A) $28,650.

B) $10,500.

C) $25,500.

D) $15,000.

Correct Answer

verified

Correct Answer

verified

True/False

Total mixed costs can be expressed as a combination of the fixed and sunk cost equations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

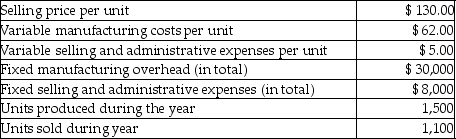

Neon Company manufactures widgets. The following data is related to sales and production of the widgets for last year.  Using variable costing, what is the operating income for last year?

Using variable costing, what is the operating income for last year?

A) $143,000

B) $31,300

C) $69,300

D) $107,300

Correct Answer

verified

Correct Answer

verified

Multiple Choice

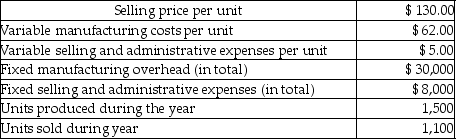

Neon Company manufactures widgets. The following data is related to sales and production of the widgets for last year.  Using absorption costing, what is operating income for last year?

Using absorption costing, what is operating income for last year?

A) $ 39,300

B) $ 66,300

C) $219,700

D) $143,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total costs for Locke & Company at 120,000 units are $289,000, while total fixed costs are $145,000. The total variable costs at a level of 250,000 units would be

A) $300,000.

B) $602,083.

C) $138,720.

D) $302,083.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All variable costs are listed ________ on a contribution margin income statement.

A) above the gross profit line

B) above the contribution margin line

C) below the contribution margin line

D) below the gross profit line

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered a committed fixed cost?

A) Depreciation

B) Research and Development

C) Office holiday party

D) Advertising

Correct Answer

verified

Correct Answer

verified

True/False

The cost equation determined by regression analysis is usually more accurate than the line determined by the high-low method.

Correct Answer

verified

Correct Answer

verified

True/False

If inventory has grown, operating income will be higher under absorption costing than it is under variable costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The contribution margin income statement presents ________ below the contribution margin line.

A) only variable expenses relating to selling and administrative activities

B) only fixed expenses relating to selling and administrative activities

C) all fixed expenses

D) all variable expenses

Correct Answer

verified

Correct Answer

verified

Matching

Match the term on the right with the appropriate definition provided on the right.

Correct Answer

Multiple Choice

Manufacturing overhead (consisting of costs like factory rent, factory utilities, factory maintenance, and other similar costs) is usually what type of cost?

A) Variable

B) Fixed

C) Step

D) Mixed

Correct Answer

verified

Correct Answer

verified

True/False

In a regression output, the "X variable 1 coefficient" represents the variable cost component of a mixed cost equation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An equation of a line for total costs is

A) y = vx - f.

B) y = fx + v.

C) y = f.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which step is performed first when using the high-low method?

A) Find the vertical intercept

B) Write the cost equation

C) Predict total cost

D) Find the slope

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Absorption costing is required to be used for

A) federal income tax reports.

B) external financial reports, but not income taxes.

C) neither external financial reports nor income tax reports.

D) both external financial reports and income tax reports.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your client's company wants to determine the relationship between its monthly operating costs and a potential cost driver. The output of regression analysis showed the following information: Intercept Coefficient = 75,828 X Variable 1 Coefficient = 52.61 R-square = 0.9756 Should your client use this information to predict monthly operating costs?

A) No, because R-square is so high.

B) Yes, because R-square is so high.

C) Yes, because regression analysis can be relied upon.

D) There is not enough information to make this prediction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lily's Pastries produces cupcakes, which sell for $5 each. During the current month, Lily produced 2,800 cupcakes, but only sold 2,700 cupcakes. The variable cost per cupcake was $3 and the sales commission per cupcake was $0.50. Total fixed manufacturing costs were $1,400 and total fixed marketing and administrative costs were $1,200. What is the product cost per cupcake under absorption costing?

A) $3.50

B) $5.50

C) $5.00

D) $3.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using account analysis, what type of cost is the rental of a space at $6,000 per month?

A) Mixed

B) Fixed

C) Step

D) Variable

Correct Answer

verified

Correct Answer

verified

True/False

If the data points in a scatter plot fall in a fairly straight line, it means that there is a fairly strong relationship between cost and volume.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 289

Related Exams