A) increases, so the quantity of money demanded increases.

B) increases, so the quantity of money demanded decreases.

C) decreases, so the quantity of money demanded decreases.

D) decreases, so the quantity of money demanded increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wealth is redistributed from debtors to creditors when inflation was expected to be

A) high and it turns out to be high.

B) low and it turns out to be low.

C) low and it turns out to be high.

D) high and it turns out to be low.

Correct Answer

verified

Correct Answer

verified

True/False

Monetary neutrality means that while real variables may change in response to changes in the money supply, nominal variables do not.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real interest rate is 6 percent and the price level is falling at a rate of 2 percent, what is the nominal interest rate?

A) 4 percent

B) 6 percent

C) 8 percent

D) 10 percent

Correct Answer

verified

Correct Answer

verified

True/False

Even though monetary policy is neutral in the short run, it may have profound real effects in the long run.

Correct Answer

verified

Correct Answer

verified

True/False

In United States history there were long periods when most prices fell.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If V and M are constant and Y doubles, the quantity equation implies that the price level

A) falls to half its original level.

B) does not change.

C) doubles.

D) more than doubles.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

James took out a fixed-interest-rate loan when the CPI was 200. He expected the CPI to increase to 206 but it actually increased to 204. The real interest rate he paid is

A) higher than he had expected, and the real value of the loan is higher than he had expected.

B) higher than he had expected, and the real value of the loan is lower than he had expected.

C) lower than he had expected, and the real value of the loan is higher than he had expected.

D) lower then he had expected, and the real value of the loan is lower than he had expected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the classical dichotomy, when the money supply doubles which of the following doubles?

A) the price level and nominal GDP

B) the price level and real GDP

C) only real GDP

D) only the price level

Correct Answer

verified

Correct Answer

verified

Multiple Choice

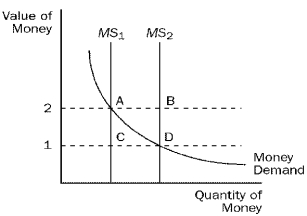

Figure 17-1  -Refer to Figure 17-1. When the money supply curve shifts from MS1 to MS2,

-Refer to Figure 17-1. When the money supply curve shifts from MS1 to MS2,

A) the equilibrium value of money decreases.

B) the equilibrium price level decreases.

C) the supply of money has decreased.

D) the demand for goods and services will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the classical dichotomy, which of the following is affected by monetary factors?

A) nominal wages

B) the price level

C) nominal GDP

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that monetary neutrality and the Fisher effect both hold. An increase in the money supply growth rate increases

A) the inflation rate and growth of real GDP.

B) the inflation rate but not the growth rate of real GDP.

C) the growth rate of real GDP, but not the inflation rate.

D) neither the inflation rate nor the growth rate of real GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shoeleather cost refers to

A) the cost of more frequent price changes induced by higher inflation.

B) the distortion in resource allocation created by distortions in relative prices due to inflation.

C) resources used to maintain lower money holdings when inflation is high.

D) the tendency to expend more effort searching for the lowest price when inflation is high.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about U.S. inflation is not correct?

A) Low inflation was viewed as a triumph of President Carter's economic policy.

B) There were long periods in the nineteenth century during which prices fell.

C) The U.S. public has viewed inflation rates of even 7 percent as a major economic problem.

D) The U.S. inflation rate has varied over time, but international data show even more variation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the economy unexpectedly went from inflation to deflation,

A) both debtors and creditors would have reduced real wealth.

B) both debtors and creditors would have increased real wealth.

C) debtors would gain at the expense of creditors.

D) creditors would gain at the expense of debtors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price level falls. This might be because the Federal Reserve

A) bought bonds which raised the money supply.

B) bought bonds which reduced the money supply.

C) sold bonds which raised the money supply.

D) sold bonds which reduced the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the price level rises, the value of money

A) increases, so people want to hold more of it.

B) increases, so people want to hold less of it.

C) decreases, so people want to hold more of it.

D) decreases, so people want to hold less of it.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Between 1880 and 1886, prices that were

A) lower than expected transferred wealth from creditors to debtors.

B) lower than expected transferred wealth from debtors to creditors.

C) higher than expected transferred wealth from creditors to debtors.

D) higher than expected transferred wealth from debtors to creditors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inflation falls, people

A) make less frequent trips to the bank and firms make less frequent price changes.

B) make less frequent trips to the bank while firms make more frequent price changes.

C) make more frequent trips to the bank while firms make less frequent price changes.

D) make more frequent trips to the bank and firms make more frequent price changes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When we assume that the supply of money is a variable that the central bank controls, we

A) must then assume as well that the demand for money is not influenced by the value of money.

B) must then assume as well that the price level is unrelated to the value of money.

C) are ignoring the fact that, in the real world, households are also suppliers of money.

D) are ignoring the complications introduced by the role of the banking system.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 388

Related Exams