Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amounts stipulated in a life insurance policy that protect the cash value in the event that the policyholder chooses not to pay the required premiums are

A) nonforfeiture values.

B) cash surrender values.

C) forced savings.

D) cash value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

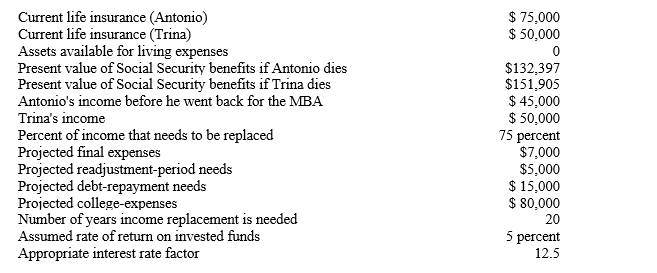

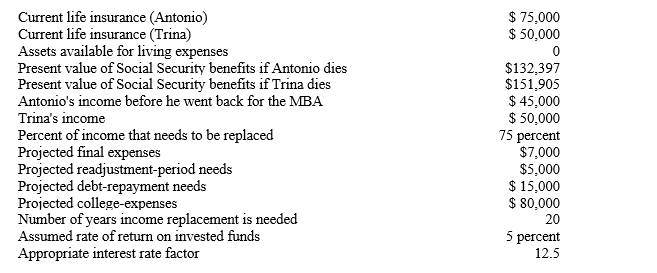

Figure 12-1

Antonio and Trina are a young couple with two small children,Jason (age four) and Claudia (age two) .Trina is an account executive for a brokerage firm while Antonio has taken a couple years off from his profession as a civil engineer to work on an MBA degree.Right now Antonio and Trina's budget is very tight,as they are accustomed to living on two incomes,but Trina's employer has just circulated employer benefit information,so Antonio and Trina believe this is a good time to evaluate their life insurance needs.They have listed the financial information they believe is relevant.

-Refer to Figure 12-1.Using the needs-based approach,how much additional life insurance is needed on Trina's life?

-Refer to Figure 12-1.Using the needs-based approach,how much additional life insurance is needed on Trina's life?

A) $373,845

B) $468,750

C) $525,750

D) $575,750

Correct Answer

verified

Correct Answer

verified

True/False

A modest funeral can easily cost more than $10,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are 33-years old and have children ages 3,6 and 8.You have determined that you need an additional $700,000 in additional life insurance.You should buy.

A) one $700,000 5-year,guaranteed renewable term life policy.

B) one $700,000 cash-value life insurance policy with guaranteed insurability.

C) 3-5,5-year,guaranteed renewable term life policies in various amounts adding up to $700,000.

D) realize that you cannot afford such coverage and simply start saving more in case you die before your children are independent.

Correct Answer

verified

Correct Answer

verified

True/False

Buying cash-value life insurance is a method of forced savings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marvin was widowed at age 38 when his children were 8 and 10 years of age.Assuming his deceased spouse was eligible for Social Security survivor's benefits,how many years would Marvin be in the "blackout period"?

A) 0 years

B) 10 years

C) 12 years

D) 13 years

Correct Answer

verified

Correct Answer

verified

True/False

Convertible term offers the policyholder the option of exchanging a term policy for a cash-value policy without evidence of insurability.

Correct Answer

verified

Correct Answer

verified

True/False

A survivorship joint life policy pays when the first insured dies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most accurate and complex method of calculating life insurance needs is the

A) needs-based approach.

B) multiple-of-earnings approach.

C) value-of-life approach.

D) term life approach.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rate of return on cash-value life insurance has historically ____ what can be achieved by a diversified portfolio of stock and bond mutual funds.

A) lagged well behind

B) remained higher than

C) been even with

D) fluctuated above and below

Correct Answer

verified

Correct Answer

verified

True/False

The interest-adjusted cost index method provides an accurate means of comparing among greatly different types of policies.

Correct Answer

verified

Correct Answer

verified

True/False

A life insurance policy irrevocably lapses when the premium is not paid by the stated due date.

Correct Answer

verified

Correct Answer

verified

True/False

Whenever the cause of death for an insured person is suicide the company will simply refund the collected premium.

Correct Answer

verified

Correct Answer

verified

True/False

The premiums for a $100,000,20-year,decreasing term policy would be less than the premiums for a $100,000,20-year policy with a fixed face value,other things being equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The person who controls all rights granted by a life insurance policy is called the

A) beneficiary.

B) contingent beneficiary.

C) policyholder.

D) insured.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 12-1

Antonio and Trina are a young couple with two small children,Jason (age four) and Claudia (age two) .Trina is an account executive for a brokerage firm while Antonio has taken a couple years off from his profession as a civil engineer to work on an MBA degree.Right now Antonio and Trina's budget is very tight,as they are accustomed to living on two incomes,but Trina's employer has just circulated employer benefit information,so Antonio and Trina believe this is a good time to evaluate their life insurance needs.They have listed the financial information they believe is relevant.

-Refer to Figure 12-1.Using a 7-year multiple-of-earnings approach,how much additional life insurance is needed on Trina's life?

-Refer to Figure 12-1.Using a 7-year multiple-of-earnings approach,how much additional life insurance is needed on Trina's life?

A) $625,000

B) $575,000

C) $350,000

D) $300,000

Correct Answer

verified

Correct Answer

verified

True/False

The major reason that people buy life insurance is to protect the person whose life is insured.

Correct Answer

verified

Correct Answer

verified

True/False

You should be contributing the maximum into any available tax-sheltered retirement plan before you consider cash-value life insurance as a retirement savings vehicle.

Correct Answer

verified

Correct Answer

verified

True/False

A disadvantage of first-to-die life insurance policies is that the survivor will have no coverage after the death of the first person.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 214

Related Exams