A) If the IRR exceeds the required return, the profitability index will be less than 1.0.

B) The profitability index will be greater than 1.0 when the net present value is negative.

C) When the internal rate of return is greater than the required return, the net present value is positive.

D) Projects with conventional cash flows have multiple internal rates of return.

E) If two projects are mutually exclusive, you should select the project with the shortest payback period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Auto Detailers is buying some new equipment at a cost of $228,900.This equipment will be depreciated on a straight-line basis to a zero book value its eight-year life.The equipment is expected to generate net income of $36,000 a year for the first four years and $22,000 a year for the last four years.What is the average accounting rate of return?

A) 15.48 percent

B) 17.76 percent

C) 18.09 percent

D) 22.68 percent

E) 25.34 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

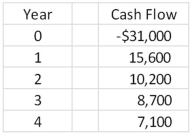

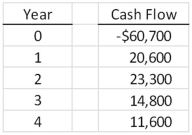

A project has the following cash flows.What is the payback period?

A) 2.38 years

B) 2.49 years

C) 2.60 years

D) 3.01 years

E) 3.33 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Greasy Spoon Restaurant is considering a project with an initial cost of $525,000.The project will not produce any cash flows for the first three years.Starting in year 4,the project will produce cash inflows of $721,000 a year for three years.This project is risky,so the firm has assigned it a discount rate of 16 percent.What is the project's net present value?

A) $417,294.85

B) $424,591.11

C) $451,786.86

D) $492,255.56

E) $512,408.23

Correct Answer

verified

Correct Answer

verified

Multiple Choice

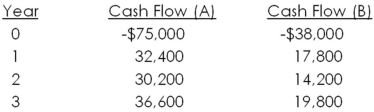

Jefferson International is trying to choose between the following two mutually exclusive design projects:  The required return is 12 percent.If the company applies the profitability index (PI) decision rule,which project should the firm accept?

If the company applies the NPV decision rule,which project should it take?

Given your first two answers,which project should the firm actually accept?

The required return is 12 percent.If the company applies the profitability index (PI) decision rule,which project should the firm accept?

If the company applies the NPV decision rule,which project should it take?

Given your first two answers,which project should the firm actually accept?

A) Project A; Project B; Project A

B) Project A; Project B; Project B

C) Project B; Project A; Project A

D) Project B; Project A; Project B

E) Project B; Project B, Project B

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The net present value is a measure of profits expressed in today's dollars.

B) The net present value is positive when the required return exceeds the internal rate of return.

C) If the initial cost of a project is increased, the net present value of that project will also increase.

D) If the internal rate of return equals the required return, the net present value will equal zero.

E) Net present value is equal to an investment's cash inflows discounted to today's dollars.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value of a project's cash inflows is $8,216 at a 14 percent discount rate.The profitability index is 1.03 and the firm's tax rate is 34 percent.What is the initial cost of the project?

A) $6,900.00

B) $7,018.50

C) $7,428.32

D) $7,976.70

E) $8,066.67

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Golden Goose is considering a project with an initial cost of $46,700.The project will produce cash inflows of $10,000 a year for the first two years and $12,000 a year for the following three years.What is the payback period?

A) 2.87 years

B) 3.23 years

C) 3.41 years

D) 3.79 years

E) 4.23 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicators offers the best assurance that a project will produce value for its owners?

A) PI equal to zero

B) Negative rate of return

C) Positive AAR

D) Positive IRR

E) Positive NPV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

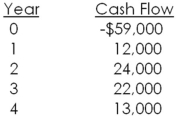

The Flour Baker is considering a project with the following cash flows.Should this project be accepted based on its internal rate of return if the required return is 11 percent?

A) Yes, because the project's rate of return is 7.78 percent

B) Yes, because the project's rate of return is 9.36 percent

C) No, because the project's rate of return is 7.78 percent

D) No, because the project's rate of return is 9.36 percent

E) No, because the project's rate of return is 13.08 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is specifically designed to compute the rate of return on a project that has unconventional cash flows?

A) Average accounting return

B) Profitability index

C) Internal rate of return

D) Indexed rate of return

E) Modified internal rate of return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will occur when the internal rate of return equals the required return?

A) The average accounting return will equal 1.0.

B) The profitability index will equal 1.0.

C) The profitability index will equal 0.

D) The net present value will equal the initial cash outflow.

E) The profitability index will equal the average accounting return.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are making a $120,000 investment and feel that a 20 percent rate of return is reasonable given the nature of the risks involved.You feel you will receive $48,000 in the first year,$54,000 in the second year,and $56,000 in the third year.You expect to pay out $12,000 as an additional investment in the fourth year.What is the net present value of this investment given your expectations?

A) -$15,879.63

B) -$4,305.56

C) $15,879.63

D) $16,233.33

E) $18,534.25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

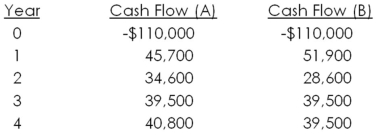

Textiles Unlimited has gathered projected cash flows for two projects.At what interest rate would the company be indifferent between the two projects? Which project is better if the required return is above this interest rate?

A) 11.76 percent; A

B) 12.49 percent; A

C) 12.49 percent; B

D) 13.15 percent; A

E) 13.15 percent: B

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the primary advantage of payback analysis?

A) Incorporation of the time value of money concept

B) Ease of use

C) Research and development bias

D) Arbitrary cutoff point

E) Long-term bias

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payback period is the length of time it takes an investment to generate sufficient cash flows to enable the project to:

A) produce a positive annual cash flow.

B) produce a positive cash flow from assets.

C) offset its fixed expenses.

D) offset its total expenses.

E) recoup its initial cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is reviewing a project that has an initial cost of $71,000.The project will produce annual cash inflows,starting with year 1,of $8,000,$13,400,$18,600,$33,100,and finally in year 5,$37,900.What is the profitability index if the discount rate is 11 percent?

A) 0.92

B) 0.98

C) 1.02

D) 1.07

E) 1.12

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The possibility that more than one discount rate can cause the net present value of an investment to equal zero is referred to as:

A) duplication.

B) the net present value profile.

C) multiple rates of return.

D) the AAR problem.

E) the dual dilemma.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the payback period for a project with the following cash flows?

A) 2.56 years

B) 2.89 years

C) 3.17 years

D) 3.74 years

E) never

Correct Answer

verified

Correct Answer

verified

Multiple Choice

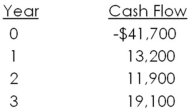

What is the NPV of the following set of cash flows at a discount rate of zero percent? What if the discount rate is 15 percent?

A) -$41,700; -$8,665.07

B) -$41,700; $1,208.19

C) $0; $1,208.19

D) $2,500; $1,208.19

E) $2,500; -$8,665.07

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 113

Related Exams