

North Company sells a single product.The product has a selling price of $30 per unit and variable expenses are 70% of sales.If the company's fixed expenses total $60,000 per year,then what will be its break-even?

A) $60,000.

B) $85,714.

C) $42,000.

D) $200,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Dorian Company desires a monthly operating income equal to 10% of sales,what will its monthly sales have to be?

A) $90,000.

B) $45,600.

C) $120,000.

D) $96,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The margin of safety in the Flaherty Company is $24,000.If the company's sales are $120,000 and its variable expenses are $80,000,what must its fixed expenses be?

A) $8,000.

B) $32,000.

C) $24,000.

D) $16,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

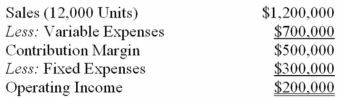

The following is last month's contribution format income statement:  What is the company's margin of safety percentage,rounded to the nearest whole percent?

What is the company's margin of safety percentage,rounded to the nearest whole percent?

A) 42%.

B) 40%.

C) 17%.

D) 20%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company increased the selling price for its product from $1.00 to $1.10 a unit when total fixed expenses increased from $400,000 to $480,000 and the variable expense per unit remained unchanged at $0.50.How would these changes affect the break-even point?

A) The break-even point in units would increase.

B) The break-even point in units would decrease.

C) The break-even point in units would remain unchanged.

D) The effect cannot be determined from the information given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

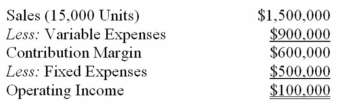

In the current year,the company sold 43,000 units.Due to competition,management will be forced to lower the selling price by 10% next year.How many units must be sold next year to earn the same operating income as was earned in the current year?

A) 50,000 units.

B) 53,200 units.

C) 58,800 units.

D) 60,200 units.New CM = 40 * (1 - .10) - 20 - 6 = $10.Units required = (532,000 + 70,000) /10 = 60,200 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following is last month's contribution format income statement:  What is the company's margin of safety in dollars?

What is the company's margin of safety in dollars?

A) $100,000.

B) $600,000.

C) $1,500,000.

D) $250,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company increased the selling price for its product from $1.00 to $1.10 a unit when total fixed expenses increased from $400,000 to $480,000 and the variable expense per unit remained unchanged at $0.50.How would these changes affect the break-even point?

A) The break-even point in units would increase.

B) The break-even point in units would decrease.

C) The break-even point in units would remain unchanged.

D) The effect cannot be determined from the information given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

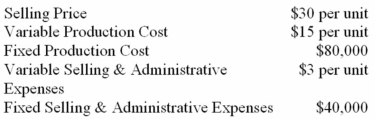

What is the break-even point in sales dollars? Refer To: 04-05

A) $48,000.

B) $72,000.

C) $28,800.

D) $0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

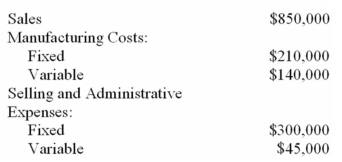

The following information relates to Clyde Corporation,which produced and sold 50,000 units last month.  There were no beginning or ending inventories.Production and sales next month are expected to be 40,000 units.In the next month,what should the company's unit contribution margin be?

There were no beginning or ending inventories.Production and sales next month are expected to be 40,000 units.In the next month,what should the company's unit contribution margin be?

A) $16.63.

B) $3.10.

C) $7.98.

D) $13.30.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodman Company has sales of 3,000 units at $80 per unit.Variable costs are 35% of the sales price.If total fixed costs are $66,000,what is the degree of operating leverage rounded to 2 decimal places?

A) 0.79.

B) 0.93.

C) 2.67.

D) 1.73.DOL = 156,000/(156,000 - 66,000) = 1.73

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales increase from $80,000 per year to $120,000 per year,and if the degree of operating leverage is 5,then by what percentage should operating income increase?

A) 167%.

B) 250%.

C) 100%.

D) 334%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data pertain to last month's operations:  What is the break-even point in dollars?

What is the break-even point in dollars?

A) $300,000.

B) $240,000.

C) $200,000.

D) $160,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company increased the selling price for its product from $1.00 to $1.10 a unit when total fixed expenses increased from $400,000 to $480,000 and the variable expense per unit remained unchanged at $0.50.How would these changes affect the break-even point?

A) The break-even point in units would increase.

B) The break-even point in units would decrease.

C) The break-even point in units would remain unchanged.

D) The effect cannot be determined from the information given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the company's degree of operating leverage?

A) 0.2.

B) 8.0.

C) 1.7.

D) 5.0.

Correct Answer

verified

Correct Answer

verified

True/False

The margin of safety percentage is equal to the margin of safety in dollars divided by total sales in dollars.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carver Company produces a product that sells for $30.Variable manufacturing costs are $15 per unit.Fixed manufacturing costs are $5 per unit based on the current level of activity,and fixed selling and administrative costs are $4 per unit.A selling commission of 10% of the selling price is paid on each unit sold.What is the contribution margin per unit?

A) $3.

B) $15.

C) $8.

D) $12.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 401

Related Exams