A) $120 billion.

B) $800 billion.

C) $920 billion.

D) $1 trillion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basic money supply:

A) Is controlled by Congress and the U.S.Treasury.

B) Includes savings accounts.

C) Includes currency and transactions accounts.

D) Includes money market mutual funds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under Alan Greenspan,the Fed:

A) Targeted interest rates only.

B) Targeted the money supply only.

C) Targeted the unemployment level.

D) Used a mix of money-supply and interest-rate adjustments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One News Wire article in the text has the title "Fed Cuts Key Interest Rate Half-Point to 1 Percent." Assuming the economy is in the upward sloping portion of the eclectic aggregate supply curve,what should happen to the price level and output as a result of the Fed's action,ceteris paribus?

A) The equilibrium price level and equilibrium output should both increase.

B) The equilibrium price level should increase and equilibrium output should decrease.

C) The equilibrium price level should decrease and equilibrium output should increase.

D) The equilibrium price level and equilibrium output should both decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

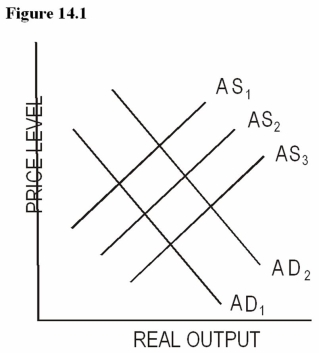

Figure 14.1  -Using Figure 14.1,ceteris paribus,if the Federal Reserve increases the discount rate,this indicates a desire to _______ the money supply and will cause a shift from ______.

-Using Figure 14.1,ceteris paribus,if the Federal Reserve increases the discount rate,this indicates a desire to _______ the money supply and will cause a shift from ______.

A) Expand;AD1 to AD2

B) Expand;AS1 to AS2

C) Contract;AD2 to AD1

D) Contract;AS3 to AS2

Correct Answer

verified

Correct Answer

verified

True/False

The reserve requirement is the tool used least frequently by the Fed because it can cause abrupt changes in the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

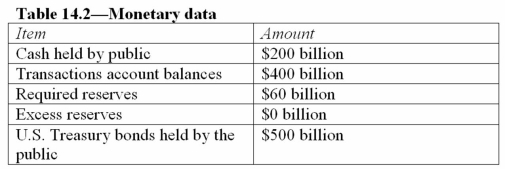

Answer the indicated question on the basis of the information in Table 14.2.Each question is based on the original balance sheet.

-In Table 14.2,the level of total reserves is equal to:

-In Table 14.2,the level of total reserves is equal to:

A) $60 billion.

B) $260 billion.

C) $460 billion.

D) $660 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of money and credit controls to change macroeconomic activity is known as:

A) Fiscal policy.

B) Monetary policy.

C) Supply-side policy.

D) Eclectic policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the aggregate supply drawn under the monetarist view,which of the following would lead to a higher price level?

A) The purchase of bonds in the open market by the Fed.

B) An increase in the discount rate.

C) An increase in the reserve requirement.

D) A decrease in the money multiplier.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed wishes to increase the money supply it can:

A) Raise the federal funds rate.

B) Sell bonds on the open market.

C) Decrease the discount rate.

D) Increase the required reserve ratio.

Correct Answer

verified

Correct Answer

verified

True/False

By changing the reserve requirement the Fed can change the level of bank reserves and the lending capacity of the banking system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is often described as the most powerful person in the U.S.economy?

A) The president of the United States.

B) The Speaker of the House of Representatives.

C) The chairman of the House Ways and Means Committee.

D) The chairman of the Federal Reserve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The different shapes of the aggregate supply curve:

A) Determine the level of reserves held by the banking system.

B) Result in the Fed's need for total control of the money supply.

C) Determine the impact of monetary policy on price level and output.

D) Explain why the Fed must respond to market instability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a basic monetary policy tool used by the Fed?

A) The discount rate.

B) The reserve requirement.

C) Taxes.

D) Open-market operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given an upward-sloping aggregate supply curve,which of the following is most likely to occur if the Fed pursues restrictive monetary policy,ceteris paribus?

A) The equilibrium price level and output will both decrease.

B) The equilibrium price level and output will both increase.

C) The equilibrium price level will decrease but output will stay the same.

D) The equilibrium output will decrease but the price level will stay the same.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One News Wire article in the text is titled "Fed Cuts Key Interest Rate Half-Point to 1 Percent." Which of the following is the Fed trying to accomplish as a result of this action?

A) A leftward shift of aggregate demand.

B) A rightward shift of aggregate demand.

C) A leftward shift of aggregate supply.

D) A rightward shift of aggregate supply.

Correct Answer

verified

Correct Answer

verified

True/False

When the Fed sells bonds,bank reserves increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reserve requirement:

A) Is the most frequently used tool by the Fed.

B) Changes required reserves but not excess reserves.

C) Does not affect the lending capacity for a bank.

D) Affects the level of bank reserves.

Correct Answer

verified

Correct Answer

verified

True/False

Congress and the president are the key decision makers for U.S.monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

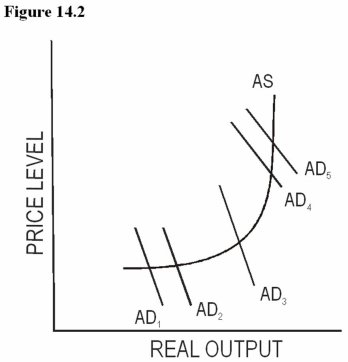

Figure 14.2  -Using Figure 14.2,a shift in aggregate demand from AD3 to AD4 will cause,ceteris paribus:

-Using Figure 14.2,a shift in aggregate demand from AD3 to AD4 will cause,ceteris paribus:

A) An increase in real output and an increase in the price level.

B) An increase in real output,but no change in the price level.

C) An increase in the price level,but no change in real output.

D) A decrease in the price level,but no change in real output.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 148

Related Exams