A) The more inelastic the supply of a product, the larger the portion of the benefit will be to buyers.

B) The more inelastic the demand for a product, the larger the portion of the benefit will be to buyers.

C) The more elastic the supply of a product, the smaller the portion of the benefit will be to buyers.

D) The distribution of the benefit of a subsidy is not affected by the elasticity of the supply and demand for the product for which the subsidy is granted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the market equilibrium price of wheat is $5 per bushel, and the government sets a price floor of $7 per bushel to aid growers. What is the most likely result of this action?

A) There will be a shortage of wheat.

B) There will be a surplus of wheat.

C) There will be an increase in the quantity of wheat demanded as the result of the price floor.

D) There will be a decrease in the quantity of wheat supplied as the result of the price floor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a local government enacts rent control legislation that sets the price of rental housing below equilibrium, which of the following will most likely happen in the local rental housing market?

A) Discrimination in the rental housing market will be less likely.

B) The quality of rental housing will improve.

C) A surplus of rental housing will develop.

D) A shortage of rental housing will develop.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Heather's tax liability increases from $10,000 to $16,000 when her income increases from $30,000 to $40,000, her marginal tax rate is

A) 33 percent.

B) 35 percent.

C) 50 percent.

D) 60 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

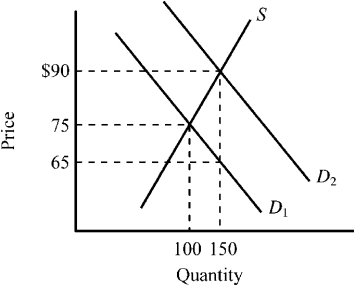

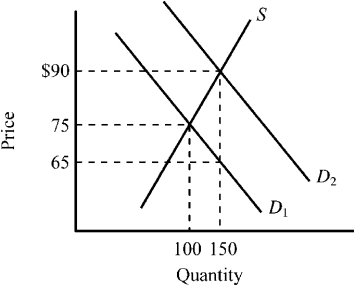

Use the figure below to answer the following question(s) .

Figure 4-13

-Refer to Figure 4-13. The supply curve S and the demand curve D₁ indicate initial conditions in the market for flu shots. A new government program is implemented that grants buyers a $25 subsidy when they buy a flu shot, shifting the demand curve from D₁ to D₂. Which of the following is true for this subsidy given the information provided in the figure?

-Refer to Figure 4-13. The supply curve S and the demand curve D₁ indicate initial conditions in the market for flu shots. A new government program is implemented that grants buyers a $25 subsidy when they buy a flu shot, shifting the demand curve from D₁ to D₂. Which of the following is true for this subsidy given the information provided in the figure?

A) The original price of a flu shot was $75, and after the subsidy, it rises to $90.

B) $65 represents the net price a buyer must pay for a flu shot after taking into account the subsidy payment.

C) Buyers of flu shots will receive an actual benefit of $10 from the subsidy, while sellers of flu shots will receive an actual benefit of $15 from the subsidy.

D) All of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

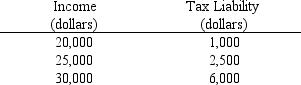

Use the table below to choose the correct answer.  The marginal tax rate on income in the $25,000 to $30,000 range is

The marginal tax rate on income in the $25,000 to $30,000 range is

A) 10 percent.

B) 20 percent.

C) 50 percent.

D) 70 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the top marginal tax rates were lowered substantially during the 1980s, the inflation-adjusted income tax revenue collected from the top 1 percent of all income earners

A) declined sharply.

B) remained approximately constant.

C) increased substantially.

D) did none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a government subsidy is granted to the sellers of a product, buyers can end up capturing some of the benefit because

A) the market price of the product will fall in response to the subsidy.

B) the market price of the product will rise in response to the subsidy.

C) the market price of the product will not change in response to the subsidy.

D) producers will reduce the supply of the product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

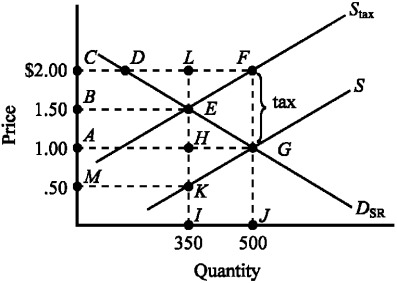

Use the figure below illustrating the impact of an excise tax to answer the following question(s) .

Figure 4-6

-The deadweight loss of the tax illustrated in Figure 4-6 is given by the area

-The deadweight loss of the tax illustrated in Figure 4-6 is given by the area

A) ABEH.

B) DFE.

C) EKG.

D) EFG.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Neleh's income increases from $60,000 to $80,000 and her tax liability increases from $12,000 to $16,000, which of the following is true?

A) Her marginal tax rate is 20 percent in this income range.

B) Her average tax rate is 30 percent at her new income level of $80,000.

C) She faces a regressive tax in this income range.

D) She faces a progressive tax in this income range.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Laffer curve,

A) an increase in tax rates will always cause tax revenues to increase.

B) when marginal tax rates are high, an increase in tax rates is likely to cause tax revenues to increase.

C) when marginal taxes are low, an increase in tax rates will probably cause tax revenues to decline.

D) when marginal tax rates are high, a reduction in tax rates may increase tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the figure below to answer the following question(s) .

Figure 4-13

-Refer to Figure 4-13. The supply curve S and the demand curve D₁ indicate initial conditions in the market for flu shots. A new government program is implemented that grants buyers a $25 subsidy when they buy a flu shot, shifting the demand curve from D₁ to D₂. Which of the following is true for this subsidy given the information provided in the exhibit?

-Refer to Figure 4-13. The supply curve S and the demand curve D₁ indicate initial conditions in the market for flu shots. A new government program is implemented that grants buyers a $25 subsidy when they buy a flu shot, shifting the demand curve from D₁ to D₂. Which of the following is true for this subsidy given the information provided in the exhibit?

A) Buyers of flu shots will receive an actual benefit of $10 from the subsidy, while sellers of flu shots will receive an actual benefit of $15 from the subsidy.

B) Buyers of flu shots will receive an actual benefit of $15 from the subsidy, while sellers of flu shots will receive an actual benefit of $10 from the subsidy.

C) Buyers of flu shots will receive the full $25 benefit from the subsidy.

D) Sellers of flu shots will receive the full $25 benefit from the subsidy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax tends to

A) increase formal market activity because it decreases prices

B) reduce formal market activity because it increases work incentives

C) reduce formal market activity because it lowers the return on such activity

D) reduce activity in the underground economy because people are afraid of being connected with tax fraud

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legally mandated minimum wage is an example of

A) the invisible hand principle.

B) a price floor.

C) a price ceiling.

D) a fringe benefit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose an excise tax is imposed on two products X and Y, both of which have identical supply elasticities. The demand for good X is highly elastic, while the demand for good Y is highly inelastic. The deadweight loss (or excess burden) will be

A) equal in both cases.

B) larger for good X than good Y.

C) larger for good Y than good X.

D) zero in both cases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling set below an equilibrium price tends to cause persistent imbalances in the market because

A) Quantity demanded exceeds quantity supplied but price cannot rise to remove the shortage.

B) Quantity demanded exceeds quantity supplied but price cannot fall to remove the surplus.

C) Quantity supplied exceeds quantity demanded but price cannot rise to remove the shortage.

D) Quantity supplied exceeds quantity demanded but price cannot fall to remove the surplus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things constant, if a labor union is able to successfully increase the wages of autoworkers, there will be

A) an increase in the supply of automobiles causing the price of automobiles to fall.

B) an increase in the supply of automobiles causing the price of automobiles to rise.

C) a decrease in the supply of automobiles causing the price of automobiles to fall.

D) a decrease in the supply of automobiles causing the price of automobiles to rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

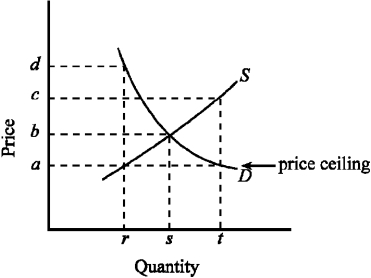

Figure 4-3

-Figure 4-3 indicates the demand (D) and supply (S) for the rental housing market in a large city. If the government imposed a price ceiling of a, which of the following would be true?

-Figure 4-3 indicates the demand (D) and supply (S) for the rental housing market in a large city. If the government imposed a price ceiling of a, which of the following would be true?

A) The quantity of rental housing demanded would be t.

B) The quantity of rental housing supplied would be r.

C) There would be a shortage of rental housing.

D) All of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

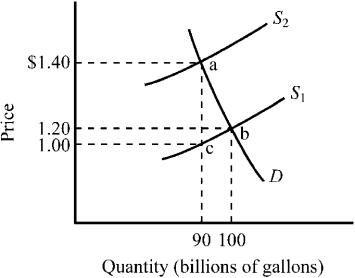

Use the figure below to answer the following question(s) .

Figure 4-9

-Refer to Figure 4-9. The market for gasoline was initially in equilibrium at point b and a $.40 excise tax is illustrated. How much revenue would the $.40 gasoline tax raise?

-Refer to Figure 4-9. The market for gasoline was initially in equilibrium at point b and a $.40 excise tax is illustrated. How much revenue would the $.40 gasoline tax raise?

A) $18 million

B) $36 million

C) $72 million

D) $100 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things constant, as the price of a resource increases,

A) the quantity of the resource demanded falls.

B) the quantity of the resource supplied falls.

C) the price of the product the resource helps to produce falls.

D) there is less of an incentive for users of the resource to find substitute resources.

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 233

Related Exams