Correct Answer

verified

Correct Answer

verified

Multiple Choice

____ investors consider investments in new companies,collectibles,and limited real estate partnerships.

A) Ultraconservative

B) Conservative

C) Moderate

D) Aggressive

Correct Answer

verified

Correct Answer

verified

True/False

Long-term investors seek growth in the value of their investments that equals the rate of inflation.

Correct Answer

verified

Correct Answer

verified

True/False

Dividends are distributions of profits an investor receives for depositing funds in a bank or savings and loan association.

Correct Answer

verified

Correct Answer

verified

True/False

A good investment program replaces one's savings program.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Four strategies of portfolio management for long-term investors are portfolio diversification,asset allocation,buy-and-hold,and

A) dollar-cost averaging.

B) real return on investment.

C) market risk.

D) leverage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If one is in the 25 percent marginal tax bracket,he or she will have an after-tax income of ____ from an investment that pays $1,500 in taxable income.

A) $1,500

B) $1,125

C) $960

D) $420

Correct Answer

verified

Correct Answer

verified

True/False

Savings is the accumulation of excess funds by intentionally spending less than you earn.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

____ risk represents the uncertainty that the yield on an investment will deviate from what is expected.

A) Financial

B) Premium

C) Investment

D) Market

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When choosing among investment alternatives you want to focus on their

A) current income.

B) capital gains.

C) interest.

D) yields.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investing goes beyond saving in that it

A) requires that less be spent than you earn.

B) involves increased risk.

C) ignores current income.

D) is something only few people should do.

Correct Answer

verified

Correct Answer

verified

True/False

The first step in the investment planning process is to study available investment alternatives and learn as much as you can about the ones you like.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically the highest commissions are charged on investments in

A) stocks.

B) bonds.

C) collectibles.

D) real estate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

____ are located at the base of the investment risk pyramid.

A) Blue-chip stocks

B) High-quality corporate bonds

C) Growth and income mutual funds

D) Treasury securities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

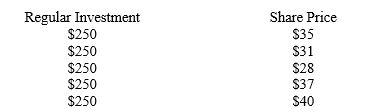

What is the average share price for the dollar-cost averaging strategy shown below?

A) $34.20

B) $37.14

C) $33.66

D) $36.55

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The investment strategy where an investor buys a fixed dollar amount of stocks or mutual funds regularly over a long period of time is called

A) dollar-cost averaging.

B) asset allocation.

C) portfolio diversification.

D) business-cycle timing.

Correct Answer

verified

Correct Answer

verified

True/False

An active investor could be described as a long-term investor who makes regular investments in securities,such as mutual funds,and his or her assets are rarely sold for short-term profits.

Correct Answer

verified

Correct Answer

verified

True/False

Investment risk is speculative risk rather than pure risk.

Correct Answer

verified

Correct Answer

verified

True/False

Portfolio diversification is the practice of selecting a collection of investments that have dissimilar risk-return characteristics.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using borrowed funds to make an investment is called

A) diversification.

B) leverage.

C) liquidity.

D) hedging.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 172

Related Exams