A) $21.50

B) $15.03

C) $15.78

D) $22.57

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ____ of a portfolio of two or more securities is equal to the weighted average of the ____ of each of the individual securities in the portfolio.

A) standard deviation, standard deviation

B) risk, risk

C) expected return, expected return

D) standard deviation, risk

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ____ is a statistical measure of the mean or average value of the possible outcomes.

A) probability distribution

B) standard deviation

C) expected value

D) coefficient of variation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What will happen to the Security Market Line if: (1) inflation expectations increase, and (2) investors become more risk averse?

A) shift up and have a steeper slope

B) shift down and have the same slope

C) shift down and have a steeper slope

D) shift up but have less slope

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term structure of interest rates is the pattern of interest rate yields for securities that differ only in

A) default risk

B) liquidity premiums

C) the yield to maturity

D) the length of time to maturity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

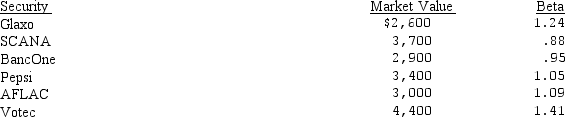

Determine the beta of a portfolio consisting of the following common stocks:

A) 1.00

B) 1.12

C) 1.09

D) 1.11

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All other things being equal, what is the major impact that an increase in the expected inflation rate would be expected to have on the security market line?

A) reduce its slope

B) shift it down and to the right

C) shift it up and to the left

D) reduce required returns for investors in any individual asset

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors can obtain high returns in their investments if:

A) they use hedging techniques

B) they assume high risks

C) they invest only international securities

D) they invest in legal Ponzi type securities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following (if any) is a relative (rather than absolute) measure of risk?

A) standard deviation

B) standard normal probability distribution

C) expected value

D) coefficient of variation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quick Start, Inc. is expected to pay a dividend of $1.05 next year and dividends are expected to continue their 7 percent annual growth rate. The SML has been estimated as follows: Ke = 0.08 + 0.064b? If Quick Start has a beta of 1.1, what would happen to its stock price if inflation expectations went from the current 5 percent to 8 percent?

A) decrease $8.14

B) decrease $3.55

C) decrease $3.18

D) stock price will not change

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected rate of return for 3COM is 18 percent, with a standard deviation of 10.98 percent. The expected rate of return for Just the Fax is 26 percent with a standard deviation of 15.86%. Which firm would be considered the riskier from a total risk perspective?

A) 3COM

B) Just the Fax

C) Neither, both have the same risk

D) Cannot be determined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arbitrage pricing theory is a model that relates expected returns on securities to

A) security risk and yield spreads

B) yield spreads and yield curve slope

C) anticipated economic factors

D) multiple risk factors

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A beta value of 0.5 for a security indicates

A) the security has average systematic risk

B) the security has above-average systematic risk

C) the security has no unsystematic risk

D) the security has below-average systematic risk

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Richtex Brick has a current dividend of $1.70 and the market value of its common stock is $28. The expected market return is 13 percent and the risk-free rate is 9 percent. If Richtex stock is half as volatile as the market, and the market is in equilibrium, what rate of growth is expected for Richtex's dividends assuming a constant growth valuation model is appropriate for Richtex?

A) 4.93%

B) 4.65%

C) 5.37%

D) 5.41%

Correct Answer

verified

Correct Answer

verified

Showing 101 - 114 of 114

Related Exams