A) $9 million.

B) $11 million.

C) $12 million.

D) $14 million.

E) $15 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which intermediation function results in an FI's exposure to liquidity risk?

A) Information production.

B) Asset transformation.

C) Conduit for monetary policy.

D) Lender of last resort.

E) Brokering between funds deficit units and funds surplus units.

Correct Answer

verified

Correct Answer

verified

True/False

The liquidity index should be a number that is either greater than one or less than zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a primary source of liquidity?

A) Excess cash reserves over and above regulatory reserve requirements.

B) Borrowings in the money market.

C) Borrowings in the purchased funds market.

D) Capital notes and other long-term financing alternatives.

E) Cash-type assets that can be sold with little price risk and low transaction costs.

Correct Answer

verified

Correct Answer

verified

True/False

Net asset value is the current value of a mutual fund's assets divided by the number of shares outstanding.

Correct Answer

verified

Correct Answer

verified

True/False

Liquidity risk for an FI includes the possibility of an unexpected inflow of funds.

Correct Answer

verified

Correct Answer

verified

True/False

Purchased liquidity risk management usually involves purchased funds such as fed funds, repurchase agreements and CDs.

Correct Answer

verified

Correct Answer

verified

True/False

A bank must be ready to pay out all demand deposit liabilities on any given day.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a crisis, which of the following are relatively less likely to withdraw funds quickly from banks and thrifts?

A) Correspondent banks.

B) Small business corporations.

C) Individual depositors.

D) Mutual funds.

E) Pension funds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

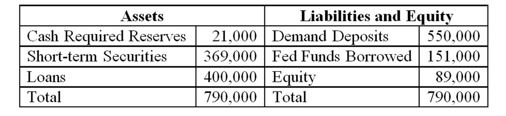

-If the bank experiences a $50,000 sudden liquidity drain caused by a loan commitment draw down, what will be the impact on the balance sheet if stored liquidity management techniques are used?

-If the bank experiences a $50,000 sudden liquidity drain caused by a loan commitment draw down, what will be the impact on the balance sheet if stored liquidity management techniques are used?

A) A reduction in cash of $21,000 and an increase in demand deposits of $29,000.

B) A reduction in securities and/or current loans totaling $50,000.

C) A reduction in cash of $21,000 and a decrease in securities holdings of $29,000.

D) A decrease in equity of $50,000.

E) A decrease in lending of $50,000.

Correct Answer

verified

Correct Answer

verified

True/False

Deposit insurance is the only deterrent to bank runs, contagious runs, and bank panics.

Correct Answer

verified

Correct Answer

verified

True/False

The cost of stored liquidity management is the interest that must be paid on the stored funds.

Correct Answer

verified

Correct Answer

verified

True/False

For life insurance companies, the distribution of premium income minus policyholder liquidations is unpredictable.

Correct Answer

verified

Correct Answer

verified

True/False

Insurance companies have had to deal with liability runs by policyholders.

Correct Answer

verified

Correct Answer

verified

True/False

In general, money center banks are exposed to less liquidity risk than smaller, regional banks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why have purchased liquidity management techniques become very popular in spite of its limitations?

A) Because it insulates the assets of an FI from normal drains on liability liquidity.

B) Because funds can be easily raised in the eventuality of a liquidity crunch.

C) Because of decrease in the cost of funds during periods of high interest rate volatility.

D) Because the funds are covered by deposit insurance.

E) Because the adjustment to the deposit drain occurs on the liability side of the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If purchased liquidity is used by a DI to fund an exercised loan commitment

A) the balance sheet will decrease by the amount of the new loan.

B) only the asset side of the balance sheet will increase.

C) the balance sheet will increase by the amount of the new loan.

D) only the liability side of the balance sheet will increase.

E) there will be no effect on the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT included as high-quality liquid assets when computing a liquidity coverage ratio?

A) Sovereign debt.

B) Bank capital.

C) Government guaranteed mortgage-backed securities.

D) Central bank reserves.

E) Cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the asset adjustment to a bank's balance sheet if the bank sold a five-year, 7 percent annual coupon $100,000 bond acquired at par, but now yielding 8 percent? The bond was not in the mark-to-market portfolio.

A) A $96,007 reduction in assets.

B) A $96,007 increase in assets.

C) A $100,000 reduction in assets.

D) A $100,000 increase in assets.

E) A $100,000 increase in liabilities.

Correct Answer

verified

Correct Answer

verified

True/False

An FI's most liquid asset is cash.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 100

Related Exams