A) decline in total surplus that results from a tax.

B) decline in government revenue when taxes are reduced in a market.

C) decline in consumer surplus when a tax is placed on buyers.

D) loss of profits to business firms when a tax is imposed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 8-2 Tom mows Stephanie's lawn for $25. Tom's opportunity cost of mowing Stephanie's lawn is $20, and Stephanie's willingness to pay Tom to mow her lawn is $28. -Refer to Scenario 8-2.Assume Ryan is required to pay a tax of $3 each time he mows a lawn.Which of the following results is most likely?

A) Stephanie now will decide to mow her own lawn, and Ryan will decide it is no longer in his interest to mow Stephanie's lawn.

B) Stephanie still is willing to pay Ryan to mow her lawn, but Ryan will decline her offer.

C) Ryan still is willing to mow Stephanie's lawn, but Stephanie will decide to mow her own lawn.

D) Ryan and Stephanie still can engage in a mutually-agreeable trade.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anger over British taxes played a significant role in bringing about

A) the election of John Adams as the second American president.

B) the American Revolution.

C) the War of 1812.

D) the "no new taxes" clause in the U.S.Constitution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the price of a good is measured in dollars,then the size of the deadweight loss that results from taxing that good is measured in

A) units of the good that is being taxed.

B) units of another good that is not being taxed.

C) dollars.

D) abstract units of measurement that reflect the well-being of the society.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $4 per unit is imposed on a good,and the tax causes the equilibrium quantity of the good to decrease from 2,000 units to 1,700 units.The tax decreases consumer surplus by $3,000 and it decreases producer surplus by $4,400.The deadweight loss of the tax is

A) $200.

B) $400.

C) $600.

D) $1,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oliver Wendell Holmes once said taxes

A) are the price we pay for a civilized society.

B) are a fact of life.

C) cannot be escaped unless you are in jail.

D) can be avoided only by the rich.

Correct Answer

verified

Correct Answer

verified

True/False

If a tax did not induce buyers or sellers to change their behavior,it would not cause a deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on raw land causes

A) a large deadweight loss.

B) no deadweight loss.

C) landlords to bear none of the burden of the tax.

D) the generation of such a large amount of tax revenue that all other taxes could be eliminated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 8-2 Tom mows Stephanie's lawn for $25. Tom's opportunity cost of mowing Stephanie's lawn is $20, and Stephanie's willingness to pay Tom to mow her lawn is $28. -Refer to Scenario 8-2.Assume Ryan is required to pay a tax of $10 each time he mows a lawn.Which of the following results is most likely?

A) Stephanie now will decide to mow her own lawn, and Ryan will decide it is no longer in his interest to mow Stephanie's lawn.

B) Stephanie still is willing to pay Ryan to mow her lawn, but Ryan will decline her offer.

C) Ryan still is willing to mow Stephanie's lawn, but Stephanie will decide to mow her own lawn.

D) Ryan and Stephanie still can engage in a mutually-agreeable trade.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

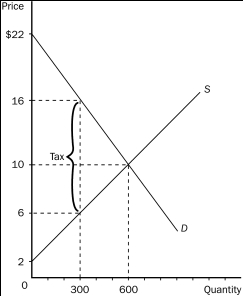

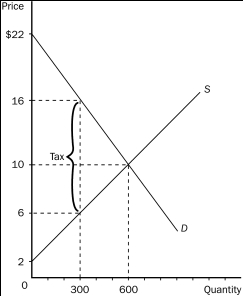

Figure 8-5

-Refer to Figure 8-5.Without a tax,total surplus in this market is

-Refer to Figure 8-5.Without a tax,total surplus in this market is

A) $3,000.

B) $4,800.

C) $6,000.

D) $7,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

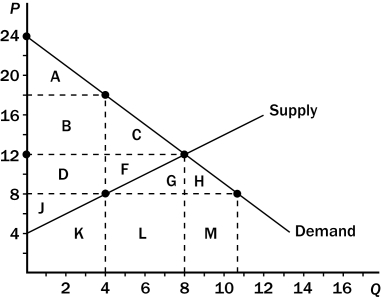

Figure 8-7 The graph below represents a $10 per unit tax on a good. On the graph, Q represents quantity and P represents price.

-Refer to Figure 8-7.The deadweight loss of the tax is represented by the area

-Refer to Figure 8-7.The deadweight loss of the tax is represented by the area

A) B + D.

B) C + F.

C) A + C + F + J.

D) B + C + D + F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on a good is increased from $0.10 per unit to $0.40 per unit,the deadweight loss from the tax

A) remains constant.

B) increases by a factor of 4.

C) increases by a factor of 9.

D) increases by a factor of 16.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

-Refer to Figure 8-5.Total surplus with the tax in place is

-Refer to Figure 8-5.Total surplus with the tax in place is

A) $1,500.

B) $3,600.

C) $4,500.

D) $6,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

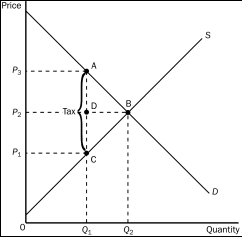

Figure 8-2

-Refer to Figure 8-2.The amount of deadweight loss associated with the tax is equal to

-Refer to Figure 8-2.The amount of deadweight loss associated with the tax is equal to

A) P₃ A C P₁.

B) A B C.

C) P₂ A D P₃.

D) P₁ D C P₂.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

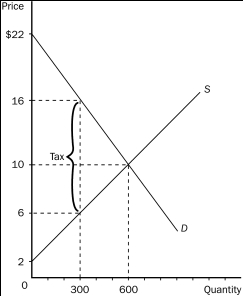

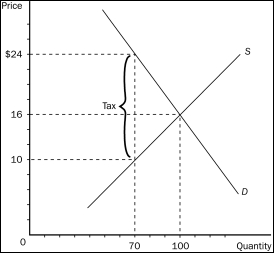

Figure 8-3

-Refer to Figure 8-3.The equilibrium price before the tax is imposed is

-Refer to Figure 8-3.The equilibrium price before the tax is imposed is

A) $24 and the equilibrium quantity is 70.

B) $16 and the equilibrium quantity is 100.

C) $10 and the equilibrium quantity is 70.

D) $8 and the equilibrium quantity is 100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

-Refer to Figure 8-5.What happens to producer surplus when a tax is imposed in this market?

-Refer to Figure 8-5.What happens to producer surplus when a tax is imposed in this market?

A) It falls by $600.

B) It falls by $900.

C) It falls by $1,800.

D) It falls by $2,100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the equilibrium quantity in the market for widgets is 200 per month when there is no tax.Then a tax of $5 per widget is imposed.As a result,the government is able to raise $750 per month in tax revenue.We can conclude that the equilibrium quantity of widgets has fallen by

A) 25 per month.

B) 50 per month.

C) 75 per month.

D) 100 per month.

Correct Answer

verified

Correct Answer

verified

True/False

The result of the large tax cuts in the first Reagan Administration demonstrated very convincingly that Arthur Laffer was correct when he asserted that cuts in tax rates would increase tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Studies indicate that if income tax rates in Sweden had been reduced from their high 1980s levels,income tax collections would have

A) decreased moderately.

B) decreased significantly.

C) risen.

D) remained roughly constant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax levied on the buyers of a good shifts the

A) supply curve upward (or to the left) .

B) supply curve downward (or to the right) .

C) demand curve downward (or to the left) .

D) demand curve upward (or to the right) .

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 245

Related Exams