Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Jack Incorporated borrows $38,000 to purchase a new company car by agreeing to a 6%,5-year note with the bank.Payments of $734.65 are due at the end of each month with the first installment due on January 31,Year 1.What are the amounts of interest and principal,respectively,that will be paid in the first month?

A) $544.65 and $190.00

B) $190.00 and $544.65

C) $2,280.00 and $544.65

D) $190.00 and $734.65

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes what happens when bonds are issued when the market interest rate is less than the stated interest rate?

A) The bonds are issued at a premium.

B) The bonds are issued at less than their face value.

C) It raises the effective interest rate above the stated rate of interest.

D) The bonds are issued at a premium and the effective interest rate is higher than the stated rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company A and Company B are identical in all regards except that during Year 1 Company A borrowed $40,000 at an interest rate of 10%.In contrast,Company B obtained financing by acquiring $40,000 from sale of common stock.Company B agreed to pay a $4,000 cash dividend each year.Both companies are in a 30% tax bracket.Which company would show the greater retained earnings at the end of Year 1,and by what amount?

A) Company A's retained earnings would be higher by $4,000.

B) Company B's retained earnings would be higher by $2,800.

C) Company A's retained earnings would be higher by $1,200.

D) Both would show the same retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Wayne Company issued bonds with a face value of $600,000, a 6% stated rate of interest, and a 10-year term. Interest is payable in cash on December 31 of each year. Wayne uses the straight-line method to amortize bond discounts and premiums. -Assuming Wayne issued the bonds for 102.5,what is the carrying value of the bonds on the December 31,Year 1 balance sheet?

A) $601,500

B) $613,500

C) $615,000

D) $616,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is one of the main advantages of using long-term debt financing instead of equity financing?

A) Not having to pay back the principal

B) Ability to raise large amounts of capital

C) Tax-deductibility of interest

D) Tax-deductibility of dividends

Correct Answer

verified

Correct Answer

verified

Multiple Choice

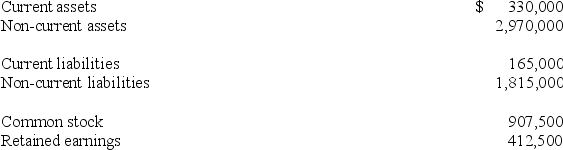

Gates,Inc.and Markham,Inc.each had the same financial position on January 1,Year 2.The following is a summary of each of their balance sheets on that date:

Gates is about to raise $200,000 in cash by issuing bonds.Markham is going to raise $200,000 on the same day by issuing common stock.Immediately after these transactions,which of the following statements will be correct?

Gates is about to raise $200,000 in cash by issuing bonds.Markham is going to raise $200,000 on the same day by issuing common stock.Immediately after these transactions,which of the following statements will be correct?

A) Gates' current ratio will be higher than Markham's.

B) Gates' current ratio will be lower than Markham's.

C) Gates' debt to asset ratio will be higher than Markham's.

D) Gates' debt to asset ratio will be lower than Markham's.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Wayne Company issued bonds with a face value of $600,000, a 6% stated rate of interest, and a 10-year term. Interest is payable in cash on December 31 of each year. Wayne uses the straight-line method to amortize bond discounts and premiums. -Which of the following statements is true regarding the straight-line method of amortizing discounts and premiums on bonds?

A) It assigns variable amounts of interest over the term of the liability.

B) It uses compound interest principles.

C) It assigns the same amount of interest to each interest period over the life of the bond.

D) It accurately reports the amount of interest expense incurred during each interest period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On January 1, Year 1, Pierce Corporation issued $25,000 in 8%, 5-year bonds payable at 102. Interest payments are due each December 31. Pierce uses the straight-line method to amortize bond discounts and premiums.

-Which of the following shows the effect of the bond issuance on January 1,Year 1?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Pierce Corporation issued $25,000 in 8%, 5-year bonds payable at 102. Interest payments are due each December 31. Pierce uses the straight-line method to amortize bond discounts and premiums. -Which of the following shows the effect of the bond issuance on January 1,Year 1? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f29_5521_ace2_5b29fc34dcc2_TB1323_00_TB1323_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes the characteristics of a convertible bond?

A) Bonds mature at specified intervals throughout the life of the total issuance.

B) Bonds may be exchanged for stock at the discretion of the bondholder.

C) Bonds mature on a specified date in the future.

D) Bonds may be exchanged for stock at the discretion of the issuer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why are bonds sometimes issued at a discount?

A) The stated rate of interest is higher than the rate being paid on investments in the securities market with comparable risk.

B) The stated rate of interest is the same as the rate being paid on investments in the securities market with comparable risk.

C) The stated rate of interest is lower than the rate being paid on investments in the securities market with comparable risk.

D) The bonds are being issued between interest payment dates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the amortization of the principal balance on an installment note payable affect the amount of interest expense recorded each succeeding year?

A) Reduces the amount of interest expense each year

B) Increase the amount of interest expense each year

C) Has no effect on interest expense each year

D) Cannot be determined from the information provided

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A discount or premium on bonds payable can be defined by which of the following statements?

A) The difference between the market price on the issue date and the face value.

B) The difference between the call price and the face value of the bond.

C) The market rate of interest on the date of the bond issuance.

D) The difference between the interest rate and the market price of the bond.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Victor Company issued bonds with a $250,000 face value, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds sold at 95. Interest is payable in cash on December 31 of each year. Victor uses the straight-line method to amortize bond discounts and premiums. -What is the amount of cash flow from operating activities on the statement of cash flows for the year ending December 31,Year 3?

A) $17,500

B) $15,000

C) $14,250

D) $12,500

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements about bonds payable is true or false.

Correct Answer

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method. -What is the amount of cash outflow from operating activities shown on Jones' statement of cash flows for the year ending December 31,Year 2?

A) $15,000

B) $16,200

C) $13,800

D) $17,400

Correct Answer

verified

Correct Answer

verified

True/False

Amortization of a discount on bonds payable is an asset use transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Echols Company borrowed $100,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $25,045.65. -What is the amount of principal repayment included in the payment made on December 31,Year 1?

A) $20,000.00

B) $8,000.00

C) $25,045.65

D) $17,045.65

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements about bonds payable is true or false.

Correct Answer

Multiple Choice

Which of the following conditions indicate a company has a relatively high level of financial risk?

A) A low times-interest-earned ratio

B) A low debt to assets ratio

C) A high return on equity

D) A high current ratio

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 112

Related Exams