Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest Rate Parity (IRP) is best defined as

A) when a government brings its domestic interest rate in line with other major financial markets.

B) when the central bank of a country brings its domestic interest rate in line with its major trading partners.

C) an arbitrage condition that must hold when international financial markets are in equilibrium.

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A formal statement of IRP is

A) ![]() .

.

B) ![]() .

.

C) ![]() .

.

D) ![]() .

.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of today, the spot exchange rate is €1.00 = $1.60 and the rates of inflation expected to prevail for the next year in the U.S. is 2% and 3% in the euro zone. What is the one-year forward rate that should prevail?

A) €1.00 = $1.6157

B) €1.6157 = $1.00

C) €1.00 = $1.5845

D) $1.00 × 1.03 = €1.60 × 1.02

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of a McDonald's Big Mac sandwich

A) is about the same in the 120 countries that McDonalds does business in.

B) varies considerably across the world in dollar terms.

C) supports PPP.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the one-year interest rate is 5.0 percent in the United States and 3.5 percent in Germany, and that the spot exchange rate is $1.12/€ and the one-year forward exchange rate, is $1.16/€. Assume that an arbitrageur can borrow up to $1,000,000.

A) This is an example where interest rate parity holds.

B) This is an example of an arbitrage opportunity; interest rate parity does NOT hold.

C) This is an example of a Purchasing Power Parity violation and an arbitrage opportunity.

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If IRP fails to hold

A) pressure from arbitrageurs should bring exchange rates and interest rates back into line.

B) it may fail to hold due to transactions costs.

C) it may be due to government-imposed capital controls.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Essay

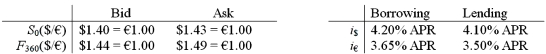

If you had €1,000,000 and traded it for USD at the spot rate, how many USD will you get?

Correct Answer

verified

Correct Answer

verified

Essay

USING YOUR PREVIOUS ANSWERS and a bit more work, find the 1-year forward BID exchange rate in $ per € that that satisfies IRP from the perspective of a customer.

Correct Answer

verified

Correct Answer

verified

Essay

If you borrowed $1,000,000 for one year, how much money would you owe at maturity?

Correct Answer

verified

Correct Answer

verified

Essay

USING YOUR PREVIOUS ANSWERS and a bit more work, find the 1-year forward exchange rate in $ per € that satisfies IRP from the perspective of a customer that borrowed $1m traded for € at the spot and invested at i€ = 3%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generating exchange rate forecasts with the fundamental approach involves

A) looking at charts of the exchange rate and extrapolating the patterns into the future

B) estimation of a structural model

C) substituting the estimated values of the independent variables into the estimated structural model to generate the forecast

D) both b and c

Correct Answer

verified

Correct Answer

verified

Essay

USING YOUR PREVIOUS ANSWERS and a bit more work, find the 1-year forward exchange rate in $ per € that that satisfies IRP from the perspective of a customer who borrowed €1m, traded for dollars at the spot rate and invested at i$ = 2%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the annual inflation rate is 2.5 percent in the United States and 4 percent in the U.K., and the dollar appreciated against the pound by 1.5 percent, then the real exchange rate, assuming that PPP initially held, is _____.

A) parity

B) 0.9710

C) -0.0198

D) 4.5

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An arbitrage is best defined as

A) a legal condition imposed by the CFTC.

B) the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making reasonable profits.

C) the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making guaranteed profits.

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Will an arbitrageur facing the following prices be able to make money?

A) Yes, borrow €1,000,000 at 3.65%; Trade for $ at the bid spot rate $1.40 = €1.00; Invest at 4.1%; Hedge this with a long position in a forward contract.

B) Yes, borrow $1,000,000 at 4.2%; Trade for € at the spot ask exchange rate $1.43 = €1.00; Invest €699,300.70 at 3.5%; Hedge this by going SHORT in forward (agree to sell € @ BID price of $1.44/€ in one year) . Cash flow in 1 year $237.76.

C) No; the transactions costs are too high.

D) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

USING YOUR PREVIOUS ANSWERS and a bit more work, find the 1-year forward BID exchange rate in $ per € that satisfies IRP from the perspective of a customer.

Correct Answer

verified

Correct Answer

verified

Essay

If you borrowed $1,000,000 for one year, how much money would you owe at maturity?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you observe a spot exchange rate of $1.50/€. If interest rates are 5% APR in the U.S. and 3% APR in the euro zone, what is the no-arbitrage 1-year forward rate?

A) €1.5291/$

B) $1.5291/€

C) €1.4714/$

D) $1.4714/€

Correct Answer

verified

Correct Answer

verified

Essay

If you borrowed $1,000,000 for one year, how much money would you owe at maturity?

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 100

Related Exams