A) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days' sales outstanding will decline.

B) If a security analyst saw that a firm's days' sales outstanding (DSO) was higher than the industry average and was also increasing and trending still higher, this would be interpreted as a sign of strength.

C) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days' sales outstanding (DSO) will increase.

D) There is no relationship between the days' sales outstanding (DSO) and the average collection period (ACP) . These ratios measure entirely different things.

E) A reduction in accounts receivable would have no effect on the current ratio, but it would lead to an increase in the quick ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

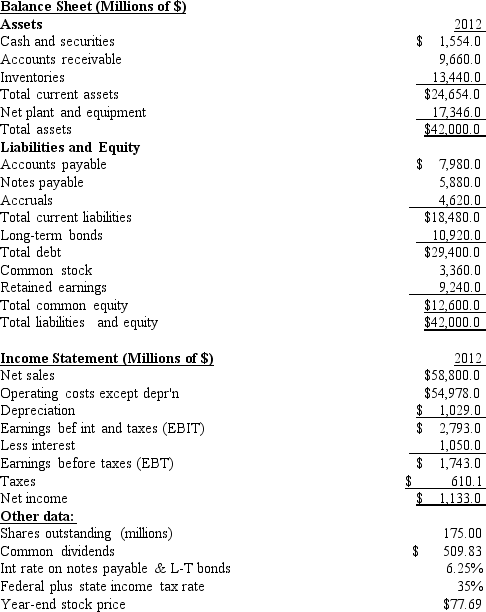

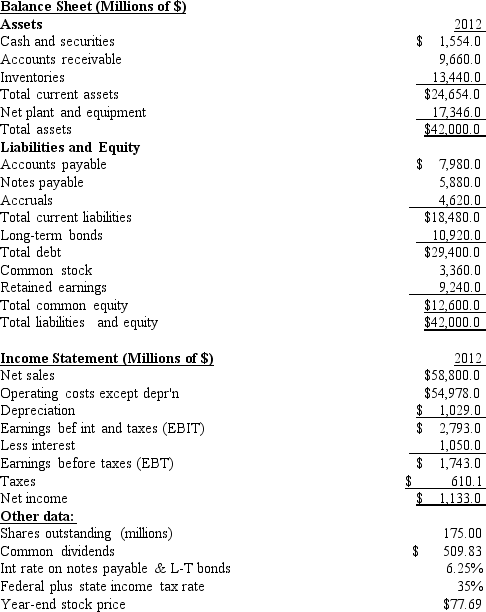

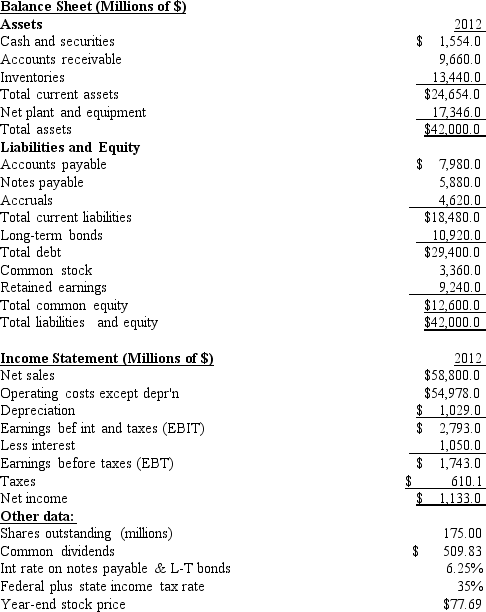

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's cash flow per share?

-Refer to Exhibit 3.1.What is the firm's cash flow per share?

A) $10.06

B) $10.59

C) $11.15

D) $11.74

E) $12.35

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amram Company's current ratio is 1.9.Considered alone,which of the following actions would reduce the company's current ratio?

A) Use cash to reduce accounts payable.

B) Borrow using short-term notes payable and use the proceeds to reduce accruals.

C) Borrow using short-term notes payable and use the proceeds to reduce long-term debt.

D) Use cash to reduce accruals.

E) Use cash to reduce short-term notes payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

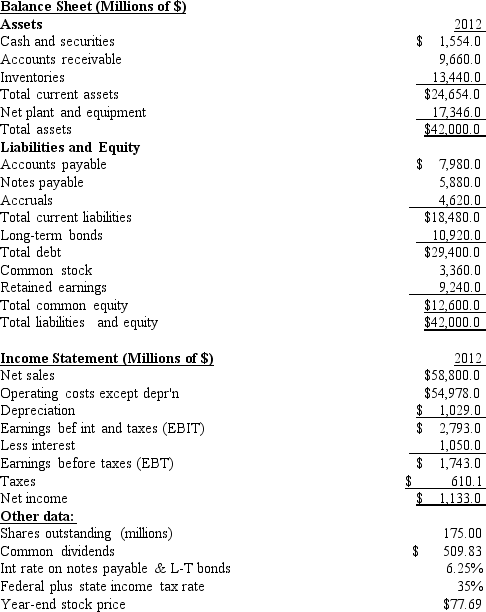

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's total assets turnover?

-Refer to Exhibit 3.1.What is the firm's total assets turnover?

A) 0.90

B) 1.12

C) 1.40

D) 1.68

E) 2.02

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cordelion Communications is considering issuing new common stock and using the proceeds to reduce its outstanding debt.The stock issue would have no effect on total assets,the interest rate Cordelion pays,EBIT,or the tax rate.Which of the following is likely to occur if the company goes ahead with the stock issue?

A) The times interest earned ratio will decrease.

B) The ROA will decline.

C) Taxable income will decrease.

D) The tax bill will increase.

E) Net income will decrease.

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is one,but not the only,indication of a firm's ability to meet its long-term and short-term debt obligations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

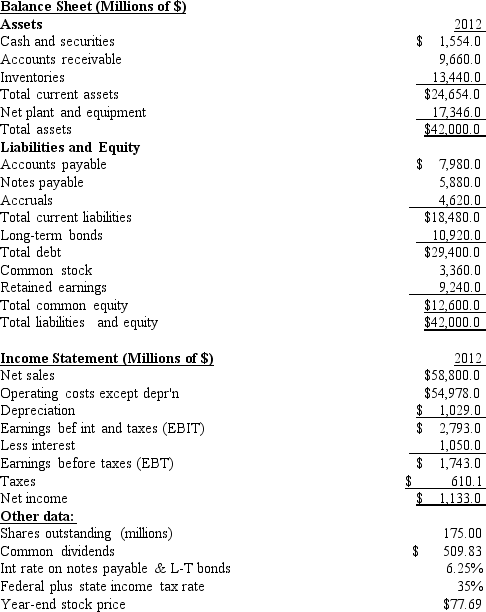

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's equity multiplier?

-Refer to Exhibit 3.1.What is the firm's equity multiplier?

A) 3.33

B) 3.50

C) 3.68

D) 3.86

E) 4.05

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bostian,Inc.has total assets of $625,000.Its total debt outstanding is $185,000.The Board of Directors has directed the CFO to move towards a debt-to-assets ratio of 55%.How much debt must the company add or subtract to achieve the target debt ratio?

A) $158,750

B) $166,688

C) $175,022

D) $183,773

E) $192,962

Correct Answer

verified

Correct Answer

verified

Multiple Choice

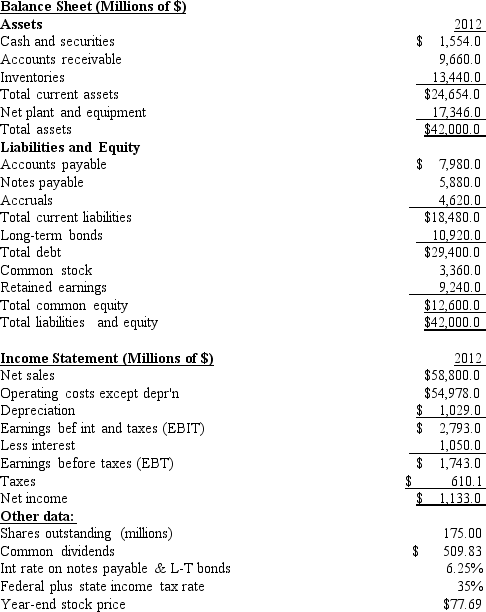

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's TIE?

-Refer to Exhibit 3.1.What is the firm's TIE?

A) 1.94

B) 2.15

C) 2.39

D) 2.66

E) 2.93

Correct Answer

verified

Correct Answer

verified

True/False

Profitability ratios show the combined effects of liquidity,asset management,and debt management on operating results.

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio and inventory turnover ratios both help us measure the firm's liquidity.The current ratio measures the relationship of a firm's current assets to its current liabilities,while the inventory turnover ratio gives us an indication of how long it takes the firm to convert its inventory into cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nikko Corp.'s total common equity at the end of last year was $305,000 and its net income after taxes was $60,000.What was its ROE?

A) 16.87%

B) 17.75%

C) 18.69%

D) 19.67%

E) 20.66%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lindley Corp.'s stock price at the end of last year was $33.50,and its book value per share was $25.00.What was its market/book ratio?

A) 1.34

B) 1.41

C) 1.48

D) 1.55

E) 1.63

Correct Answer

verified

Correct Answer

verified

True/False

High current and quick ratios always indicate that a firm is managing its liquidity position well.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Central Chemicals had sales of $205,000,assets of $127,500,a profit margin of 5.3%,and an equity multiplier of 1.2.The CFO believes that the company could reduce its assets by $21,000 without affecting either sales or costs.Had it reduced its assets in this amount,and had the debt-to-assets ratio,sales,and costs remained constant,by how much would the ROE have changed?

A) 1.81%

B) 2.02%

C) 2.22%

D) 2.44%

E) 2.68%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's ROA?

-Refer to Exhibit 3.1.What is the firm's ROA?

A) 2.70%

B) 2.97%

C) 3.26%

D) 3.59%

E) 3.95%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stewart Inc.'s latest EPS was $3.50,its book value per share was $22.75,it had 215,000 shares outstanding,and its debt-to-assets ratio was 46%.How much debt was outstanding?

A) $3,393,738

B) $3,572,356

C) $3,760,375

D) $3,958,289

E) $4,166,620

Correct Answer

verified

Correct Answer

verified

True/False

One problem with ratio analysis is that relationships can be manipulated.For example,we know that if our current ratio is less than 1.0,then using some of our cash to pay off some of our current liabilities would cause the current ratio to increase and thus make the firm look stronger.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's ROE?

-Refer to Exhibit 3.1.What is the firm's ROE?

A) 8.54%

B) 8.99%

C) 9.44%

D) 9.91%

E) 10.41%

Correct Answer

verified

Correct Answer

verified

True/False

Determining whether a firm's financial position is improving or deteriorating requires analyzing more than the ratios for a given year.Trend analysis is one method of measuring changes in a firm's performance over time.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 104

Related Exams