A) they fall $220 million

B) they fall $200 million

C) they rise $200 million

D) they rise $220 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

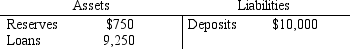

Table 21-2.An economy starts with $10,000 in currency.All of this currency is deposited into a single bank,and the bank then makes loans totaling $9,250.The T-account of the bank is shown below.

-Refer to Table 21-2.If all banks in the economy have the same reserve ratio as this bank,then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

-Refer to Table 21-2.If all banks in the economy have the same reserve ratio as this bank,then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

A) $866.67.

B) $1,666.67.

C) $2,000.00.

D) an infinite amount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) The Federal Reserve has 14 regional banks.The Board of Governors has 12 members who serve 7-year terms.

B) The Federal Reserve has 14 regional banks.The Board of Governors has 7 members who serve 14-year terms.

C) The Federal Reserve has 12 regional banks.The Board of Governors has 12 members who serve 7-year terms.

D) The Federal Reserve has 12 regional banks.The Board of Governors has 7 members who serve 14-year terms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 10 percent,$1,000 of additional reserves can create up to

A) $100 of new money.

B) $1,000 of new money.

C) $10,000 of new money.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following increases when the Fed makes open-market sales?

A) currency and reserves

B) currency but not reserves

C) reserves but not currency

D) neither currency nor reserves

Correct Answer

verified

Correct Answer

verified

True/False

In an economy that relies on barter,trade requires a double-coincidence of wants.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 15 percent,and banks do not hold excess reserves,and people hold only deposits and no currency,then when the Fed sells $65 million worth of bonds to the public,bank reserves

A) increase by $65 million and the money supply eventually increases by $266.67 million.

B) increase by $65 million and the money supply eventually increases by $433.33 million.

C) decrease by $65 million and the money supply eventually decreases by $266.67 million.

D) decrease by $65 million and the money supply eventually decreases by $433.33 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose banks decide to hold more excess reserves relative to deposits.Other things the same,this action will cause the

A) money supply to fall.To reduce the impact of this the Fed could sell Treasury bonds.

B) money supply to fall.To reduce the impact of this the Fed could buy Treasury bonds.

C) money supply to rise.To reduce the impact of this the Fed could sell Treasury bonds.

D) money supply to rise.To reduce the impact of this the Fed could buy Treasury bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most financial assets other than money function as

A) a medium of exchange,a unit of account,and a store of value.

B) a medium of exchange and a store of value,but not a unit of account.

C) a store of value and a unit of account,but not a mediuim of exchange.

D) a store of value,but not a unit of account nor a medium of exchange

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Savings deposits are included in

A) M1 but not M2.

B) M2 but not M1.

C) M1 and M2.

D) neither M1 nor M2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists is included in what economists call "money"?

A) cash

B) cash and stocks and bonds

C) cash and stocks and bonds and real estate

D) cash and stocks and bonds and real estate and all other assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money

A) is a perfect store of value.

B) is the most liquid asset.

C) has intrinsic value,regardless of which form it takes.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is both a store of value and regularly used as a medium of exchange?

A) cash and stocks

B) cash but not stocks

C) stocks but not cash

D) neither cash nor stocks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply decreases if the Fed

A) sells Treasury bonds.The larger the reserve requirement,the larger the decrease will be.

B) sells Treasury bonds.The smaller the reserve requirement,the larger the decrease will be.

C) buys Treasury bonds.The larger the reserve requirement,the larger the decrease will be.

D) buys Treasury bonds.The smaller the reserve requirement,the larger the decrease will be.

Correct Answer

verified

Correct Answer

verified

True/False

Assume that when $100 of new reserves enter the banking system,the money supply ultimately increases by $800.Assume also that no banks hold excess reserves and that the entire money supply consists of bank deposits.If,at a point in time,reserves for all banks amount to $750,then at that same point in time,loans for all banks amount to $6,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank's reserve ratio is 10 percent and the bank has $2,000 in deposits.Its reserves amount to

A) $20.

B) $200.

C) $400.

D) $1,800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 5 percent,then $1,000 of additional reserves can create up to

A) $200 of new money.

B) $2,000 of new money.

C) $20,000 of new money.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

True/False

Demand deposits are balances in bank accounts that depositors can access by writing a check or using a debit card.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank's reserve ratio is 5 percent and the bank has $1,000 in deposits.Its reserves amount to

A) $5.

B) $50.

C) $95.

D) $950.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed can increase the money supply by conducting open-market

A) sales or by raising the discount rate.

B) sales or by lowering the discount rate.

C) purchases or by raising the discount rate.

D) purchases or by lowering the discount rate.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 423

Related Exams