A) to help managers control operations

B) to help managers isolate problems

C) to project production

D) to help managers improve operations

Correct Answer

verified

Correct Answer

verified

Short Answer

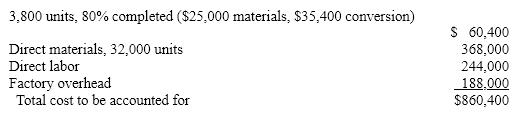

The inventory at June 1 and costs charged to Work in Process-Department 60 during June are as follows:  During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units which were 40% completed. Inventories are costed by the average cost method and all materials are added at the beginning of the process.

Determine the following, presenting your computations:

(a) Equivalent units of production for conversion cost

(b) Conversion cost per equivalent unit and material cost per equivalent unit.

(c) Total and unit cost of finished goods completed in the current period

(d) Total cost of work in process inventory at June 30

During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units which were 40% completed. Inventories are costed by the average cost method and all materials are added at the beginning of the process.

Determine the following, presenting your computations:

(a) Equivalent units of production for conversion cost

(b) Conversion cost per equivalent unit and material cost per equivalent unit.

(c) Total and unit cost of finished goods completed in the current period

(d) Total cost of work in process inventory at June 30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the manufacture of 10,000 units of a product, direct materials cost incurred was $165,000, direct labor cost incurred was $105,000, and applied factory overhead was $53,000. What is the total conversion cost?

A) $218,000

B) $158,000

C) $323,000

D) $53,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following businesses would a process cost system be appropriate?

A) boat repair service

B) shampoo manufacturer

C) dressmaker

D) custom furniture manufacturer

Correct Answer

verified

Correct Answer

verified

True/False

If the costs for direct materials, direct labor, and factory overhead were $60,000, $35,000, and $25,000, respectively, for 20,000 equivalent units of production, the conversion cost per equivalent unit was $6.

Correct Answer

verified

Correct Answer

verified

True/False

Companies recognizing the need to simultaneously produce products with high quality, low cost, and instant availability have adopted a just-in-time processing philosophy.

Correct Answer

verified

Correct Answer

verified

True/False

The amount journalized showing the cost added to finished goods is taken from the cost of production report.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two categories of cost comprising conversion costs are

A) direct labor and indirect labor

B) direct labor and factory overhead

C) factory overhead and direct materials

D) direct labor and direct materials

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department F had 4,000 units in Work in Process that were 40% completed at the beginning of the period at a cost of $12,500. Of the $12,500, $8,000 was for material and $4,500 was for conversion costs. 14,000 units of direct materials were added during the period at a cost of $28,700. 15,000 units were completed during the period, and 3,000 units were 75% completed at the end of the period. All materials are added at the beginning of the process. Direct labor was $32,450 and factory overhead was $18,710. If the average cost method is used, the materials cost per unit (to the nearest cent) would be

A) $2.04

B) $1.59

C) $1.91

D) $2.00

Correct Answer

verified

Correct Answer

verified

True/False

When a process cost accounting system records the purchase of materials, the Materials account is credited.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

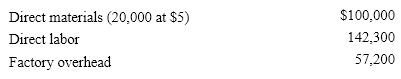

Department J had no work in process at the beginning of the period; 18,000 units were completed during the period; and 2,000 units were 30% completed at the end of the period. The following manufacturing costs were debited to the departmental work in process account during the period (Assume the company uses FIFO and rounds cost per unit to two decimal places) :  Assuming that all direct materials are placed in process at the beginning of production, what is the total cost of the 18,000 units completed during the period?

Assuming that all direct materials are placed in process at the beginning of production, what is the total cost of the 18,000 units completed during the period?

A) $256,500

B) $199,500

C) $299,500

D) $269,550

Correct Answer

verified

Correct Answer

verified

True/False

The first step in determining the cost of goods completed and ending inventory valuation using process costing is to calculate equivalent units of production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a process cost system, the cost of completed production in Department A is transferred to Department B by which of the following entries?

A) debit Work in Process-Dept. B; credit Work in Process-Dept. A

B) debit Work in Process-Dept. B; credit Finished Goods-Dept. A

C) debit Work in Process-Dept. B; credit Cost of Goods Sold-Dept. A

D) debit Finished Goods-Dept. A; credit Work in Process-Dept. B

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would use a process costing system?

A) custom home builder

B) custom helicopter manufacturer

C) graduation photographer

D) lumber mill

Correct Answer

verified

Correct Answer

verified

Multiple Choice

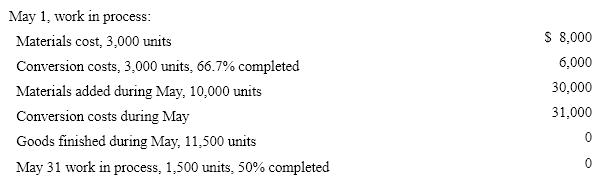

The debits to Work in Process-Assembly Department for May, together with data concerning production, are as follows:  All direct materials are placed in process at the beginning of the process and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for May is

All direct materials are placed in process at the beginning of the process and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for May is

A) $3.00

B) $3.80

C) $2.92

D) $2.31

Correct Answer

verified

Correct Answer

verified

True/False

The FIFO method separates work done on beginning inventory in the previous period from work done on it in the current period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

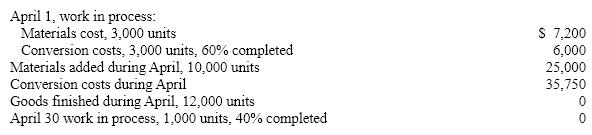

The debits to Work in Process-Assembly Department for April, together with data concerning production, are as follows:  All direct materials are added at the beginning of the process, and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for April is

All direct materials are added at the beginning of the process, and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for April is

A) $2.48

B) $2.08

C) $2.50

D) $5.25

Correct Answer

verified

Correct Answer

verified

True/False

All costs of the processes in a process costing system ultimately pass through the Cost of Goods Sold account.

Correct Answer

verified

Correct Answer

verified

Short Answer

The cost of energy consumed in producing good units in the Bottling Department of Mountain Springs Water Company was $36,850 and $39,060 for June and July, respectively. The number of equivalent units produced in June and July was 55,000 and 62,000 liters, respectively. Evaluate the change in the cost of energy between the two months.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department F had 4,000 units in Work in Process that were 40% completed at the beginning of the period at a cost of $12,500. Of the $12,500, $8,000 was for material and $4,500 was for conversion costs. 14,000 units of direct materials were added during the period at a cost of $28,700. 15,000 units were completed during the period, and 3,000 units were 75% completed at the end of the period. All materials are added at the beginning of the process. Direct labor was $32,450 and factory overhead was $18,710. If the average cost method is used, the conversion cost per unit (to the nearest cent) would be

A) $3.71

B) $2.84

C) $2.97

D) $3.23

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 182

Related Exams