A) An increase in the balance on capital account.

B) A decrease in U.S.goods exports.

C) An increase in net transfers.

D) A decrease in U.S.purchases of assets abroad.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose interest rates fall sharply in the United States but are unchanged in Great Britain.Other things equal,under a system of freely floating exchange rates,we can expect the demand for pounds in the United States to:

A) decrease,the supply of pounds to increase,and the dollar to appreciate relative to the pound.

B) increase,the supply of pounds to increase,and the dollar may either appreciate or depreciate relative to the pound.

C) increase,the supply of pounds to decrease,and the dollar to depreciate relative to the pound.

D) decrease,the supply of pounds to increase,and the dollar to depreciate relative to the pound.

Correct Answer

verified

Correct Answer

verified

True/False

Answer the question on the basis of the following 2008 balance of payments statement for Transylvania.All figures are in billions of dollars. Refer to the given data.If Transylvania was on a system of freely floating exchange rates,its balance of payments position would cause the international value of its currency to depreciate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following combinations is plausible,as it relates to a nation's balance of payments?

A) Current account = $+40 billion;capital account = $-10 billion;financial account = $-50 billion.

B) Current account = $+50 billion;capital account = $-20 billion;financial account = $+30 billion.

C) Current account = $+10 billion;capital account = $+40 billion;financial account = $+50 billion.

D) Current account = $+30 billion;capital account = $-20 billion;financial account = $-10 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relatively rapid U.S.growth between 2002 and 2007 contributed to large U.S.trade deficits by:

A) increasing U.S.national income,which decreased U.S.exports.

B) reducing real interest rates in the United States.

C) increasing U.S.tax revenues and reducing the federal budget deficit.

D) increasing U.S.national income,which increased U.S.imports.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists of exchange-rate systems is arranged in proper historical order,from earliest to most current?

A) Bretton Woods system,gold standard,managed float.

B) Gold standard,managed float,Bretton Woods system.

C) Managed float,Bretton Woods system,gold standard.

D) Gold standard,Bretton Woods system,managed float.

Correct Answer

verified

Correct Answer

verified

True/False

A system of fixed exchange rates is more likely to result in exchange controls than is a system of flexible (floating)exchange rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S.balance of payments account for a certain year,a positive number in the financial account means a:

A) net buildup of assets held by the U.S.

B) net reduction in the ownership of assets by U.S.interests.

C) buildup of total foreign debt.

D) reduction of total foreign debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States' current account deficit reached a new high in:

A) 2006.

B) 2007.

C) 2008.

D) 2009.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation's official reserves:

A) compensate for differences in the current and capital and financial accounts.

B) consist of all domestic and foreign currency held by a nation's central bank.

C) are always zero.

D) are always negative.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the balance on the current account is +$100 billion and the balance on the capital account is -$1 billion.The balance on the financial account is:

A) +$101 billion.

B) -$100 billion.

C) -$99 billion.

D) -$101 billion.

Correct Answer

verified

Correct Answer

verified

True/False

Answer the question on the basis of the following 2008 balance of payments statement for Transylvania.All figures are in billions of dollars. Refer to the given data.In 2008 Transylvania was a net recipient of transfers from the rest of the world.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

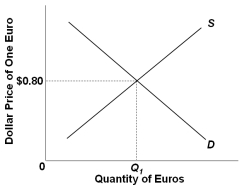

The following diagram is a flexible exchange market for foreign currency:  Refer to the diagram.At the equilibrium exchange rate:

Refer to the diagram.At the equilibrium exchange rate:

A) $8 will buy 1 euro.

B) 0.8 euros will buy $1.

C) 1.25 euros will buy $1.

D) $1 will buy 8 euros.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a nation's goods exports are $55 billion,while its goods imports are $50 billion,we can conclude with certainty that this nation has a:

A) balance of trade (goods) surplus.

B) balance of payments surplus.

C) positive balance on current account.

D) positive balance on goods and services.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following combinations is plausible,as it relates to a nation's balance of payments?

A) Current account = $+40 billion;capital account = $+20 billion;financial account = $-50 billion.

B) Current account = $-50 billion;capital account = $+20 billion;financial account = $+30 billion.

C) Current account = $+10 billion;capital account = $+40 billion;financial account = $+50 billion.

D) Current account = $+30 billion;capital account = $-20 billion;financial account = $-50 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of the 2007-2009 recession:

A) declining imports created a trade surplus for the United States.

B) the U.S.trade deficit grew significantly.

C) declining imports reduced the size of the U.S.trade deficit.

D) roughly equivalent declines in both exports and imports left the U.S.trade balance unchanged.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2012,the United States' balance on goods was about:

A) -$735 billion.

B) +$630 billion.

C) -$540 billion.

D) +$199 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years,the United States has had large:

A) current account surpluses.

B) current account deficits.

C) balance of trade surpluses.

D) balance of payments surpluses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the balance on the current account is +$50 billion and the balance on the capital account is +$1 billion.The balance on the financial account is:

A) -$51 billion.

B) -$50 billion.

C) -$49 billion.

D) +$51 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mainly because of large current account deficits,the United States:

A) is the leading exporting nation in the world.

B) has the world's largest external debt.

C) has the world's highest saving rate.

D) is experiencing an increase in its net inflow of investment income.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 138

Related Exams