A) is the nature and cause of the disequilibrium.

B) is whether it is a trade surplus or deficit.

C) is whether the local government is mercantilist or not.

D) Nothing is more important than the absolute size of a country's balance-of-payments disequilibrium.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

There is an intimate relationship between a country's BCA and how the country finances its domestic investment and pays for government expenditures.Given this,which of the following is a true statement?

A) If (S - I) < 0, it implies that a country's domestic savings is insufficient to finance domestic investment.

B) If (T - G) < 0, it implies that a country's tax revenue is insufficient to finance government spending.

C) When BCA is negative, it implies that government budget deficits an/or part of domestic investment are being finance with foreign-controlled capital.

D) All of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

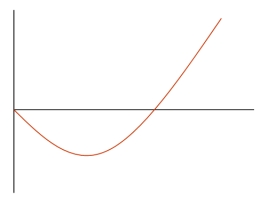

What is the correct label for the vertical axis in the J-curve?

A) Time

B) Change in the Trade Balance

C) Size of Trade Balance

D) Size of Merchandise Trade Balance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the short run a currency depreciation can make a trade balance worse if

A) there is no domestic producer of an import.

B) there is no domestic buyer for an import.

C) there is no export market for a country's output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Honda,a Japanese auto maker,built a factory in Ohio,

A) it was engaged in foreign direct investment.

B) it was engaged in portfolio investment.

C) it was engaged in a cross-border acquisition.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the balance-of-payments accounts are recorded correctly,the combined balance of the current account,the capital account,and the reserves account must be

A) equal in magnitude to the country's national debt.

B) zero.

C) equal in magnitude to the Trade Deficit or Surplus.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate rises in the U.S.while other variables remain constant

A) capital inflows into the U.S.will increase.

B) capital inflows into the U.S.may not materialize.

C) capital will flow out of the U.S.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The official reserve account includes

A) the export and import of goods and services.

B) all purchases and sales of assets such as stocks, bonds, bank accounts, real estate, and businesses.

C) all purchases and sales of international reserve assets such as dollars, foreign exchanges, gold, and special drawing rights (SDRs) .

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "J-curve effect"

A) happens most of the time, in the short run.

B) actually only occurs in about 40 percent of the cases according to a study by Sebastian Edwards.

C) is a long-run phenomenon, not a short-run one.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital account is divided into three subcategories: direct investment,portfolio investment,and other investment.Portfolio investment involves

A) acquisitions of controlling interests in foreign businesses.

B) investments in foreign stocks and bonds that do not involve acquisitions of control.

C) bank deposits, currency investment, trade credit, and the like.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country with a current account surplus

A) acquires IOUs from foreigners, thereby increasing its net foreign wealth.

B) must borrow from foreigners or draw down on its previously accumulated foreign wealth.

C) will experience a reduction in the country's net foreign wealth.

D) both b and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

International reserve assets include "foreign exchanges".These are

A) Special Drawing Rights (SDRs) at the IMF.

B) reserve positions in the International Monetary Fund (IMF) .

C) foreign currency held by a country's central bank.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Statistical discrepancy,which by definition represents errors and omissions

A) cannot be calculated directly.

B) is calculated by taking into account the balance-of-payments identity.

C) probably has some elements that are honest mistakes, it can't all be money laundering and drugs.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance on the reserves account (BRA) ,under the fixed exchange regime is

A) -$44 billion

B) $44 billion

C) $216 billion

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between Foreign Direct Investment and Portfolio Investment is that

A) Portfolio Investment mostly represents the sale and purchase of foreign financial assets such as stocks and bonds that do not involve a transfer of control.

B) Foreign Direct Investment mostly represents the sale and purchase of foreign financial assets such as stocks whereas Portfolio Investment mostly involves the sales and purchase of foreign bonds.

C) Foreign Direct Investment is about buying land and building factories, whereas portfolio investment is about buying stocks and bonds.

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the pure flexible exchange rate regime

A) the combined balance on the current and capital accounts will be equal in size, but opposite in sign, to the change in the official reserves.

B) the balance on the current and capital accounts will be equal in size, but opposite in sign.

C) a current account surplus or deficit must be matched by an official reserves deficit or surplus.

D) a capital account surplus or deficit must be matched by an official reserves deficit or surplus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With regard to the capital account

A) the capital account balance measures the difference between U.S.sales of assets to foreigners and U.S.purchases of foreign assets.

B) U.S.sales (or exports) of assets are recorded as credits, as they result in capital inflow.

C) U.S.purchases (imports) of foreign assets are recorded as debits, as they lead to capital outflow.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Factor income

A) consists largely of interest, dividends, and other income on foreign investments.

B) is a theoretical construct of the factors of production, land, labor, capital, and entrepreneurial ability.

C) is generally a very minor part of national income accounting, smaller than the statistical discrepancy.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current account includes

A) the export and import of goods and services.

B) all purchases and sales of assets such as stocks, bonds, bank accounts, real estate, and businesses.

C) all purchases and sales of international reserve assets such as dollars, foreign exchanges, gold, and special drawing rights (SDRs) .

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the central banks of the world chose to diversify their foreign-exchange reserves away from the dollar and into the euro,

A) this would have the result of a strengthening of the value of the dollar.

B) this would have the result of a weakening in the value of the dollar.

C) this would not have much impact, as the information would be lost in the day-to-day volatility of exchange rates.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 100

Related Exams