A) I and III only

B) II and IV only

C) II, III, and IV only

D) I, III, and IV only

E) I, II, III, and IV

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio has an expected return of 12.3 percent. This portfolio contains two stocks and one risk-free security. The expected return on stock X is 9.7 percent and on stock Y it is 17.7 percent. The risk-free rate is 3.8 percent. The portfolio value is $78,000 of which $18,000 is the risk-free security. How much is invested in stock X?

A) $18,600

B) $19,667

C) $21,375

D) $22,204

E) $24,800

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a portfolio comprised of four risky securities. Assume the economy has three states with varying probabilities of occurrence. Which one of the following will guarantee that the portfolio variance will equal zero?

A) The portfolio beta must be 1.0.

B) The portfolio expected rate of return must be the same for each economic state.

C) The portfolio risk premium must equal zero.

D) The portfolio expected rate of return must equal the expected market rate of return.

E) There must be equal probabilities that the state of the economy will be a boom or a bust.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own a stock that has an expected return of 16.48 percent and a beta of 1.33. The U.S. Treasury bill is yielding 3.65 percent and the inflation rate is 2.95 percent. What is the expected rate of return on the market?

A) 13.07 percent

B) 13.30 percent

C) 13.64 percent

D) 14.09 percent

E) 14.42 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

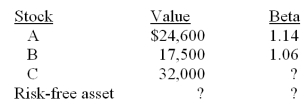

You currently own a portfolio valued at $80,000 that is equally as risky as the market. Given the information below, what is the beta of stock C?

A) 0.91

B) 0.95

C) 1.04

D) 1.13

E) 1.18

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has an expected return of 17.2 percent and a beta of 1.59. The risk-free rate is 5.1 percent. What is the slope of the security market line?

A) 7.55 percent

B) 7.61 percent

C) 7.78 percent

D) 7.92 percent

E) 8.03 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following terms best refers to the practice of investing in a variety of diverse assets as a means of reducing risk?

A) Systematic

B) Unsystematic

C) Diversification

D) Security market line

E) Capital asset pricing model

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

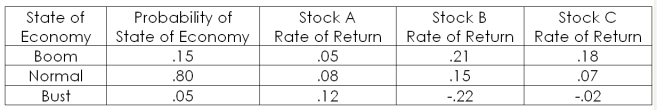

Consider the following information on a portfolio of three stocks:  The portfolio is invested 35 percent in each A and B and 30 percent in C. If the expected T-bill rate is 3.90 percent, what is the expected risk premium on the portfolio?

The portfolio is invested 35 percent in each A and B and 30 percent in C. If the expected T-bill rate is 3.90 percent, what is the expected risk premium on the portfolio?

A) 6.19 percent

B) 6.90 percent

C) 7.38 percent

D) 7.72 percent

E) 8.68 percent

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary owns a risky stock and anticipates earning 16.5 percent on her investment in that stock. Which one of the following best describes the 16.5 percent rate?

A) Expected return

B) Real return

C) Market rate

D) Systematic return

E) Risk premium

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardware and Moore has an expected return of 12.9 percent and a beta of 1.21. The expected return on the market is 11.7 percent. What is the risk-free rate?

A) 3.87 percent

B) 4.24 percent

C) 4.61 percent

D) 5.38 percent

E) 5.99 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a security plots to the right and below the security market line, then the security has ____ systematic risk than the market and is _____.

A) more; overpriced

B) more; underpriced

C) less; overpriced

D) less; underpriced

E) less; correctly priced

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to create a $48,000 portfolio that consists of three stocks and has an expected return of 14.5 percent. Currently, you own $16,700 of stock A and $24,200 of stockB. The expected return for stock A is 18.7 percent, and for stock B it is 11.2 percent. What is the expected rate of return for stock C?

A) 13.67 percent

B) 14.14 percent

C) 15.38 percent

D) 15.87 percent

E) 16.11 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The risk premium on a risk-free security is generally considered to be one percent.

B) The expected rate of return on any security, given multiple states of the economy, must be positive.

C) There is an inverse relationship between the level of risk and the risk premium given a risky security.

D) If a risky security is correctly priced, its expected risk premium will be positive.

E) If a risky security is priced correctly, it will have an expected return equal to the risk-free rate.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Systematic risk is:

A) totally eliminated when a portfolio is fully diversified.

B) defined as the total risk associated with surprise events.

C) risk that affects a limited number of securities.

D) measured by beta.

E) measured by standard deviation.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the minimum required rate of return on a new investment that makes that investment attractive?

A) Risk-free rate

B) Market risk premium

C) Expected return minus the risk-free rate

D) Market rate of return

E) Cost of capital

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 1.47 while stock B has a beta of 1.08 and an expected return of 13.2 percent. What is the expected return on stock A if the risk-free rate is 4.5 percent and both stocks have equal reward-to-risk premiums?

A) 12.12 percent

B) 15.07 percent

C) 16.34 percent

D) 16.89 percent

E) 17.78 percent

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the best example of an announcement that is most apt to result in an unexpected return?

A) A news bulletin that the anticipated layoffs by a firm will occur as expected on December 1

B) Announcement that the CFO of the firm is retiring June ![]() as previously announced

as previously announced

C) Announcement that a firm will continue its practice of paying a $3 a share annual dividend

D) Statement by a firm that it has just discovered a manufacturing defect and is recalling its product

E) The verification by senior management that the firm is being acquired as had been rumored

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following represents the amount of compensation an investor should expect to receive for accepting the unsystematic risk associated with an individual security?

A) Security beta multiplied by the market rate of return

B) Market risk premium

C) Security beta multiplied by the market risk premium

D) Risk-free rate of return

E) Zero

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard deviation measures _____ risk while beta measures _____ risk.

A) systematic; unsystematic

B) unsystematic; systematic

C) total; unsystematic

D) total; systematic

E) asset-specific; market

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own a portfolio that has $1,900 invested in Stock A and $2,700 invested in Stock B. If the expected returns on these stocks are 9 percent and 15 percent, respectively, what is the expected return on the portfolio?

A) 10.57 percent

B) 11.14 percent

C) 11.96 percent

D) 12.52 percent

E) 13.07 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 106

Related Exams