A) just as efficient.

B) less efficient because the time spent waiting in line imposes an opportunity cost on the buyer that does not generate revenue for the seller.

C) more efficient since waiting in line reduces the transaction costs of purchasing goods.

D) more efficient since waiting in line reduces the cost of the goods to the consumer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When several hurricanes hit Florida in 2004, a number of local governments imposed price controls that prevented sellers from raising their prices for badly needed products like plywood and generators. In the areas where the controls were imposed, they resulted in

A) an expanded availability of these badly needed products.

B) a reduced availability of these badly needed products.

C) an increase in the speed with which people recovered from the hurricanes.

D) a more efficient allocation of these goods for which price controls were in effect.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there was an increase in the excise tax imposed on beer suppliers, what would be the effect on the equilibrium price and quantity of beer?

A) price increases; quantity decreases

B) price decreases; quantity decreases

C) price increases; quantity increases

D) price decreases; quantity increases

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the supply and demand model, a subsidy granted to sellers is illustrated by

A) a downward shift in the demand curve, by the per unit amount of the subsidy.

B) an upward shift in the demand curve, by the per unit amount of the subsidy.

C) a downward shift in the supply curve, by the per unit amount of the subsidy.

D) an upward shift in the supply curve, by the per unit amount of the subsidy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a market economy, which of the following would most likely cause a prolonged grain surplus?

A) a decrease in the demand for grain

B) an increase in the supply of grain

C) imposition of a price floor above the equilibrium price of grain

D) imposition of a price ceiling below the equilibrium price of grain

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss (or excess burden) resulting from levying a tax on an economic activity is the

A) tax revenue raised by the government as the result of the tax.

B) loss of potential gains from trade from activities forgone because of the tax.

C) increase in the price of an activity as the result of the tax levied on it.

D) marginal benefits derived from the expansion in government activities made possible by the increase in tax revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes adversely affect the allocation of resources because

A) they do not always fall more heavily on the rich than on the poor.

B) the taxes collected are not enough to finance government spending.

C) not everyone pays taxes.

D) they distort prices and thus distort the decisions of households and firms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of coffee will

A) increase the price of coffee paid by buyers, increase the net price of coffee received by sellers, and increase the equilibrium quantity of coffee.

B) decrease the price of coffee paid by buyers, increase the net price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

C) increase the price of coffee paid by buyers, decrease the net price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

D) increase the price of coffee paid by buyers, decrease the net price of coffee received by sellers, and increase the equilibrium quantity of coffee.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Both price floors and price ceilings lead to

A) shortages.

B) surpluses.

C) reductions in quality.

D) a reduction in the quantity traded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compared to legal markets, black markets have

A) products of higher quality.

B) similar prices.

C) lower profit rates.

D) more violence.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A payment the government makes to either the buyer or seller, usually on a per-unit basis, when a good or service is purchased or sold is called a

A) black market.

B) interest rate.

C) subsidy.

D) tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Subsidy programs that provide benefits to well organized interest groups will

A) be unattractive to elected political officials.

B) be highly attractive to elected political officials.

C) be attractive to elected political officials only if the subsidies reduce the cost of supplying the good.

D) be attractive to elected political officials only if the subsidies increase the efficiency of resource use.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

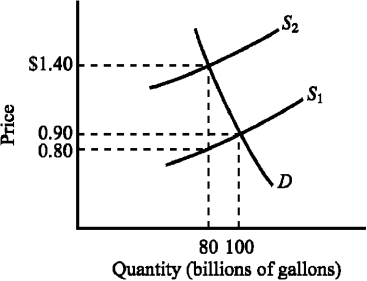

Use the figure below to answer the following question(s) .

Figure 4-7

-Refer to Figure 4-7. The supply curve S₁ and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S₁ to S₂. Imposing the tax causes the equilibrium price of gasoline to increase from

-Refer to Figure 4-7. The supply curve S₁ and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S₁ to S₂. Imposing the tax causes the equilibrium price of gasoline to increase from

A) $.80 to $1.40.

B) $.80 to $1.50.

C) $.90 to $1.50.

D) $.90 to $1.40.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If drugs such as marijuana and cocaine were legalized, it would be likely that

A) their prices would decrease.

B) there would be a reduction in tainted or poor quality drugs.

C) there would be less violence occurring in drug transactions.

D) all of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

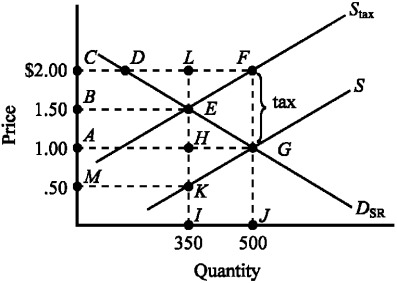

Use the figure below illustrating the impact of an excise tax to answer the following question(s) .

Figure 4-6

-Refer to Figure 4-6. The amount of the excise tax I is

-Refer to Figure 4-6. The amount of the excise tax I is

A) $.50.

B) $1.50.

C) $1.00.

D) $2.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new law requiring plumbers to pass strict certification tests that reduce the number of plumbers would

A) increase the wage rate of plumbers.

B) decrease the wage rate of plumbers.

C) increase the employment of plumbers.

D) cause no change in the labor market for plumbers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following characterizations is correct?

A) Rent control and the minimum wage are both examples of price ceilings.

B) Rent control is an example of a price ceiling and the minimum wage is an example of a price floor.

C) Rent control is an example of a price floor and the minimum wage is an example of a price ceiling.

D) Rent control and the minimum wage are both examples of price floors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a household has $40,000 in taxable income and its tax liability is $4,000, the household's average tax rate is

A) 10 percent.

B) 25 percent.

C) 40 percent.

D) 50 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

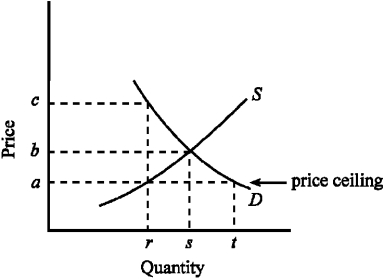

Use the figure below to answer the following question(s) .

Figure 4-4

-Given the demand and supply conditions shown in Figure 4-4, what will happen as the result of imposing a price ceiling of a?

-Given the demand and supply conditions shown in Figure 4-4, what will happen as the result of imposing a price ceiling of a?

A) Demand for the product will decline.

B) Supply will increase.

C) There will be a shortage of the product.

D) Over time, the quality of the product offered by suppliers will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2010 the federal government reduced the Social Security tax withholding rate from 12.4 percent (6.2 percent on both the employer and employee) to 8.4 percent (4.2 percent on both the employer and employee) on the wages of all workers. If the supply of labor is relatively inelastic when compared to the elasticity of the demand for labor, the burden of this tax will

A) continue to fall primarily on employees.

B) continue to fall primarily on employers.

C) be divided equally between employees and employers.

D) change from primarily falling on employees to employers.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 233

Related Exams