A) Yes, 0.75 Stock X and 0.25 Risk Free Asset

B) Yes, 0.25 Stock X and 0.75 Risk Free Asset

C) Yes, 0.5 Stock X and 0.5 Risk Free Asset

D) No

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The required return on a security is 10%,the risk-free rate is 5%,and the return on the market is 14%.What is the beta of the firm?

A) 0.14

B) 0.55

C) 0.83

D) 1.00

E) 1.40

Correct Answer

verified

Correct Answer

verified

Multiple Choice

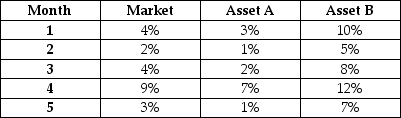

The table below gives the historic return over the past five months for the market portfolio and two assets: A and B.Which of the answers below best describes the historic beta for A and B?

A) βA < 1; βB < 1

B) βA = 0; βB < 1

C) βA = 0; βB > 0

D) βA > 1; βB > 1

E) βA < 1; βB > 1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk that affects all firms is called

A) management risk.

B) nondiversifiable risk.

C) diversifiable risk.

D) total risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Can the risk (variance) of a portfolio ever be less than the smallest risk (variance) of an individual security in the portfolio?

A) No. Yes.

B) No. No.

C) Yes. No.

D) Yes. Yes.

Correct Answer

verified

Correct Answer

verified

True/False

Beta is the slope of the security market line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

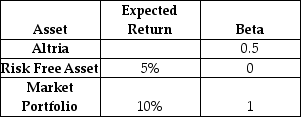

Altria Group Inc.(ticker: MO on NYSE) is an American manufacturer of tobacco products.Selected Financial information for Altria is provided in the table below.What is the expected return on shares of Altria using the SML?

A) 5.0%

B) 7.5%

C) 10.0%

D) 12.5%

E) 15%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An individual's portfolio consists of three separate assets.Asset 1 has a beta of 1.4,asset 2 has a beta of .84 and asset 3 has a beta of 1.05.The investor has invested $240 in asset 1,$500 in asset 2,and $260 in asset 3.Calculate the portfolio beta.

A) 1.03

B) 1.17

C) 1.09

D) 0.93

E) 0.85

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Geek Computer has a beta of .8,the return from Treasury bills is 3% and the return from the market portfolio is 20%,what is the required return from Geek stock?

A) 16.6%

B) 15.7%

C) 22.8%

D) 20.0%

E) 17.5%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The company that prints unemployment insurance checks is named Countercyclical Printing,Inc.Countercyclical Printing's beta is -0.75,the risk free rate is 8%,and the risk premium on the market is 7%.What is the equilibrium expected rate of return on Countercyclical Printing's stock?

A) -8.75%

B) -3.25%

C) 2.75%

D) 4.50%

E) 5.25%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

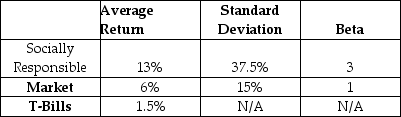

The table below presents performance data for the Socially Responsible mutual fund over the last five years.The table also includes information on the returns of the market index and T-Bills over the same period.What is the Treynor Index for Socially Responsible?

A) 2.3%

B) 3.8%

C) 7.0%

D) 9.5%

E) 11.5%

Correct Answer

verified

Correct Answer

verified

True/False

If two stocks have a correlation of +1,then the standard deviation of a portfolio between them is given by: σp = wσ1 + (1 - w)σ2

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asset p has a beta of 1.1.The risk-free rate of return is 4 percent,while the return on the market portfolio of assets is 12 percent.The asset's required rate of return is:

A) 6%

B) 12.8%

C) 5.4%

D) 10%

E) 9.5%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Analysts state that the required return from Plummet Soft Drinks stock is 25%,and the returns from Treasury bills and the market portfolio are 4% and 20%,respectively.What is Plummet's beta?

A) 0.79

B) 1.00

C) 0.05

D) 1.31

E) 1.13

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equilibrium expected return on an asset is 14%,the risk-free rate is 4% and the return on the market portfolio is 12%.What is the beta of the asset?

A) 1.10

B) 1.15

C) 1.20

D) 1.25

E) 1.30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to buy $20,000 worth of shares in Tootsie Roll Industries Inc.on margin,but you only have $10,000 of your own money to invest.The remaining $10,000 is borrowed by issuing T-Bills; assume the cost of borrowing is the risk-free rate.The weight of Tootsie Roll Industries in your portfolio is 2.0.The weight of T-Bills in your portfolio is -1.0.Assume that the expected return on Tootsie Roll is 12% and the expected return on the risk free asset (T-Bills) is 5%.What is the return on your portfolio?

A) 17%

B) 18%

C) 19%

D) 20%

E) 21%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own two mutual funds.Fund A has an expected return of 12% and a beta of 0.8.Fund B has an expected return of 18% and a beta of 1.4.If your portfolio beta is the same as the market portfolio,what proportion of your portfolio is invested in fund A?

A) 1/4

B) 1/3

C) 1/2

D) 2/3

E) 3/4

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Geek Computer has a beta of 1.1,the return from Treasury bills is 3% and the return from the market portfolio is 20%,what is the required return from Geek stock?

A) 20.0%

B) 22.8%

C) 15.7%

D) 18.7%

E) 21.7%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

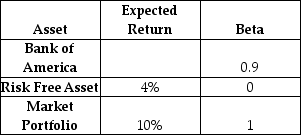

Consider the data on expected returns and betas for a variety of assets in the table below.What is the expected return on shares of Bank of America using the SML?

A) 5.4%

B) 6.0%

C) 8.2%

D) 9.4%

E) 11.2%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in nondiversifiable risk

A) would have no effect on the beta and would, therefore, cause no change in the required return.

B) would cause an increase in the beta and would increase the required return.

C) would cause an increase in the beta and would lower the required return.

D) would cause a decrease in the beta and would, therefore, lower the required rate of return.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 136

Related Exams