Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the inventory shows an actual count of $350 and the perpetual inventory according to the records shows $339,the adjusting entry for the $11 would:

A) debit Cost of Goods Sold;debit Purchase Returns and Allowances.

B) debit Cost of Goods Sold;credit Inventory.

C) debit Inventory;credit Cost of Goods Sold.

D) debit Inventory;credit Purchase Returns and Allowances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An indication that inventory is being sold quickly is:

A) a high turnover rate and high days-sales-in-inventory rate.

B) a high turnover rate and low days-sales-in-inventory rate.

C) a low turnover rate and high days-sales-in-inventory rate.

D) a low turnover rate and low days-sales-in-inventory rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A drawback to using ________ when inventory costs are rising is that the company reports lower net income.

A) LIFO

B) FIFO

C) average costing

D) specific-identification costing

Correct Answer

verified

Correct Answer

verified

True/False

The LCM rule compares original cost to current replacement cost to determine the amount at which inventory should be valued.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business with a ________ net income percentage may often have a ________ inventory turnover rate:

A) lower,higher.

B) lower,lower

C) higher,lower

D) all of the above are possible combinations of net income percentage and inventory turnover rate.

Correct Answer

verified

Correct Answer

verified

True/False

Knowledgeable decisions that are made by outsiders who read financial reports are a result of the concept of conservatism.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The LCM rule must be applied to inventory:

A) on an item-by-item basis.

B) by categories of items.

C) as a whole.

D) as a company decides,for there is no requirement to apply LCM.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an INCORRECT statement if ending inventory is understated?

A) Cost of goods sold is overstated.

B) Gross profit is overstated.

C) Net income understated.

D) Income tax is understated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manufacturer's goods available for sale represents:

A) work-in-process inventory.

B) raw materials inventory.

C) cost of goods sold inventory.

D) finished goods inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One lot of merchandise was counted at $566.34.A second count of the same merchandise showed $566.82.The difference could be ignored due to:

A) conservatism.

B) consistency.

C) materiality.

D) entity.

Correct Answer

verified

Correct Answer

verified

True/False

Under the conservatism rule,assets and income would be understated,rather than overstated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goods available for sale are $28,000;beginning inventory is $13,000;ending inventory is $15,000;and cost of goods sold is $39,000.The inventory turnover is:

A) 3) 00.

B) 2) 60.

C) 2) 79.

D) 2) 00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Period 1 ending inventory is overstated,then:

A) both cost of goods sold and net income are understated in Period 1.

B) cost of goods sold is overstated and net income is understated in Period 1.

C) cost of goods sold is understated and net income is overstated in Period 1.

D) both cost of goods sold and net income are overstated in Period 1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is often used when taking a physical inventory?

A) Pre-numbered count sheets

B) Tags to show what inventory has been counted

C) Maps of the location of the inventory

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

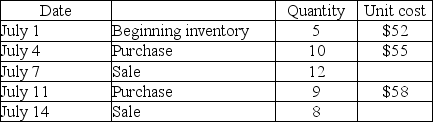

Lionworks Enterprises had the following inventory data:

Assuming FIFO,what is the cost of goods sold for the July 7 sale?

Assuming FIFO,what is the cost of goods sold for the July 7 sale?

A) $624

B) $654

C) $648

D) $645

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A method of valuing inventory based on the assumption that the oldest goods will be sold first is called the:

A) LIFO method.

B) average cost method.

C) specific cost method.

D) FIFO method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Cost of Goods Sold was understated in Period 1,then Cost of Goods Sold and gross profit in Period 2 will be:

A) both understated.

B) both overstated.

C) understated for cost of goods sold and overstated for gross profit.

D) overstated for cost of goods sold and understated for gross profit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The method used to estimate the cost of ending inventory is called:

A) the FIFO method.

B) the LIFO method.

C) gross profit method.

D) the average cost method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If ending inventory in Period 1 is overstated,gross profit in Period 2 is:

A) overstated.

B) understated.

C) not affected.

D) the same as in Period 1.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 152

Related Exams