A) uncommon because of the high reserve requirement.

B) uncommon because of FDIC deposit insurance.

C) common because of the low reserve requirement.

D) common because the FDIC is nearly bankrupt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the money supply might indicate that the Fed had

A) purchased bonds in an attempt to increase the federal funds rate.

B) purchased bonds in an attempt to reduce the federal funds rate.

C) sold bonds in an attempt to increase the federal funds rate.

D) sold bonds in an attempt to reduce the federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which group within the Federal Reserve System meets to discuss changes in the economy and determine monetary policy?

A) the Board of Governors

B) the FOMC

C) the regional Federal Reserve Bank presidents

D) the Central Bank Policy Commission

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary policy affects employment

A) only in the long run.

B) only in the short run.

C) in both the long run and the short run.

D) in neither the long run nor the short run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tool of monetary policy does the Federal Reserve use most often?

A) adjustments to long-term interest rates

B) open-market operations

C) changes in reserve requirements

D) changes in the discount rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a bank's reserve ratio is 10 percent and the bank has $2,000 in deposits.Its reserves amount to

A) $20.

B) $200.

C) $400.

D) $1,800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase the money supply,the Fed could

A) sell government bonds.

B) increase the discount rate.

C) decrease the reserve requirement.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

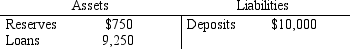

Table 29-2.An economy starts with $10,000 in currency.All of this currency is deposited

into a single bank,and the bank then makes loans totaling $9,250.The

T-account of the bank is shown below.

-Refer to Table 29-2.If all banks in the economy have the same reserve ratio as this bank,then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

-Refer to Table 29-2.If all banks in the economy have the same reserve ratio as this bank,then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by

A) $866.67.

B) $1,666.67.

C) $2,000.00.

D) an infinite amount.

Correct Answer

verified

Correct Answer

verified

True/False

Federal Reserve governors are given long terms to insulate them from politics.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entities actually executes open-market operations?

A) the Board of Governors

B) the New York Federal Reserve Bank

C) the Federal Open Market Committee

D) the Open Market Committees of the regional Federal Reserve Banks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not included in M1?

A) currency

B) demand deposits

C) savings deposits

D) travelers' checks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In early 2008,the Federal Reserve

A) announced that it was temporarily suspending its practice of making loans available to banks.

B) declared that the credit crisis,which had recently resulted in severe financial-market problems,had come to an end.

C) took actions to prevent the imminent bankruptcy of JP Morgan Chase,a bank.

D) took actions to prevent the imminent bankruptcy of Bear Stearns,an investment bank.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

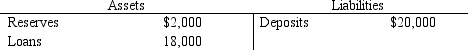

Table 29-5.

Bank of Kopeka

-Refer to Table 29-5.Assume there is a reserve requirement and the Bank of Kopeka is exactly in compliance with that requirement.Assume the same is true for all other banks.Lastly,assume people hold only deposits and no currency.What is the money multiplier?

-Refer to Table 29-5.Assume there is a reserve requirement and the Bank of Kopeka is exactly in compliance with that requirement.Assume the same is true for all other banks.Lastly,assume people hold only deposits and no currency.What is the money multiplier?

A) 5

B) 10

C) 15

D) 20

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists two things that both increase the money supply?

A) the Fed buys bonds and lowers the discount rate

B) the Fed buys bonds and raises the discount rate

C) the Fed sells bonds and lowers the discount rate

D) the Fed sells bonds and raises the discount rate

Correct Answer

verified

Correct Answer

verified

True/False

In the months of November and December,people in the United States hold a larger part of their money in the form of currency because they intend to shop and travel for the holidays.As a result,other things the same the money supply increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in M2 but not in M1?

A) demand deposits

B) corporate bonds

C) large time deposits

D) money market mutual funds

Correct Answer

verified

Correct Answer

verified

Multiple Choice

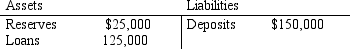

Table 29-4.

The First Bank of Wahooton

-Refer to Table 29-4.If the bank faces a reserve requirement of 20 percent,then it

-Refer to Table 29-4.If the bank faces a reserve requirement of 20 percent,then it

A) has $10,000 of excess reserves.

B) needs $10,000 more reserves to meet its reserve requirements.

C) needs $5,000 more reserves to meet its reserve requirements.

D) just meets its reserve requirement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a bank uses $100 of excess reserves to make a new loan when the reserve ratio is 20 percent,this action by itself initially makes the money supply

A) and wealth increase by $100.

B) and wealth decrease by $100.

C) increase by $100 while wealth does not change.

D) decrease by $100 while wealth decreases by $100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Imagine that the federal funds rate was above the level the Federal Reserve had targeted.To move the rate back towards it's target the Federal Reserve could

A) buy bonds.This buying would increase the money supply.

B) buy bonds.This buying would reduce the money supply.

C) sell bonds.This selling would increase the money supply..

D) sell bonds.This selling would reduce the money supply..

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the central bank in some country lowered the reserve requirement,then the money multiplier for that country

A) would increase.

B) would not change.

C) would decrease.

D) could do any of the above.

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 366

Related Exams