B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

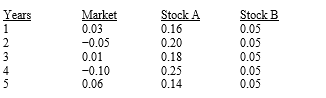

You have developed data which give (1) the average annual returns on the market for the past five years,and (2) similar information on Stocks A and B.If these data are as follows,which of the possible answers best describes the historical betas for A and B?

A) βA > 0;βB = 1

B) βA > +1;βB = 0

C) βA = 0;βB = −1

D) βA < 0;βB = 0

E) βA < −1;βB = 1

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A financial analyst has been following Fast Start Inc. ,a new high-growth company.She estimates that the current risk-free rate is 6.25 percent,the market risk premium is 5 percent,and that Fast Start's beta is 1.75.The current earnings per share (EPS0) is $2.50.The company has a 40 percent payout ratio.The analyst estimates that the company's dividend will grow at a rate of 25 percent this year,20 percent next year,and 15 percent the following year.After three years the dividend is expected to grow at a constant rate of 7 percent a year.The company is expected to maintain its current payout ratio.The analyst believes that the stock is fairly priced.What is the current price of the stock?

A) $16.51

B) $17.33

C) $18.53

D) $19.25

E) $19.89

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation,recession,and high interest rates are economic events which are characterized as

A) Company specific risk that can be diversified away.

B) Market risk.

C) Systematic risk that can be diversified away.

D) Diversifiable risk.

E) Unsystematic risk that can be diversified away.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A probability distribution is a listing of all possible outcomes,or events,with a probability assigned to each outcome.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The only condition under which risk can be reduced to zero is to find securities that are perfectly negatively correlated (ρ = −1.0)with each other.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) According to CAPM theory,the required rate of return on a given stock can be found by use of the SML equation:

Ri = rRF + (rM − rRF) βi.

Expectations for inflation are not reflected anywhere in this equation,even indirectly,and because of that the text notes that the CAPM may not be strictly correct.

B) If the required rate of return is given by the SML equation as set forth in Answer a,there is nothing a financial manager can do to change his or her company's cost of capital,because each of the elements in the equation is determined exclusively by the market,not by the type of actions a company's management can take,even in the long run.

C) Assume that the required rate of return on the market is currently rM = 15%,and that rM remains fixed at that level.If the yield curve has a steep upward slope,the calculated market risk premium would be larger if the 30-day T-bill rate were used as the risk-free rate than if the 30-year T-bond rate were used as rRF.

D) Statements a and b are both true.

E) Statements a and c are both true.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If investors become more averse to risk,the slope of the Security Market Line (SML)will increase.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Assume Stock A has a standard deviation of 0.21 while Stock B has a standard deviation of 0.10.If both Stock A and Stock B must be held in isolation,and if investors are risk averse,we can conclude that Stock A will have a greater required return.However,if the assets could be held in portfolios,it is conceivable that the required return could be higher on the low standard deviation stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A highly risk-averse investor is considering the addition of an asset to a 10-stock portfolio.The two securities under consideration both have an expected return equal to 15 percent.However,the distribution of possible returns associated with Asset A has a standard deviation of 12 percent,while Asset B's standard deviation is 8 percent.Both assets are correlated with the market with ρ = 0.75.Which asset should the risk-averse investor add to his/her portfolio?

A) Asset A.

B) Asset B.

C) Both A and B.

D) Neither A nor B.

E) Cannot tell without more information.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

HR Corporation has a beta of 2.0,while LR Corporation's beta is 0.5.The risk-free rate is 10%,and the required rate of return on an average stock is 15%.Now the expected rate of inflation built into rRF falls by 3 percentage points,the real risk-free rate remains constant,the required return on the market falls to 11%,and the betas remain constant.When all of these changes are made,what will be the difference in required returns on HR's and LR's stocks?

A) 1.0%

B) 2.5%

C) 4.5%

D) 5.4%

E) 6.0%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) The SML relates required returns to firms' systematic (or market) risk.The slope and intercept of this line cannot be controlled by the financial manager.

B) The slope of the SML is determined by the value of beta.

C) If you plotted the returns of a given stock against those of the market,and you found that the slope of the regression line was negative,the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor,assuming that the observed relationship is expected to continue on into the future.

D) If investors become less risk averse,the slope of the Security Market Line will increase.

E) Statements a and c are both true.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are holding a stock which has a beta of 2.0 and is currently in equilibrium.The required return on the stock is 15 percent,and the return on an average stock is 10 percent.What would be the percentage change in the return on the stock if the return on an average stock increased by 30 percent while the risk-free rate remained unchanged?

A) +20%

B) +30%

C) +40%

D) +50%

E) +60%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The systematic (market) risk associated with an individual stock is most closely identified with the

A) Standard deviation of the returns on the stock.

B) Standard deviation of the returns on the market.

C) Beta of the stock.

D) Coefficient of variation of returns on the stock.

E) Coefficient of variation of returns on the market.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oakdale Furniture Inc.has a beta coefficient of 0.7 and a required rate of return of 15 percent.The market risk premium is currently 5 percent.If the inflation premium increases by 2 percentage points,and Oakdale acquires new assets which increase its beta by 50 percent,what will be Oakdale's new required rate of return?

A) 13.5%

B) 22.8%

C) 18.75%

D) 15.25%

E) 17.00%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a difficulty concerning beta and its estimation?

A) Sometimes a security or project does not have a past history which can be used as a basis for calculating beta.

B) Sometimes,during a period when the company is undergoing a change such as toward more leverage or riskier assets,the calculated beta will be drastically different than the "true" or "expected future" beta.

C) The beta of an "average stock," or "the market," can change over time,sometimes drastically.

D) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

E) All of the above are potentially serious difficulties.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Risk aversion implies that some securities will go unpurchased in the market even if a large risk premium is paid to investors.

B) When investors require higher rates of return for investments that demonstrate higher variability of returns,this is evidence of risk aversion.

C) Risk aversion implies a general dislike for risk,thus,the lower the expected return the higher the risk premium.

D) In comparing two firms that differ from each other only with respect to risk,the expected returns on the stock of the firms should be equal.

E) None of the above statements is correct.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hard Hat Construction's stock is currently selling at an equilibrium price of $30 per share.The firm has been experiencing a 6 percent annual growth rate.Last year's earnings per share,E0,were $4.00,and the dividend payout ratio is 40 percent.The risk-free rate is 8 percent,and the market risk premium is 5 percent.If systematic risk (beta) increases by 50 percent,and all other factors remain constant,by how much will the stock price change? (Hint: Use four decimal places in your calculations. )

A) −$7.33

B) +$7.14

C) −$15.00

D) −$15.22

E) +$22.63

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Portfolio A contains only one security,while Portfolio B contains 100 securities.Because of diversification effects,we would expect Portfolio B to have the lower relevant risk,but it is possible for Portfolio A to be less risky.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) Suppose the returns on two stocks are negatively correlated.One has a beta of 1.2 as determined in a regression analysis,while the other has a beta of −0.6.The returns on the stock with the negative beta will be negatively correlated with returns on most other stocks in the market.

B) Suppose you are managing a stock portfolio,and you have information which leads you to believe that the stock market is likely to be very strong in the immediate future,i.e. ,you are confident that the market is about to rise sharply.You should sell your high beta stocks and buy low beta stocks in order to take advantage of the expected market move.

C) In a recent issue,The Wall Street Journal ran a story on a company named Collections Inc. ,which is in the business of collecting past due accounts for other companies,i.e. ,it is a collection agency.According to the Journal,Collections's revenues,profits,and stock price tend to rise during recessions.This suggests that Collections Inc.'s beta should be quite high,say 2.0,because it does so much better than most other companies when the economy is weak.

D) Statements a and b are both true.

E) Statements a and c are both true.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 104

Related Exams