A) $28,843.38

B) $30,361.46

C) $31,959.43

D) $33,641.50

E) $35,323.58

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A salt mine you inherited will pay you $25,000 per year for 25 years,with the first payment being made today.If you think a fair return on the mine is 7.5%,how much should you ask for it if you decide to sell it?

A) $284,595

B) $299,574

C) $314,553

D) $330,281

E) $346,795

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $250,000 loan is to be amortized over 8 years,with annual end-of-year payments.Which of these statements is CORRECT?

A) The proportion of interest versus principal repayment would be the same for each of the 8 payments.

B) The annual payments would be larger if the interest rate were lower.

C) If the loan were amortized over 10 years rather than 8 years, and if the interest rate were the same in either case, the first payment would include more dollars of interest under the 8-year amortization plan.

D) The proportion of each payment that represents interest as opposed to repayment of principal would be lower if the interest rate were lower.

E) The last payment would have a higher proportion of interest than the first payment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the PV of an annuity due with 5 payments of $2,500 at an interest rate of 5.5%?

A) $11,262.88

B) $11,826.02

C) $12,417.32

D) $13,038.19

E) $13,690.10

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to purchase a motorcycle 4 years from now,and you plan to save $3,500 per year,beginning immediately.You will make 4 deposits in an account that pays 5.7% interest.Under these assumptions,how much will you have 4 years from today?

A) $16,112

B) $16,918

C) $17,763

D) $18,652

E) $19,584

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What annual payment must you receive in order to earn a 6.5% rate of return on a perpetuity that has a cost of $1,250?

A) $77.19

B) $81.25

C) $85.31

D) $89.58

E) $94.06

Correct Answer

verified

Correct Answer

verified

Multiple Choice

JG Asset Services is recommending that you invest $1,500 in a 5-year certificate of deposit (CD) that pays 3.5% interest,compounded annually.How much will you have when the CD matures?

A) $1,781.53

B) $1,870.61

C) $1,964.14

D) $2,062.34

E) $2,165.46

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your business has just taken out a 1-year installment loan for $72,500 at a nominal rate of 11.0% but with equal end-of-month payments.What percentage of the 2nd monthly payment will go toward the repayment of principal?

A) 73.67%

B) 77.55%

C) 81.63%

D) 85.93%

E) 90.45%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your girlfriend just won the Florida lottery.She has the choice of $15,000,000 today or a 20-year annuity of $1,050,000,with the first payment coming one year from today.What rate of return is built into the annuity?

A) 3.44%

B) 3.79%

C) 4.17%

D) 4.58%

E) 5.04%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

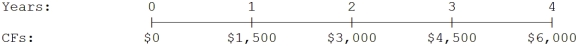

What is the present value of the following cash flow stream at a rate of 12.0%?

A) $9,699

B) $10,210

C) $10,747

D) $11,284

E) $11,849

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a 15-year (180-month) $225,000,fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs.)

A) The outstanding balance declines at a faster rate in the later years of the loan's life.

B) The remaining balance after three years will be $125,000 less one third of the interest paid during the first three years.

C) Because the outstanding balance declines over time, the monthly payments will also decline over time.

D) Interest payments on the mortgage will increase steadily over time, but the total amount of each payment will remain constant.

E) The proportion of the monthly payment that goes towards repayment of principal will be lower 10 years from now than it will be the first year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What's the present value of $4,500 discounted back 5 years if the appropriate interest rate is 4.5%,compounded semiannually?

A) $3,089

B) $3,251

C) $3,422

D) $3,602

E) $3,782

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What's the future value of $1,500 after 5 years if the appropriate interest rate is 6%,compounded semiannually?

A) $1,819

B) $1,915

C) $2,016

D) $2,117

E) $2,223

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If CF0 is positive and all the other CFs are negative, then you cannot solve for I.

B) If you have a series of cash flows, each of which is positive, you can solve for I, where the solution value of I causes the PV of the cash flows to equal the cash flow at Time 0.

C) If you have a series of cash flows, and CF0 is negative but each of the following CFs is positive, you can solve for I, but only if the sum of the undiscounted cash flows exceeds the cost.

D) To solve for I, one must identify the value of I that causes the PV of the positive CFs to equal the absolute value of the PV of the negative CFs. This is, essentially, a trial-and-error procedure that is easy with a computer or financial calculator but quite difficult otherwise.

E) If you solve for I and get a negative number, then you must have made a mistake.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of the following cash flow stream at a rate of 6.25%?

A) $411.57

B) $433.23

C) $456.03

D) $480.03

E) $505.30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers a savings account that pays 3.5% interest,compounded annually.If you invest $1,000 in the account,then how much will it be worth at the end of 25 years?

A) $2,245.08

B) $2,363.24

C) $2,481.41

D) $2,605.48

E) $2,735.75

Correct Answer

verified

Correct Answer

verified

True/False

When a loan is amortized,a relatively low percentage of the payment goes to reduce the outstanding principal in the early years,and the principal repayment's percentage increases in the loan's later years.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your aunt has $500,000 invested at 5.5%,and she now wants to retire.She wants to withdraw $45,000 at the beginning of each year,beginning immediately.When she makes her last withdrawal (at the beginning of a year) ,she also wants to have enough left in the account so that you can make a final withdrawal of $50,000 at the end of that year (her last withdrawal is at the beginning of the year,your withdrawal is at the end of that same year) .What is the maximum number of $45,000 withdrawals that she can make and still have enough in the account so that you can make a $50,000 withdrawal at the end of the year of her last withdrawal? (Hint: If your solution for N is not an integer,round down to the nearest whole number.)

A) 13

B) 14

C) 15

D) 16

E) 17

Correct Answer

verified

Correct Answer

verified

True/False

Midway through the life of an amortized loan,the percentage of the payment that represents interest could be equal to,less than,or greater than to the percentage that represents repayment of principal.The proportions depend on the original life of the loan and the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After receiving a reward for information leading to the arrest of a notorious criminal,you are considering investing it in an annuity that pays $5,000 at the end of each year for 20 years.You could earn 5% on your money in other investments with equal risk.What is the most you should pay for the annuity?

A) $50,753

B) $53,424

C) $56,236

D) $59,195

E) $62,311

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 168

Related Exams