A) $6.24

B) $6.00

C) $14.94

D) $32.59

Correct Answer

verified

Correct Answer

verified

Multiple Choice

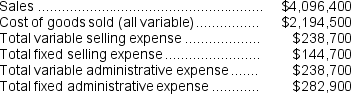

Bolka Corporation, a merchandising company, reported the following results for October:

-The gross margin for October is:

-The gross margin for October is:

A) $1,424,500

B) $1,901,900

C) $996,900

D) $3,668,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

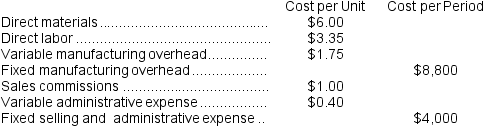

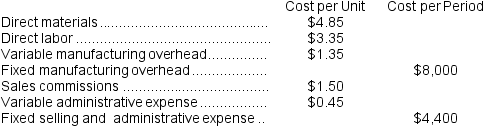

Glew Corporation has provided the following information:

-If 3,000 units are produced,the total amount of direct manufacturing cost incurred is closest to:

-If 3,000 units are produced,the total amount of direct manufacturing cost incurred is closest to:

A) $33,300

B) $31,050

C) $28,050

D) $39,900

Correct Answer

verified

Correct Answer

verified

Multiple Choice

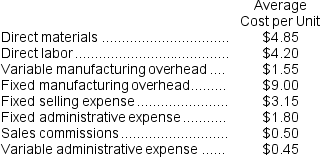

Kogler Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

-If the selling price is $25.00 per unit,the contribution margin per unit sold is closest to:

-If the selling price is $25.00 per unit,the contribution margin per unit sold is closest to:

A) $13.45

B) ($0.50)

C) $5.40

D) $15.95

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation is always considered a period cost for external financial reporting purposes in a manufacturing company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following production costs,if expressed on a per unit basis,would be most likely to change significantly as the production level varies?

A) Direct materials.

B) Direct labor.

C) Fixed manufacturing overhead.

D) Variable costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

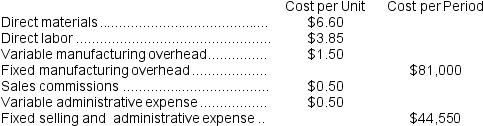

Bowering Corporation has provided the following information:

-For financial reporting purposes,the total amount of product costs incurred to make 9,000 units is closest to:

-For financial reporting purposes,the total amount of product costs incurred to make 9,000 units is closest to:

A) $81,000

B) $188,550

C) $107,550

D) $197,550

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Within the relevant range,a difference between variable costs and fixed costs is:

A) variable costs per unit fluctuate and fixed costs per unit remain constant.

B) variable costs per unit are constant and fixed costs per unit fluctuate.

C) both total variable costs and total fixed costs are constant.

D) both total variable costs and total fixed costs fluctuate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

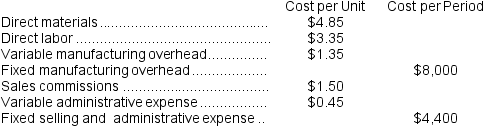

Lagle Corporation has provided the following information:

-If 5,000 units are sold,the variable cost per unit sold is closest to:

-If 5,000 units are sold,the variable cost per unit sold is closest to:

A) $14.60

B) $11.50

C) $9.55

D) $11.55

Correct Answer

verified

Correct Answer

verified

True/False

Committed fixed costs represent organizational investments with a one-year planning horizon.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One full-time clerical worker is needed for every 750 accounts receivable.The total wages of the accounts receivable clerks is an example of a:

A) fixed cost.

B) step-variable cost.

C) mixed cost.

D) curvilinear cost.

Correct Answer

verified

Correct Answer

verified

True/False

Fixed costs expressed on a per unit basis do not change with changes in activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

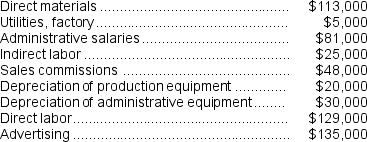

A partial listing of costs incurred at Archut Corporation during September appears below:

-The total of the period costs listed above for September is:

-The total of the period costs listed above for September is:

A) $294,000

B) $344,000

C) $292,000

D) $50,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

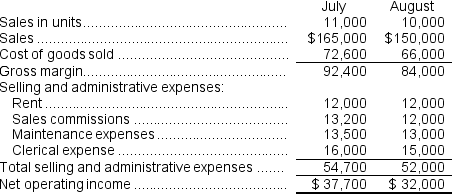

Comparative income statements for Boggs Sports Equipment Company for the last two months are presented below:

All of the company's costs are either fixed,variable,or a mixture of the two (i.e.,mixed) .Assume that the relevant range includes all of the activity levels mentioned in this problem.

Which of the selling and administrative expenses of the company is variable?

All of the company's costs are either fixed,variable,or a mixture of the two (i.e.,mixed) .Assume that the relevant range includes all of the activity levels mentioned in this problem.

Which of the selling and administrative expenses of the company is variable?

A) Rent

B) Sales Commissions

C) Maintenance Expense

D) Clerical Expense

Correct Answer

verified

Correct Answer

verified

True/False

In a traditional format income statement,the gross margin minus selling and administrative expenses equals net operating income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lagle Corporation has provided the following information:

-For financial reporting purposes,the total amount of period costs incurred to sell 4,000 units is closest to:

-For financial reporting purposes,the total amount of period costs incurred to sell 4,000 units is closest to:

A) $12,200

B) $7,800

C) $4,400

D) $8,100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

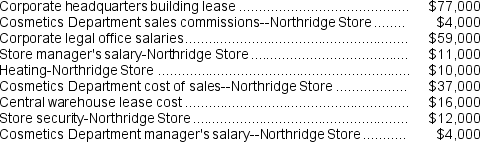

The following cost data pertain to the operations of Quinonez Department Stores, Inc., for the month of September.

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.

-What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.

-What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

A) $78,000

B) $45,000

C) $41,000

D) $37,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost incurred in the past that is not relevant to any current decision is classified as a(n) :

A) period cost.

B) opportunity cost.

C) sunk cost.

D) differential cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Product costs that have become expenses can be found in:

A) period costs.

B) selling expenses.

C) cost of goods sold.

D) administrative expenses.

Correct Answer

verified

Correct Answer

verified

Showing 281 - 299 of 299

Related Exams