Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 1.2 and a standard deviation of returns of 18%.Stock B has a beta of 1.8 and a standard deviation of returns of 18%.If the market risk premium increases,then

A) the required return on stock B will increase more than the required return on stock A.

B) the required returns on stocks A and B will both increase by the same amount.

C) the required returns on stocks A and B will remain the same.

D) the required return on stock A will increase more than the required return on stock B.

Correct Answer

verified

Correct Answer

verified

True/False

A stock with a beta of 1 has systematic or market risk equal to the "typical" stock in the marketplace.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is/are true?

A) Most of the unsystematic risk is removed by the time a portfolio contains 30 stocks.

B) Two points on the Characteristic Line are the T-bill and the market portfolio.

C) The greater the total risk of an asset,the greater the expected return.

D) All securities have a beta between 0 and 1.

Correct Answer

verified

Correct Answer

verified

True/False

As the required rate of return of an investment decreases,the market price of the investment decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following,which differs in meaning from the other three?

A) systematic risk

B) market risk

C) undiversifiable risk

D) asset-unique risk

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that an investment is forecasted to produce the following returns: a 10% probability of a $1,400 return; a 50% probability of a $6,600 return; and a 40% probability of a $1,500 return.What is the expected amount of return this investment will produce?

A) $4,040

B) $7,640

C) $12140

D) $1,540

Correct Answer

verified

Correct Answer

verified

Multiple Choice

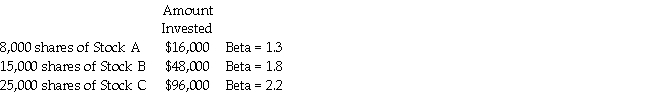

An investor currently holds the following portfolio:  The investor is worried that the beta of his portfolio is too high,so he wants to sell some stock C and add stock D,which has a beta of 1.0,to his portfolio.If the investor wants his portfolio to have a beta of 1.72,how much stock C must he replace with stock D?

The investor is worried that the beta of his portfolio is too high,so he wants to sell some stock C and add stock D,which has a beta of 1.0,to his portfolio.If the investor wants his portfolio to have a beta of 1.72,how much stock C must he replace with stock D?

A) $18,000

B) $24,000

C) $31,000

D) $36,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you were to use the standard deviation as a measure of investment risk,which of the following has historically been the least risky investment?

A) common stock of large firms

B) U.S.Treasury bills

C) common stock of small firms

D) long-term government bonds

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marble Corp.has a beta of 2.5 and a standard deviation of returns of 20%.The return on the market portfolio is 15% and the risk free rate is 4%.What is the risk premium on the market?

A) 5%

B) 6%

C) 9.00%

D) 11%

Correct Answer

verified

Correct Answer

verified

True/False

According to the CAPM,for each unit of Beta an asset's required rate of return increases by the market's risk premium.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you were to use the standard deviation as a measure of investment risk,which of the following has historically been the highest risk investment?

A) common stock of large firms

B) U.S.Treasury bills

C) common stock of small firms

D) long-term government bonds

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you have $100,000 invested in a stock whose beta is .85,$200,000 invested in a stock whose beta is 1.05,and $300,000 invested in a stock whose beta is 1.25.What is the beta of your portfolio?

A) 0.97

B) 1.02

C) 1.12

D) 1.21

Correct Answer

verified

Correct Answer

verified

True/False

The realized rate of return,or holding period return,is equal to the holding period dollar gain divided by the price at the beginning of the period.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Changes in the general economy,like changes in interest rates or tax laws represent what type of risk?

A) company-unique risk

B) market risk

C) unsystematic risk

D) diversifiable risk

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

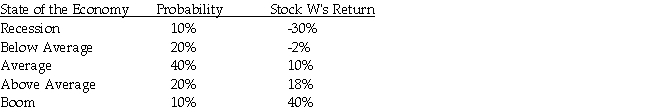

Stock W has the following returns for various states of the economy:  Stock W's standard deviation of returns is

Stock W's standard deviation of returns is

A) 10%.

B) 14%.

C) 17%.

D) 20%

Correct Answer

verified

C

Correct Answer

verified

True/False

Negative historical returns are not possible during periods of high volatility (high standard deviations of returns)due to the risk-return tradeoff.

Correct Answer

verified

Correct Answer

verified

True/False

Stocks that plot above the security market line are underpriced because their expected returns exceed their risk-adjusted required returns.

Correct Answer

verified

Correct Answer

verified

True/False

The risk-return tradeoff that investors face on a day-to-day basis is based on realized rates of return because expected returns involve too much uncertainty.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you have $100,000 invested in a stock that is returning 14%,$150,000 invested in a stock that is returning 18%,and $200,000 invested in a stock that is returning 15%.What is the expected return of your portfolio?

A) 13.25%

B) 14.97%

C) 15.67%

D) 15.78%

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 147

Related Exams