A) One

B) Two

C) Three

D) Four

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Salient economic factors for determining the functional currency include

A) cash flow indicators.

B) sales price indicators.

C) sales market indicators.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the current/noncurrent method,current assets are defined as

A) inventory that is currently salable.

B) assets with a maturity of one year or less.

C) assets with a maturity of 90 days or less.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A derivatives hedge that seeks to eliminate translation exposure

A) eliminate any mismatch of the rate of change in net assets and the rate of change in net liabilities denominated in the same currency.

B) really involves speculation about foreign exchange rate changes.

C) by simultaneously going long and short in currency futures contracts.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

FASB 8 is essentially the

A) current/noncurrent method.

B) monetary/nonmonetary method.

C) temporal method.

D) current rate method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "reporting currency" is defined in FASB 52 as

A) the currency of the primary economic environment in which the entity operates.

B) the currency in which the MNC prepares its consolidated financial statements.

C) a currency that is not the parent firm's home country currency.

D) both a and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a U.S.-based MNC with manufacturing activities in Japan.The result of a change in the ¥-$ exchange rate on the assets and liabilities of the consolidated balance sheet is: Ignoring transaction exposure in the yen,the translation exposure will indicate a possible need for a "balance sheet hedge" of

A) ¥200,000,000 more liabilities denominated in yen.

B) ¥200,000,000 less assets denominated in yen.

C) both a) or b)

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Translation exposure,also frequently called accounting exposure,refers to the effect that an unanticipated change in exchange rates will have on the

A) choice of accounting methodology.

B) consolidated financial reports of an MNC.

C) firms competitive position.

D) cash flows realized from foreign operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.parent firm,as result of its business activities in Germany,has a net exposure of €1,000,000.The consolidated reports were prepared at the year end for the last two successive years.If the exchange rates on these reporting dates changed from $1.00 = €1.10 to $1.00 = €1.00,then the translation exposure report will indicate a "reporting currency imbalance" of

A) $90,910.

B) $0.

C) -$90,910.

D) none of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Under which accounting method are most income statement accounts translated at the average exchange rate for the period?

A) Current/noncurrent method

B) Monetary/nonmonetary method

C) Temporal method

D) Current rate method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With regard to foreign currency translation methods used by foreign MNCs,

A) foreign currency translation methods are generally only used by U.S.-based MNCs since foreign firms have a built in hedge by being foreign.

B) are generally the same methods used by U.S.-based firms.

C) are exactly the same methods used by U.S.-based firms since GAAP is GAAP.

D) none of the above are true statements.

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

With regard to research on the stock price reaction to mandated accounting changes such as FASB 52

A) the results suggest that market participants seem to think that changes in reported earnings do not change the actual cash flows in multinational firms.

B) the results suggest that market agents react to "cosmetic" earning changes.

C) the results suggest that market agents do not react to cosmetic earning changes that do not affect value.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Essay

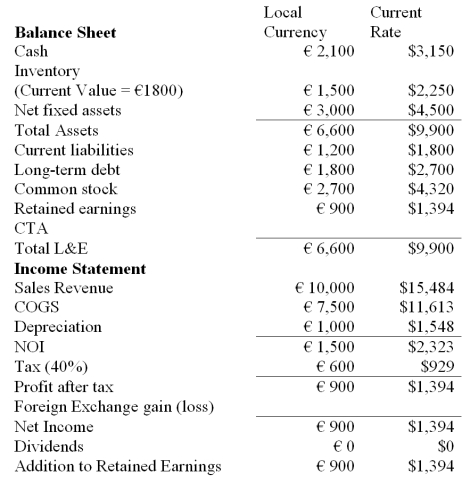

Calculate the cumulative translation adjustment for this U.S.MNC translating the balance sheet and income statement of a French subsidiary,which keeps its books in euro,but that is translated into U.S.dollars using the current rate method,the reporting currency of the U.S.MNC.

The subsidiary is at the end of its first year of operation.

The historical exchange rate is $1.60/€1.00 and the most recent exchange rate is $1.50/€

Correct Answer

verified

11ea7281_b332_f496_9608_af09e2045005_TB3610_00

Correct Answer

verified

Multiple Choice

The underlying principle of the temporal method is

A) assets and liabilities should be translated based on their maturity.

B) monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C) monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D) all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The impact of financing in determining the functional currency

A) financing does not impact the choice of functional currency due to the integrated nature of capital markets.

B) if the financing of the foreign entity is primarily denominated in the foreign currency and the debt service obligations are normally handled by the foreign entity, the functional currency is the foreign currency.

C) if the financing of the foreign entity is primarily from the parent, with debt service obligations normally handled by the parent, the functional currency is the home currency.

D) both b and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the temporal method,monetary accounts such as cash

A) are not translated.

B) are translated at the average exchange rate prevailing over the reporting period.

C) are translated at the current forward exchange rate.

D) are translated at the current spot exchange rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) Most income statement items under the current/noncurrent method are translated at the average exchange rate for the accounting period.

B) Under the current/noncurrent method, revenue and expense items that are associated with current assets or liabilities, such as depreciation expense, are translated at the historical rate that applies to the applicable balance sheet item.

C) Under the current/noncurrent method, revenue and expense items that are associated with noncurrent assets or liabilities, such as depreciation expense, are translated at the historical rate that applies to the applicable balance sheet item.

D) Depreciation expense is translated at the historical rate that applies to the applicable depreciable asset items.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under FASB 52,when a net translation exposure exists,

A) a derivatives hedge is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

B) a money market hedge is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

C) a cumulative translation adjustment account is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The generally accepted method for consolidating the financial reports of an MNC from the 1930s to 1975 was

A) current/noncurrent method.

B) monetary/nonmonetary method.

C) temporal method.

D) current rate method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The underlying principle of the monetary/nonmonetary method is

A) assets and liabilities should be translated based on their maturity.

B) monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C) monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D) all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 81

Related Exams