Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the sellers of flour,then

A) buyers will bear the entire burden of the tax.

B) sellers will bear the entire burden of the tax.

C) buyers and sellers will share the burden of the tax.

D) the government will bear the entire burden of the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the buyers of a good will raise the

A) price paid by buyers and lower the equilibrium quantity.

B) price paid by buyers and raise the equilibrium quantity.

C) effective price received by sellers and lower the equilibrium quantity.

D) effective price received by sellers and raise the equilibrium quantity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is imposed on a market with inelastic demand and elastic supply,then

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) it is impossible to determine how the burden of the tax will be shared.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product,then there will be a(n)

A) downward shift of the supply curve.

B) upward shift of the supply curve.

C) movement up and to the right along the supply curve.

D) movement down and to the left along the supply curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When OPEC raised the price of crude oil in the 1970s,it caused the

A) supply of gasoline to decrease.

B) quantity of gasoline demanded to decrease.

C) equilibrium price of gasoline to increase.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a binding price ceiling from a market,then the price received by sellers will

A) decrease, and the quantity sold in the market will decrease.

B) decrease, and the quantity sold in the market will increase.

C) increase, and the quantity sold in the market will decrease.

D) increase, and the quantity sold in the market will increase.

Correct Answer

verified

Correct Answer

verified

True/False

Even though federal law mandates that workers and firms each pay half of the total FICA tax,the tax burden may not fall equally on workers and firms.

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling causes a shortage in the market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the sellers of a product,then the supply curve will

A) shift up.

B) shift down.

C) become flatter.

D) not shift.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nonbinding price floor (i) causes a surplus. (ii) causes a shortage. (iii) is set at a price above the equilibrium price. (iv) is set at a price below the equilibrium price.

A) (iii) only

B) (iv) only

C) (i) and (iii) only

D) (ii) and (iv) only

Correct Answer

verified

Correct Answer

verified

True/False

To be binding,a price ceiling must be set above the equilibrium price.

Correct Answer

verified

Correct Answer

verified

True/False

A binding price floor causes quantity supplied to be less than quantity demanded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

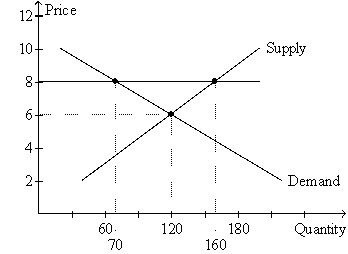

Figure 6-5

-Refer to Figure 6-5.If the horizontal line on the graph represents a price ceiling,then the price ceiling is

-Refer to Figure 6-5.If the horizontal line on the graph represents a price ceiling,then the price ceiling is

A) binding and creates a surplus of 40 units of the good.

B) binding and creates a surplus of 90 units of the good.

C) not binding but creates a surplus of 40 units of the good.

D) not binding, and there will be no surplus or shortage of the good.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

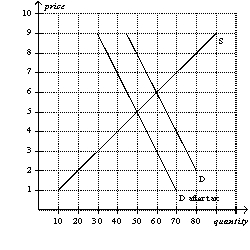

Figure 6-21

-Refer to Figure 6-22.The effective price that sellers receive after the tax is imposed is

-Refer to Figure 6-22.The effective price that sellers receive after the tax is imposed is

A) $5.

B) $6.

C) $7.

D) $8.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The incidence of a tax falls more heavily on

A) consumers than producers if demand is more inelastic than supply.

B) producers than consumers if supply is more inelastic than demand.

C) consumers than producers if supply is more elastic than demand.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-21

-Refer to Figure 6-22.As the figure is drawn,who sends the tax payment to the government?

-Refer to Figure 6-22.As the figure is drawn,who sends the tax payment to the government?

A) The buyers send the tax payment.

B) The sellers send the tax payment.

C) A portion of the tax payment is sent by the buyers, and the remaining portion is sent by the sellers.

D) The question of who sends the tax payment cannot be determined from the figure.

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling may not help all consumers,but it does not hurt any consumers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will decrease if the government

A) imposes a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) decreases a binding price floor in that market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Some states in the U.S. mandate minimum wages above the federal level.

B) Most European nations have minimum-wage laws.

C) The U.S. minimum wage is significantly higher than the minimum wages in France and the United Kingdom.

D) The U.S. Congress first instituted a minimum wage with the Fair Labor Standards Act.

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 557

Related Exams