A) increase by $1,000.

B) decrease by $1,000.

C) decrease by $4,000.

D) increase by $4,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the required reserve ratio decreases,the:

A) money multiplier increases.

B) money multiplier decreases.

C) amount of excess reserves the bank has decreases.

D) money multiplier stays the same.

E) amount of excess reserves stays the same.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An individual bank can lend out at most its:

A) actual reserves.

B) fractional reserves.

C) legal reserves.

D) checkable deposits.

E) excess reserves.

Correct Answer

verified

Correct Answer

verified

True/False

In a simplified system where all banks have uniform reserve requirements and checkable deposits are the only form of money,the money multiplier is equal to 1 over the required reserve ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When new checkable deposits are created through loans,

A) the money supply contracts.

B) excess reserves are destroyed.

C) the money supply remains the same.

D) the money supply expands.

E) the required reserve ratio declines

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is no one who is interested in borrowing from a bank:

A) the bank's excess reserves will be zero.

B) there will be no process of money creation.

C) the required reserve ratio must be equal to zero.

D) the required reserve ratio must be equal to 100 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

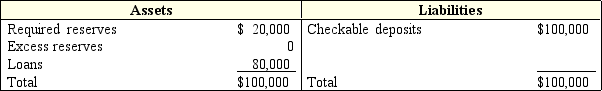

Exhibit 19-3 Balance sheet of Tucker National Bank

-The required reserve ratio in Exhibit 19-3 is:

-The required reserve ratio in Exhibit 19-3 is:

A) 10 percent.

B) 20 percent.

C) 80 percent.

D) 100 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed wishes to increase the money supply then it should:

A) increase the required reserve ratio.

B) increase the discount rate.

C) buy government securities on the open market.

D) do any of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal funds market is the market where:

A) the federal government borrows money from banks to finance the national debt.

B) the federal government lends money to commercial banks.

C) banks borrow money from other banks for short periods of time.

D) banks borrow money from the Fed for short periods of time.

E) banks borrow money from the Treasury for long periods of time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve wants to increase the availability of money and credit,it can:

A) lower the discount rate.

B) raise the reserve requirements.

C) sell U.S. government bonds to the public.

D) encourage banks to increase their prime lending rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed raises the discount rate,it:

A) lowers the cost of borrowing from the Fed, encouraging banks to make loans to the general public.

B) raises the cost of borrowing from the Fed, discouraging banks from making loans to the general public.

C) increases the amount of excess reserves that banks hold, encouraging them to make loans to the general public.

D) increases the amount of excess reserves that banks hold, discouraging them from making loans to the general public.

E) decreases the amount of excess reserves that banks hold, discouraging them from making loans to the general public.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

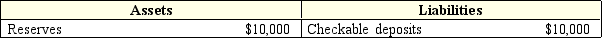

Exhibit 19-7 Lower Walloon National Bank

-In Exhibit 19-7,if the required reserve ratio is 20 percent,and Mr.Brown deposits $10,000 in Lower Walloon National Bank.The Lower Walloon National bank has excess reserves of:

-In Exhibit 19-7,if the required reserve ratio is 20 percent,and Mr.Brown deposits $10,000 in Lower Walloon National Bank.The Lower Walloon National bank has excess reserves of:

A) $2,000.

B) $8,000.

C) $0.

D) $10,000.

E) $40,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate on loans made by banks in the market in which they lend and borrow reserves from each other for very short periods of time is known as the:

A) discount rate.

B) legal reserve rate.

C) federal funds rate.

D) open market rate.

E) margin rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed raises the required reserve ratio,then the:

A) ability of banks to make loans is restricted.

B) ability of banks to make loans is enhanced.

C) ability of banks to make loans is unaffected.

D) interest rate that banks pay to the Fed to borrow money is increased.

E) interest rate that banks pay to other banks to borrow money is increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a bank has total deposits of $100,000 and $20,000 is set aside to meet reserve requirements of the Fed.Its required reserve ratio is:

A) $20,000.

B) 20 percent.

C) 0.2 percent.

D) 1 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

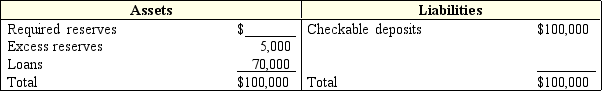

Exhibit 19-5 Balance sheet of Tucker National Bank

-In Exhibit 19-5,the bank could:

-In Exhibit 19-5,the bank could:

A) extend new loans by $5,000.

B) extend new loans by $20,000.

C) call in $5,000 existing loans.

D) call in $20,000 existing loans.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Paris First National Bank is a thriving bank with deposits of $20 million.If the required reserve ratio is 20 percent and the bank is fully loaned out,the bank will keep what amount of required reserves?

A) $2 million.

B) $4 million.

C) $10 million.

D) $16 million.

E) $20 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions by the FED would increase the money supply?

A) Reducing the required reserve ratio.

B) Selling bonds in the open market.

C) Increasing the discount rate.

D) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank currently has checkable deposits of $100,000,total reserves of $30,000,and loans of $70,000.If the required reserve ratio is lowered from 20 percent to 15 percent,this bank can increase its loans by:

A) $10,000.

B) $15,000.

C) $75,000.

D) $5,000.

E) $ 0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) The simple money multiplier equals the reciprocal of the required reserve ratio.

B) Required reserves is the minimum balance that the Fed requires a bank to hold in vault cash or on deposit with the Fed.

C) The Discount rate is the interest rate charged banks for loans from the Fed.

D) Excess reserves equal total reserves minus required reserves.

E) All of the above.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 246

Related Exams