A) A bill from the IRS for underpayment of tax plus interest and penalty

B) A refund from the IRS

C) A bill from the IRS for underpayment of tax but no interest or penalty charges since she made the mistake unknowingly

D) A letter informing her that she submitted an incorrect tax return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your taxable income is $86,000, your gross income is $115,000, and you paid $18,000 in taxes, what is your average tax rate? (Round to the nearest percent.)

A) 17%

B) 21%

C) 26%

D) 48%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tom is retired and lives off the rent he collects from his properties. Which form will Tom need to include rental income with his return?

A) Schedule A

B) Schedule B

C) Schedule D

D) Schedule E

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you sell shares of stock that you have owned for 15 months, any profit made on the sale would be classified as

A) ordinary income.

B) a short-term capital gain.

C) a long-term capital gain.

D) earned income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some of the cost of child-care expenses can be subtracted from your taxes through which of the following mechanisms?

A) Deduction

B) Exemption

C) Credit

D) Adjustment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax credits best applies to a low-income family with two children?

A) Lifetime learning credit

B) Retirement savings contribution credit

C) Child tax credit

D) American opportunity credit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to trigger the alternative minimum tax (AMT) for a tax filer?

A) Reporting the standard deduction instead of itemized deductions

B) Contributing to your company's tax-sheltered retirement plan

C) Claiming large number of deductions or credits

D) Filing as head of household

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Greg and Jamie are married and both work part-time while in graduate school. Greg earns $12,000, and Jaimie earns 11,000. Based on Greg and Jamie's situation, which of the following is true?

A) Greg and Jamie will only pay federal income tax.

B) Greg and Jamie will pay federal income tax and payroll taxes.

C) Greg and Jamie will only pay payroll taxes.

D) Greg and Jamie will not pay any form of tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

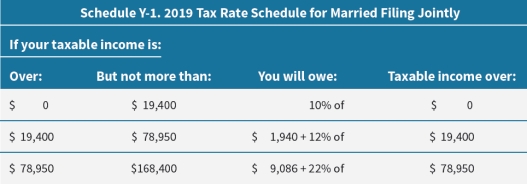

Bill and Miley had an adjusted gross income of $75,000. They file taxes jointly and the standard deduction for married filing jointly is $24,400. They listed their itemized expenses as follows: home mortgage interest, $4,750; house property tax, $5,890; state income tax, $3,000; and charitable gifts (market value) , $245. How much do they owe in federal income tax?

A) $5,684

B) $6,072

C) $6,946

D) $7,334

Correct Answer

verified

Correct Answer

verified

Multiple Choice

FICA is a ________tax, which is _________.

A) sales; progressive

B) sales; regressive

C) payroll; progressive

D) payroll; regressive

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joe and Sally file for federal taxes as married filing jointly. They originally anticipated that they will pay a total of $28,765 in taxes on an estimated taxable income of $168,400. When they filed their taxes at the end of the year, they calculated their tax burden to be $30,193 on a taxable income of $174,351. What was Joe and Sally's actual average tax rate at the end of the year?

A) 16.50%

B) 17.08%

C) 17.32%

D) 17.93%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you're a qualifying ______, you _____ file your own tax return .

A) dependent; must

B) dependent; do not have to

C) child; do not have to

D) child; may have to

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Noncash contributions, such as food or clothing, given to charitable organizations are

A) allowed as deductible contributions to a qualifying charity, only if itemizing deductions.

B) allowed as deductible contributions to a qualifying charity even if using the standard deduction.

C) not deductible contributions.

D) not deductible contributions but may qualifying for a tax credit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The first step in calculating federal income taxes owed is to

A) make adjustments to income.

B) subtract tax credits.

C) add up all sources of income.

D) subtract taxes already paid through employer withholding.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Matthew is 16 years old and can be claimed as a dependent by his parents. He received $1,500 in dividends and $650 in interest and earned $4,800 from odd jobs during the year. Will Matthew need to file a separate tax return? Why?

A) Yes. His earned income exceeds the maximum limit for a dependent.

B) Yes. His unearned income exceeds the maximum limit for a dependent.

C) No. His gross income does not exceed the maximum limit for a dependent.

D) No. His gross income is under the standard deduction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sales tax

A) is a regressive tax.

B) takes a bigger bite out of low-income families' disposable incomes.

C) places a disproportionate burden on taxpayers with lower incomes.

D) All the choices reflect sales tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Donald sold his primary residence for $198,425 after owning it for seven years. His profit on the sale was $24,500. The long-term capital gains tax rate is 0 percent for those in the 10 or 12 percent tax brackets, 20 percent for those with taxable income over $434,550 (single) , and 15 percent for everyone else. If Donald is in the 35 percent tax bracket, how much tax will he owe on the listed transactions? (Round to the nearest whole dollar.)

A) $0

B) $3,675

C) $4,900

D) $8,575

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Judy is self-employed and is in the 24% federal marginal tax bracket. If she works an extra 20 hours during the year, billing $175 an hour, how much will her after-tax income increase if her Social Security tax is 6.2% and her Medicare tax is 1.45%? Assume that the state income tax rate is 3.5%. (Round to the nearest whole dollar.)

A) $1,967

B) $2,090

C) $2,270

D) $2,625

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2020, the lowest marginal tax rate is ___ percent.

A) 0

B) 10

C) 12

D) 15

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax credits best applies to a low-income person contributing to an IRA?

A) Lifetime learning tax credit

B) Retirement savings contribution credit

C) Earned income tax credit

D) American opportunity credit

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 84

Related Exams