A) salaries of members of Parliament

B) government expenditures on paper clips

C) construction of highways

D) funding of regulatory agencies

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following best describes the net export effect associated with an expansionary Canadian fiscal policy?

A) domestic interest rate falls,foreign demand for dollars rises,dollar appreciates,and net exports increase.

B) domestic interest rate falls,foreign demand for dollars rises,dollar appreciates,and net exports fall.

C) domestic interest rate rises,foreign demand for dollars falls,dollar depreciates,and net exports increase.

D) domestic interest rate rises,foreign demand for dollars increases,dollar appreciates,and net exports decline.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One reason the public debt will not bankrupt the Federal government is that the:

A) cost is shifted to future generations.

B) debt has a pro-cyclical effect on the economy.

C) debt can be refinanced by selling new bonds.

D) burden of the debt will be crowded-out by new investment.

Correct Answer

verified

Correct Answer

verified

True/False

A net export effect may partially reinforce an expansionary fiscal policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A contractionary fiscal policy is shown as a:

A) rightward shift in the economy's aggregate demand curve.

B) rightward shift in the economy's aggregate supply curve.

C) movement along an existing aggregate demand curve.

D) leftward shift in the economy's aggregate demand curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most likely way the public debt burdens future generations is by:

A) reducing the current level of investment.

B) causing future unemployment.

C) causing a slowly falling price level.

D) reducing real interest rates.

Correct Answer

verified

Correct Answer

verified

True/False

A contractionary fiscal policy shifts the aggregate demand curve leftward and may or may not reduce real GDP.

Correct Answer

verified

Correct Answer

verified

True/False

It is more meaningful to measure the growth of the public debt relative to the GDP than to measure it in absolute terms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government increases its spending during recession to assist the economy,the funds for such expenditures must come from some source.Which of the following sources would be the most expansionary?

A) additional taxes on personal incomes

B) creating new money

C) borrowing from the public

D) additional taxes upon corporate profits

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The real burden of an increase in the public debt:

A) may be very small or conceivably zero when the economy is in the midst of a severe depression.

B) will be smaller when full employment exists than it will when the economy has large quantities of idle resources.

C) can be shifted to future generations if the debt is internally financed.

D) can best be measured by the dollar increase in the size of the debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

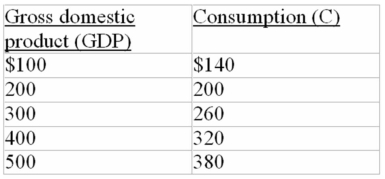

-Refer to the above data.The 10 percent proportional tax on income would:

-Refer to the above data.The 10 percent proportional tax on income would:

A) reduce the MPC from .6 to .54.

B) not affect the size of the MPC.

C) reduce the MPC from .6 to .5.

D) increase the MPC from .6 to .64.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the economy is at full employment:

A) one cannot generalize in comparing the actual and the full-employment budgets.

B) the full-employment budget will show a surplus and the actual budget will show a deficit.

C) the actual budget will show a surplus and the full-employment budget will show a deficit.

D) the actual and the full-employment budgets will be equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

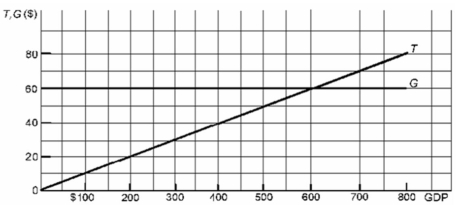

-Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP is $400 billion while the actual GDP is $200 billion,the cyclical deficit is:

-Refer to the above diagram where T is tax revenues and G is government expenditures.All figures are in billions of dollars.If the full-employment GDP is $400 billion while the actual GDP is $200 billion,the cyclical deficit is:

A) $40 billion.

B) $20 billion.

C) zero.

D) $60 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "crowding out" effect suggests that:

A) government spending is increasing at the expense of private investment.

B) imports are replacing domestic production.

C) private investment is increasing at the expense of government spending.

D) consumption is increasing at the expense of investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $400 billion; (2) investment = $40 billion; (3) government purchases = $90 billion;and (4) net export = $25 billion.If the full-employment level of GDP for this economy is $600 billion,then what combination of actions would be most consistent with the goal of achieving full employment?

A) increase government spending and taxes

B) decrease government spending and taxes

C) decrease government spending and increase taxes

D) increase government spending and decrease taxes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Countercyclical discretionary fiscal policy calls for:

A) surpluses during recessions and deficits during periods of demand-pull inflation.

B) deficits during recessions and surpluses during periods of demand-pull inflation.

C) surpluses during both recessions and periods of demand-pull inflation.

D) deficits during both recessions and periods of demand-pull inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If government increases the size of its full-employment surplus,we can:

A) assume that government is causing interest rates to rise.

B) not determine government's impact on the economy without also knowing the status of the actual budget.

C) assume that government is having a contractionary effect on the economy.

D) assume that government is having an expansionary effect on the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in an economy with a MPC of .5 the government wanted to shift the aggregate demand curve rightward by $80 billion at each price level to expand real GDP.It could:

A) reduce taxes by $160 billion.

B) increase government spending by $80 billion.

C) reduce taxes by $40 billion.

D) increase government spending by $40 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "cyclically adjusted budget" refers to:

A) the inflationary impact which the automatic stabilizers have in a full-employment economy.

B) that portion of a full-employment GDP which is not consumed in the year it is produced.

C) the size of the federal government's budgetary surplus or deficit when the economy is operating at full employment.

D) the number of workers who are underemployed when the level of unemployment is 7 to 8 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else equal,a contractionary fiscal policy in Canada which reduces domestic interest rates tends to:

A) increase Canadian imports.

B) increase the international value of the dollar.

C) reduce the foreign demand for Canadian dollars.

D) aggravate an existing Canadian trade deficit.

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 223

Related Exams