A) $0.20 trillion.

B) $1 trillion.

C) $0.5 trillion.

D) $0.25 trillion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is emphasized by supply-side economics?

A) The impact of budget deficits on interest rates and aggregate demand.

B) The impact of government spending on aggregate demand, output, and employment.

C) The impact of marginal tax rates on aggregate supply.

D) The impact of budget deficits on the rate of taxation in the future.

Correct Answer

verified

Correct Answer

verified

True/False

If the marginal propensity to consume is 0.80, the value of the spending multiplier will be 5.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Keynesian analysis of fiscal policy argues that:

A) fiscal policy should generally be expansionary except during periods of economic recession.

B) fiscal policy should generally be restrictive except during inflationary booms.

C) the federal budget should be balanced annually except during war.

D) the federal budget should be used to maintain aggregate demand at a level consistent with full employment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the marginal propensity to consume (MPC) is 0.75, and if the goal is to increase real GDP by $400 million, then by how much would government spending have to change to generate this increase in real GDP?

A) $140 million.

B) $100 million.

C) $200 million.

D) $400 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An expansionary fiscal policy may include:

A) increases in government spending.

B) discretionary increases in transfer payments.

C) reductions in taxes.

D) All of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

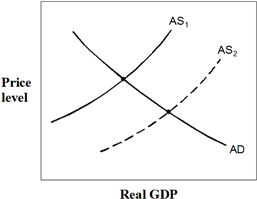

Exhibit 15-8 Aggregate demand and supply curves  In Exhibit 15-8, supply-siders claimed that the shift from AS1 to AS2 would occur if the government:

In Exhibit 15-8, supply-siders claimed that the shift from AS1 to AS2 would occur if the government:

A) increased tax rates and increased the amount of government regulation.

B) increased tax rates and decreased the amount of government regulation

C) increased tax rates and decreased the amount of government regulation.

D) decreased tax rates and decreased the amount of government regulation.

E) decreased tax rates and decreased the amount of government regulation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal propensity to consume (MPC) is computed as the change in consumption divided by the change in:

A) GDP.

B) income.

C) saving.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Laffer curve, when the tax rate is 100 percent, tax revenue will be:

A) 0.

B) at the maximum value.

C) the same as it would be at a 50 percent tax rate.

D) greater than it would be at a 50 percent tax rate.

E) the same as it would be at a 20 percent tax rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the marginal propensity to consume (MPC) is 0.80 and the government increases taxes by $100 billion. The aggregate demand curve will shift to the:

A) left by $80 billion.

B) right by $200 billion.

C) right by $400 billion.

D) left by $400 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the marginal propensity to consume (MPC) increases, the spending multiplier:

A) increases.

B) decreases.

C) remains constant.

D) becomes undefinable.

Correct Answer

verified

Correct Answer

verified

True/False

If consumption is $800 when income is $1,000, the marginal propensity to consume (MPC) must be 0.80.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

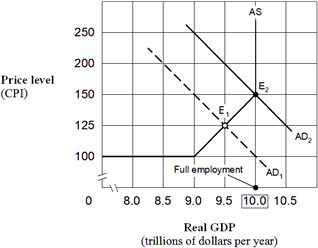

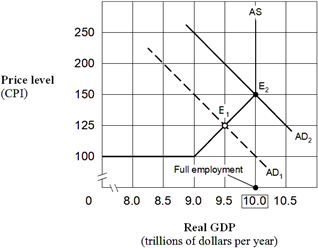

Exhibit 15-3 Aggregate demand and supply model  Suppose the economy in Exhibit 15-3 is in equilibrium at point E1 and the marginal propensity to consume (MPC) is 0.80. Following Keynesian economics, to restore full employment, the government should increase its spending by:

Suppose the economy in Exhibit 15-3 is in equilibrium at point E1 and the marginal propensity to consume (MPC) is 0.80. Following Keynesian economics, to restore full employment, the government should increase its spending by:

A) $200 billion.

B) $250 billion.

C) $500 billion.

D) $1 trillion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose inflation is a threat because the current aggregate demand curve will increase by $600 billion at any price level. If the marginal propensity to consume is 0.75, federal policymakers can follow Keynesian economics and restrain inflation by:

A) decreasing tax revenues by $600 billion.

B) decreasing government spending by $200 billion.

C) increasing tax revenues by $200 billion.

D) increasing government purchases by $150 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the marginal propensity to save (MPS) is 0.10, the value of the spending multiplier is:

A) 1.

B) 9.

C) 10.

D) 90.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The nation has its own MPC. When national income increases from $300 billion to $400 billion, national consumption increases from $300 billion to $360 billion. At Y = $400 billion, the MPC is:

A) 0.2.

B) 0.5.

C) 0.6.

D) 0.67.

E) 1.33.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Laffer curve shows the relationship between tax:

A) revenue and tax rates.

B) revenue and take-home pay.

C) revenue and government spending.

D) rates and take-home pay.

E) rates and government spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the economy is in recession and real GDP is below full employment. The marginal propensity to consume (MPC) is 0.90, and the government follows Keynesian economics by using expansionary fiscal policy to increase aggregate demand (total spending) . If an increase of $1,000 billion aggregate demand can restore full employment, the government should:

A) increase spending by $100 billion.

B) decrease spending by $790 billion.

C) increase spending by $1,000 billion.

D) increase spending by $250 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 15-3 Aggregate demand and supply model  Suppose the economy in Exhibit 15-3 is in equilibrium at point E1, and the marginal propensity to consume (MPC) is 0.80. Following Keynesian economics, to restore full employment, the government should cut taxes by:

Suppose the economy in Exhibit 15-3 is in equilibrium at point E1, and the marginal propensity to consume (MPC) is 0.80. Following Keynesian economics, to restore full employment, the government should cut taxes by:

A) $0.20 trillion.

B) $250 billion.

C) $0.50 trillion.

D) $1 trillion.

Correct Answer

verified

Correct Answer

verified

True/False

The tax multiplier is equal to the spending multiplier.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 205

Related Exams