A) Sell puts and buy calls

B) Buy puts and sell calls

C) Buy puts and buy calls

D) Both a and b

Correct Answer

verified

Correct Answer

verified

Multiple Choice

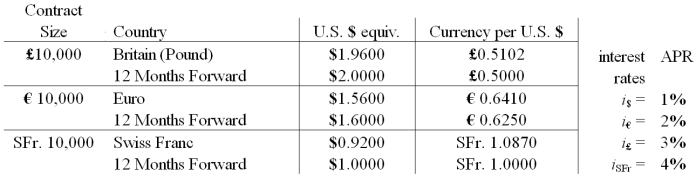

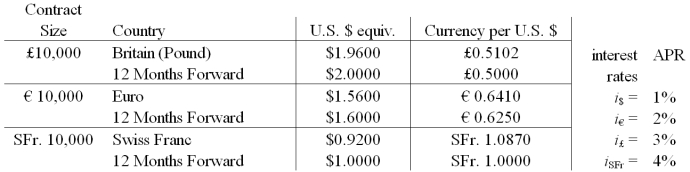

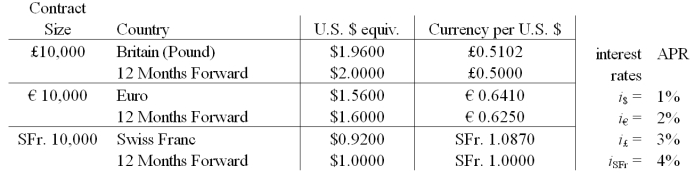

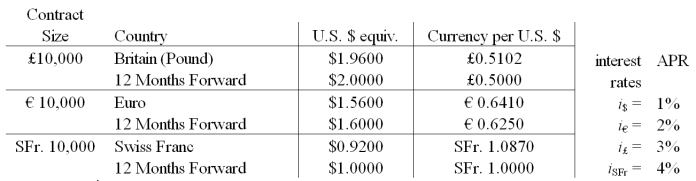

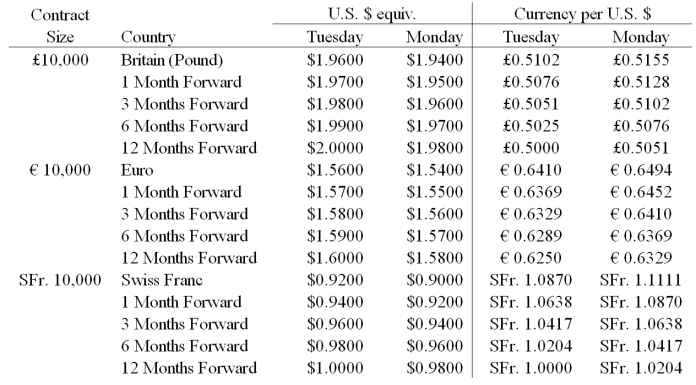

Your firm is an Italian importer of British bicycles.You have placed an order with a British firm for £1,000,000 worth of bicycles.Payment (in pounds sterling) is due in 12 months.Use a money market hedge to redenominate this one-year receivable into a euro-denominated receivable with a one-year maturity.  The following were computed without rounding.Select the answer closest to yours.

The following were computed without rounding.Select the answer closest to yours.

A) €1,225,490.20

B) €1,244,212.10

C) €1,250,000

D) €1,219,815.78

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Boeing Corporation exported a Boeing 747 to Lufthansa and billed €10 million payable in one year.The money market interest rates and foreign exchange rates are given as follows: Assume that Boeing sells a currency forward contract of €10 million for delivery in one year,in exchange for a predetermined amount of U.S.dollar.Suppose that on the maturity date of the forward contract,the spot rate turns out to be $1.40/€ (i.e.less than the forward rate of $1.46/€) .Which of the following is true?

A) Boeing would have received only $14.0 million, rather than €14.6 million, had it not entered into the forward contract

B) Boeing gained $0.6 million from forward hedging

C) a and b

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your U.S.firm has a £100,000 payable with a 3-month maturity.Which of the following will hedge your liability?

A) Buy the present value of £100,000 today at the spot exchange rate, invest in the U.K.at i£.

B) Buy a call option on £100,000 with a strike price in dollars.

C) Take a long position in a forward contract on £100,000 with a 3-month maturity.

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock market investor would pay attention to

A) anticipated changes in exchange rates that have been already discounted and reflected in the firm's value.

B) unanticipated changes in exchange rates that have not been discounted and reflected in the firm's value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm is an Italian exporter of bicycles.You have sold an order to a Swiss firm for SFr.2,000,000 worth of bicycles.Payment from the customer (in Swiss francs) is due in 12 months.Use a money market hedge to redenominate this one-year franc denominated receivable into a euro-denominated receivable with a one-year maturity.  The following were computed without rounding.Select the answer closest to yours.

The following were computed without rounding.Select the answer closest to yours.

A) €1,116,826.92

B) €1,250,000

C) €1,134,122.29

D) €1,156,804.73

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Boeing Corporation exported a Boeing 747 to Lufthansa and billed €10 million payable in one year.The money market interest rates and foreign exchange rates are given as follows: Assume that Boeing sells a currency forward contract of €10 million for delivery in one year,in exchange for a predetermined amount of U.S.dollar.Which of the following is (or are) true? On the maturity date of the contract Boeing will: (i) have to deliver €10 million to the bank (the counterparty of the forward contract) (ii) take delivery of $14.6 million (iii) have a zero net pound exposure (iv) have a profit,or a loss,depending on the future changes in the exchange rate,from this British sale

A) (i) and (iv)

B) (ii) and (iv)

C) (ii) , (iii) , and (iv)

D) (i) , (ii) , and (iii)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.firm has sold an Italian firm €1,000,000 worth of product.In one year the U.S.firm gets paid.To hedge,the U.S.firm bought put options on the euro with a strike price of $1.65.They paid an option premium $0.01 per euro.If at maturity,the exchange rate is $1.60,

A) the firm will realize $1,145,000 on the sale net of the cost of hedging.

B) the firm will realize $1,150,000 on the sale net of the cost of hedging.

C) the firm will realize $1,140,000 on the sale net of the cost of hedging.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 5-year swap contract can be viewed as a portfolio of 5 forward contracts with maturities of 1,2,3,4 and 5 years.One important exception is that

A) the forward price is the same for the swap contract but not for the forward contracts.

B) the swap contract will have daily resettlement.

C) the forward contracts will have resettlement risk.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sensitivity of "realized" domestic currency values of the firm's contractual cash flows denominated in foreign currency to unexpected changes in the exchange rate is

A) transaction exposure.

B) translation exposure.

C) economic exposure.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally speaking,a firm with recurrent exposure can best hedge using which product?

A) Options

B) Swaps

C) Futures

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Inc.,an exporting firm,expects to earn $20 million if the dollar depreciates,but only $10 million if the dollar appreciates.Assume that the dollar has an equal chance of appreciating or depreciating.Calculate the expected tax of ABC if it is operating in a foreign country that has progressive corporate taxes as shown below: Corporate income tax rate = 15% for the first $7,500,000. Corporate income tax rate = 30% for earnings exceeding $7,500,000.

A) $3,375,000

B) $6,000,000

C) $1,500,000

D) $4,500,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm is a Swiss importer of bicycles.You have placed an order with an Italian firm for €1,000,000 worth of bicycles.Payment (in euro) is due in 12 months.Use a money market hedge to redenominate this one-year receivable into a Swiss franc-denominated receivable with a one-year maturity.  The following were computed without rounding.Select the answer closest to yours.

The following were computed without rounding.Select the answer closest to yours.

A) SFr.1,728,900.26

B) SFr.1,600,000

C) SFr.1,544,705.88

D) SFr.800,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contingent exposure can best be hedged with

A) Options.

B) Money market hedging.

C) Futures.

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm is an Italian exporter of bicycles.You have sold an order to a British firm for £1,000,000 worth of bicycles.Payment from the customer (in pounds sterling) is due in 12 months.Use a money market hedge to redenominate this one-year receivable into a euro-denominated receivable with a one-year maturity.  The following were computed without rounding.Select the answer closest to yours.

The following were computed without rounding.Select the answer closest to yours.

A) €1,225,490.20

B) €1,244,212.10

C) €1,250,000

D) €1,219,815.78

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buying a currency option provides

A) a flexible hedge against exchange exposure.

B) limits the downside risk while preserving the upside potential.

C) a right, but not an obligation, to buy or sell a currency.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm is an Italian exporter of bicycles.You have sold an order to a British firm for £1,000,000 worth of bicycles.Payment from the customer (in pounds sterling) is due in 12 months.Detail a strategy using futures contracts that will hedge your exchange rate risk.Have an estimate of how many contracts of what type and maturity.

A) Go long 100 12-month pound futures contracts; and long 125 12-month euro futures contracts.

B) Go short 100 12-month pound futures contracts; and short 125 12-month euro futures contracts.

C) Go long 100 12-month pound futures contracts; and short 125 12-month euro futures contracts.

D) Go short 100 12-month pound futures contracts; and long 125 12-month euro futures contracts.

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.-based MNC with exposure to the Swedish krona could best cross-hedge with

A) forward contracts on the euro.

B) forward contracts on the ruble.

C) forward contracts on the pound.

D) forward contracts on the yen.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A study of Fortune 500 firms hedging practices shows that

A) over 90 percent of Fortune 500 firms use forward contracts.

B) over 90 percent of Fortune 500 firms use options contracts.

C) both a and b

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the exchange rate is €1.25 = £1.00. Options (calls and puts) are available on the London exchange in units of €10,000 with strike prices of £0.80 = €1.00. Options (calls and puts) are available on the Frankfurt exchange in units of £10,000 with strike prices of €1.25 = £1.00. For a U.K.firm to hedge a €100,000 payable,

A) buy 10 call options on the euro with a strike in pounds sterling.

B) buy 8 put options on the pound with a strike in euro.

C) sell 10 call options on the euro with a strike in pounds sterling.

D) sell 8 put options on the pound with a strike in euro.

E) both a and b

F) both c and d

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 100

Related Exams