A) Certified Public Accountants (CPAs)

B) Attorneys

C) Certified Financial Planner (CFP®)

D) All these professionals are required.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial planning process includes five steps. Four of the steps are listed next: .Analyze your current financial status. .Implement your financial plan. .Monitor your progress and revise your plan as needed. .Organize your financial information and set short-term and long-term goals. What is the missing step?

A) Identify and evaluate alternative strategies for meeting your goals.

B) Understand the personal financial planning process.

C) Acquire the necessary decision-making skills and tools.

D) Build wealth and protection against emergencies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Desiree currently works as a manager of an electronics store earning an annual salary of $50,000. She noticed an internal job opening for a regional manager that pays $100,000 salary, but an MBA is required for consideration. The cost for a full-time MBA program in two years is $60,000. What is her opportunity cost for attending graduate school, without consideration for time value of money?

A) $100,000

B) $120,000

C) $160,000

D) $220,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In deciding whether to attend graduate school full-time, estimating your lost earnings while you are in school is an example of

A) marginal reasoning.

B) sensitivity analysis.

C) future value.

D) opportunity cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve often __________ the __________ rate to stimulate the economy.

A) lowers; prime

B) lowers; federal funds

C) raises; federal funds

D) raises; prime

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your goals will differ depending on your stage in the life cycle and your family makeup. Which is not an appropriate short-term savings goal?

A) Spring break vacation

B) Emergency fund

C) Down payment on a home

D) Life insurance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are calculating your potential return on your stock investments. If you calculate different possible returns based on assuming a variety of interest rates and stock market conditions, this is an example of

A) reasonable assumptions.

B) sensitivity analysis.

C) marginal analysis.

D) opportunity cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holly is uncomfortable with change. She spends a lot of time thinking over alternatives, even for relatively inconsequential decisions. She is a typical

A) agonizer.

B) antagonizer.

C) intuitive decision maker.

D) analytical decision maker.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Henry pays his financial planner a one percent fee based on the value of the assets in his investment account. He noticed on his year-end statement that the firm rebated a $1,200 credit to his account. His planner said that was because the firm made $1,200 in dealer concessions from an IPO that he purchased. What type of fee arrangement is this?

A) Fee-based

B) Fee-only

C) Fee plus commission

D) Fee offset by commission

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have estimated that, if your investments earn 10 percent per year, you can retire at age 65. If you reestimate your retirement date assuming a lower investment return, you are using

A) average reasoning.

B) sensitivity analysis.

C) marginal reasoning.

D) opportunity cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is not a necessary activity in securing your basic needs?

A) Making purchase and credit decisions

B) Managing cash for liquidity and emergencies

C) Selecting financial institutions for checking and savings accounts

D) Investing to achieve long-term goals

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rosa graduated at the top of her high school class, and has set the following goal as part of her financial plan: "graduate from college with a B. S. in Business Management." Which aspect of the SMART goal model is missing from her goal?

A) The goal is not specific.

B) The goal is not measurable.

C) The goal is not attainable.

D) The goal is not time-specific.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the consumer price index (CPI) increases,

A) you can buy goods and services cheaper.

B) the prices of goods and services are more expensive.

C) the value of the dollar is high.

D) you will earn less on your investments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal funds rate is the rate that

A) banks charge customers for short-term loans.

B) the Federal Reserve charges banks for short-term loans.

C) banks charge each other for short-term loans.

D) credit card issuers use as the teaser rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Personal finance is a specialized area of study that focuses

A) exclusively on investments and retirement planning.

B) on financial management, household budgets, and investments.

C) exclusively on investment management and household budgets.

D) on individual and household financial decisions, such as budgeting, saving, spending, tax planning, insurance, and investments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An expansion is a phase in the economic cycle that is characterized by _____ business investment and ______ employment opportunities.

A) decreasing; decreasing

B) increasing; increasing

C) decreasing; increasing

D) increasing; decreasing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

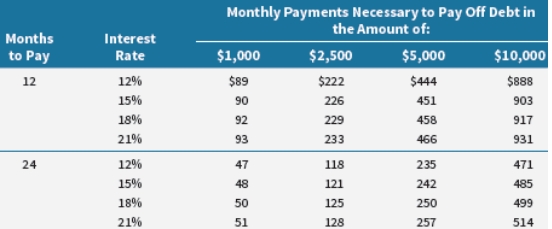

For many households, repayment of high-interest debt is an important financial goal. Using the following table, estimate the payments necessary to pay off $2,500 in credit card debt in two years at 15% APR.

A) $113

B) $121

C) $226

D) $242

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your salary increased from $20,000 to $30,000 in five years. What is the percentage increase?

A) 33%

B) 50%

C) 100%

D) 150%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is not a necessary activity in building and protecting wealth?

A) Writing a will

B) Investing to achieve long-term goals

C) Buying property and liability insurance

D) Managing cash for liquidity and emergencies

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of decision maker is most likely to have trouble sticking to a budget and, as a result, may fall into debt?

A) Rational decision maker

B) External decision maker

C) Intuitive decision maker

D) Internal decision maker

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 47

Related Exams