Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the demand for digital cameras is elastic, and the supply of digital cameras is inelastic. A tax of $20 per camera levied on digital cameras will decrease the effective price received by sellers of digital cameras by

A) less than $10.

B) $10.

C) between $10 and $20.

D) $20.

Correct Answer

verified

Correct Answer

verified

True/False

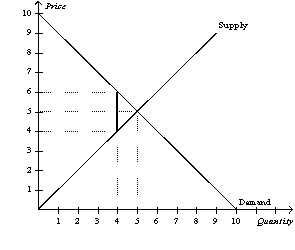

Figure 6-27  -Refer to Figure 6-27. If the government places a $2 tax in the market, the seller bears $1 of the tax burden.

-Refer to Figure 6-27. If the government places a $2 tax in the market, the seller bears $1 of the tax burden.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the buyers of a good will

A) raise both the price buyers pay and the effective price sellers receive.

B) raise the price buyers pay and lower the effective price sellers receive.

C) lower the price buyers pay and raise the effective price sellers receive.

D) lower both the price buyers pay and the effective price sellers receive.

Correct Answer

verified

Correct Answer

verified

True/False

When policymakers set prices by legal decree, they obscure the signals that normally guide the allocation of society's resources.

Correct Answer

verified

Correct Answer

verified

True/False

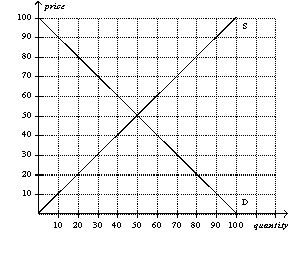

Figure 6-26  -Refer to Figure 6-26. A price floor set at $40 would create a surplus of 20 units.

-Refer to Figure 6-26. A price floor set at $40 would create a surplus of 20 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of lemonade, the

A) sellers bear the entire burden of the tax.

B) buyers bear the entire burden of the tax.

C) burden of the tax will be always be equally divided between the buyers and the sellers.

D) burden of the tax will be shared by the buyers and the sellers, but the division of the burden is not always equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding price floor will reduce a firm's total revenue

A) always.

B) when demand is elastic.

C) when demand is inelastic.

D) never.

Correct Answer

verified

Correct Answer

verified

True/False

The economy contains many labor markets for different types of workers.

Correct Answer

verified

Correct Answer

verified

True/False

If a price ceiling is not binding, then it will have no effect on the market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is a binding constraint on a market, then

A) the equilibrium price must be above the price floor.

B) the quantity demanded must exceed the quantity supplied.

C) sellers cannot sell all they want to sell at the price floor.

D) buyers cannot buy all they want to buy at the price floor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a $40 tax on the buyers of refrigerators. The tax would

A) shift the demand curve downward by less than $40.

B) raise the equilibrium price by $40.

C) create a $20 tax burden each for buyers and sellers.

D) discourage market activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

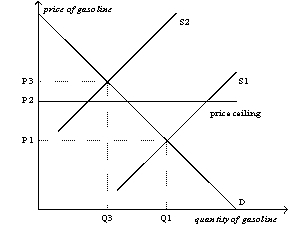

Figure 6-12  -Refer to Figure 6-12. When the price ceiling applies in this market, and the supply curve for gasoline shifts from S1 to S2,

-Refer to Figure 6-12. When the price ceiling applies in this market, and the supply curve for gasoline shifts from S1 to S2,

A) the market price will increase to P3.

B) a surplus will occur at the new market price of P2.

C) the market price will stay at P1.

D) a shortage will occur at the new market price of P2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax burden will fall most heavily on buyers of the good when the demand curve

A) is relatively steep, and the supply curve is relatively flat.

B) is relatively flat, and the supply curve is relatively steep.

C) and the supply curve are both relatively flat.

D) and the supply curve are both relatively steep.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 6-3 The following table contains the demand schedule and supply schedule for a market for a particular good. Suppose sellers of the good successfully lobby Congress to impose a price floor $2 above the equilibrium price in this market. -Refer to Table 6-3. Following the imposition of a price floor $2 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting shortage is

A) 0 units.

B) 2 units.

C) 5 units.

D) 7 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce the burning of fossil fuels, it should impose a tax on

A) buyers of gasoline.

B) sellers of gasoline.

C) either buyers or sellers of gasoline.

D) whichever side of the market is less elastic.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the minimum wage exceeds the equilibrium wage, then

A) the quantity demanded of labor will exceed the quantity supplied.

B) the quantity supplied of labor will exceed the quantity demanded.

C) the minimum wage will not be binding.

D) there will be no unemployment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When OPEC raised the price of crude oil in the 1970s, it caused the

A) demand for gasoline to increase.

B) demand for gasoline to decrease.

C) supply of gasoline to increase.

D) supply of gasoline to decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax burden falls more heavily on the side of the market that

A) has a fewer number of participants.

B) is more inelastic.

C) is closer to unit elastic.

D) is less inelastic.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will decrease if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Showing 441 - 460 of 556

Related Exams