A) Total assets on the balance sheet.

B) Total cash on the balance sheet.

C) Total current assets on the balance sheet.

D) None of these answers is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The return on investment measure is also referred to as:

A) Net margin.

B) Return on equity.

C) Return on debt.

D) Return on assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding net margin is incorrect?

A) Net margin refers to the average amount of each sales dollar remaining after all expenses are subtracted.

B) Net margin may be calculated in several ways.

C) The amount of net margin is affected by a company's choices of accounting principles.

D) The smaller the net margin the better.

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

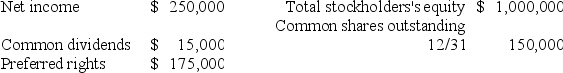

The Bernard Company provided the following information from its financial records:  What is the company's book value per share?

What is the company's book value per share?

A) $0.50

B) $5.50

C) $6.67

D) $1.67

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the correct statement regarding vertical analysis.

A) Vertical analysis of the income statement involves showing each item as a percentage of sales.

B) Vertical analysis of the balance sheet involves showing each asset as a percentage of total assets.

C) Vertical analysis examines two or more items from the financial statements of one accounting period.

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Earnings before interest and taxes divided by interest expense is the formula for which of these analytical measures?

A) Debt to assets ratio

B) Earnings per share

C) Return on investment

D) Number of times interest is earned

Correct Answer

verified

Correct Answer

verified

True/False

Solvency ratios are used to analyze the long-term debt-paying ability and the composition of the financing structure of the firm.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accrual accounting requires the use of many estimates, including:

A) Uncollectible accounts expense.

B) Warranty costs.

C) Assets' useful lives.

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solvency ratios are used to assess a company's:

A) Long-term debt paying ability.

B) Profitability.

C) Short-term debt paying ability.

D) Efficiency in use of its assets.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

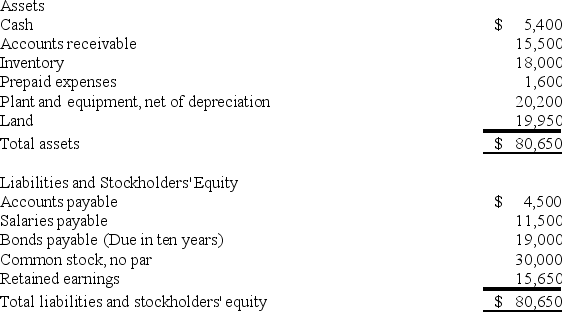

The following balance sheet information is provided for Greene Company for Year 2:  What is the company's quick (acid-test) ratio?

What is the company's quick (acid-test) ratio?

A) 0.7

B) 1.4

C) 1.3

D) 3.8

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Common methods of financial statement analysis include all of the following except:

A) Incremental analysis.

B) Horizontal analysis.

C) Vertical analysis.

D) Ratio analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is generally incorrect from an investor's perspective?

A) A 1:1 current ratio is generally preferred over a 1.5:1 current ratio.

B) A 20-day average collection period for accounts receivable is generally preferred over a 30-day average collection period.

C) A 5% dividend yield is generally preferred over a 3% dividend yield.

D) A 10% net margin is generally preferred over an 8% net margin.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following statement is correct regarding the quick ratio?

A) The numerator for the quick ratio is current assets minus inventory minus accounts receivable.

B) The numerator for the quick ratio is current assets.

C) The quick ratio is also called the working capital ratio.

D) The quick ratio is a more conservative variation of the current ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the quick ratio is incorrect?

A) The quick ratio is also known as the acid-test ratio.

B) The quick ratio ignores some current assets that are less liquid than others.

C) The quick ratio is a conservative variation of the current ratio.

D) The quick ratio equals quick assets divided by total liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment in Frontier Airlines stock and wish to assess the firm's earnings performance. All of the following ratios can be used to assess profitability except:

A) Average days to collect receivables.

B) Asset turnover.

C) Return on investment.

D) Net margin.

Correct Answer

verified

Correct Answer

verified

True/False

A vertical analysis uses percentages to compare each of the parts of an individual statement to a key statement figure. For example, on an income statement each item would be shown as a percentage of net sales.

Correct Answer

verified

Correct Answer

verified

True/False

A company has an obligation to provide highly detailed information on its financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not included in the computation of the quick ratio?

A) Cash

B) Prepaid expenses

C) Accounts receivable

D) Marketable securities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

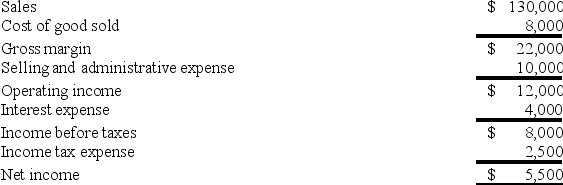

The Poole Company reported the following income for Year 2:  What is the company's net margin? (Round your answers to the nearest whole percent.)

What is the company's net margin? (Round your answers to the nearest whole percent.)

A) 73%

B) 40%

C) 18%

D) 27%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Working capital is defined as:

A) Current assets divided by current liabilities.

B) Total assets minus total liabilities.

C) Current assets less current liabilities.

D) Current liabilities divided by total liabilities.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 108

Related Exams