Correct Answer

verified

Correct Answer

verified

Essay

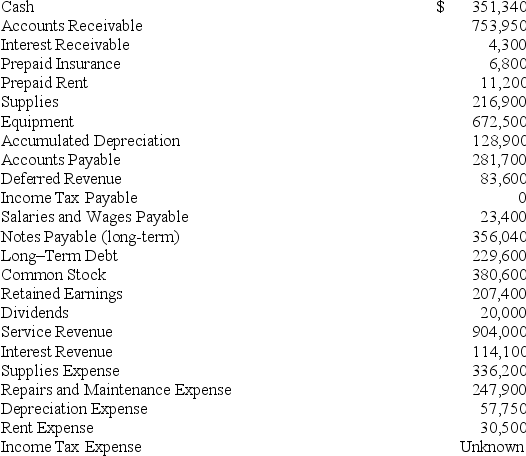

All of the accounts of the Grass is Greener Company have been adjusted as of December 31,2018,with the exception of income taxes incurred but not yet recorded.Those account balances appear below.All have normal balances.The estimated income tax rate for the company is 40%.

Required:

a.Calculate the income before income tax.

b.Calculate the income tax expense.

c.Calculate the net income.

Required:

a.Calculate the income before income tax.

b.Calculate the income tax expense.

c.Calculate the net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about an adjusted trial balance is correct?

A) It is used to prepare financial statements.

B) It is prepared to ensure assets equal liabilities.

C) It is prepared at the beginning of the year.

D) It is prepared before the adjusting journal entries have been made.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is constructed immediately prior to preparing the financial statements with the purpose of demonstrating that the accounts balance?

A) Unadjusted trial balance

B) Adjusted trial balance

C) Closing entries

D) Post-closing trial balance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Temporary Account

A) Also known as balance sheet accounts.

B) Lists the balances of all temporary and permanent accounts to provide a check on the equality of the debits and credits.

C) Lists the balances of all accounts to check that revenues equal expenses.

D) The level of profit prior to considering income tax.

E) An account that is paired with another account and acts to reduce its book value.

F) Converts some of an asset's or a liability's book value into an expense or a revenue.

G) An account that must have a zero balance after closing entries have been made.

H) Adds new values into the balance sheet and income statement accounts.

I) The amount at which an asset or liability is reported in the financial statements.

J) Lists the balances of all permanent accounts to check that debits equal credits.

K) A journal entry that transfers net income or loss to the Retained Earnings account.

L) When revenue minus expenses is a negative number.

M) Entries made to update existing accounts and record new events.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the purpose of the closing process?

A) To record transactions for the period.

B) To set all account balances to zero.

C) To prepare the accounting records so they are ready to track results for the following year.

D) To adjust for accrual and deferral transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the effects on the accounting equation from the adjustment for depreciation?

A) Total assets will increase and total stockholders' equity will increase.

B) Total assets will increase and total stockholders' equity will decrease.

C) Total assets will decrease and total stockholders' equity will decrease.

D) Total assets will decrease and total stockholders' equity will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest earned and receivable on a note receivable equals $75 for the month of March.What adjusting entry,if any,should be recorded as of March 31?

A) Debit Cash $75 and credit Interest Revenue $75.

B) Debit Interest Receivable $75 and credit Interest Revenue $75.

C) Debit Interest Revenue $75 and credit Interest Receivable $75.

D) No journal entry is needed at this time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which financial statement reports the dividends during the current accounting period?

A) Dividends are reported on the Income Statement.

B) Dividends are reported on the Statement of Retained Earnings.

C) Dividends are reported on the Balance Sheet.

D) Dividends are not reported on any of the financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Net Loss

A) Also known as balance sheet accounts.

B) Lists the balances of all temporary and permanent accounts to provide a check on the equality of the debits and credits.

C) Lists the balances of all accounts to check that revenues equal expenses.

D) The level of profit prior to considering income tax.

E) An account that is paired with another account and acts to reduce its book value.

F) Converts some of an asset's or a liability's book value into an expense or a revenue.

G) An account that must have a zero balance after closing entries have been made.

H) Adds new values into the balance sheet and income statement accounts.

I) The amount at which an asset or liability is reported in the financial statements.

J) Lists the balances of all permanent accounts to check that debits equal credits.

K) A journal entry that transfers net income or loss to the Retained Earnings account.

L) When revenue minus expenses is a negative number.

M) Entries made to update existing accounts and record new events.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of adjusting entries for income taxes is to record income taxes ________ the accounting period.

A) earned,but not yet collected,at the end of

B) accrued,but not yet paid,at the end of

C) paid during

D) deducted from employee's pay

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about adjustments is correct?

A) An accrual adjustment that increases an asset will include an increase in an expense.

B) A deferral adjustment that decreases an asset will include an increase in an expense.

C) An accrual adjustment that increases an expense will include an increase in assets.

D) A deferral adjustment that increases a contra-account will include an increase in an asset.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Prepaid Rent account is not adjusted at the end of the period,what effect will this have on the financial statements?

A) Liabilities will be overstated and net income will be understated.

B) Assets will be understated and net income will be understated.

C) Assets will be overstated and net income will be overstated.

D) Cash will be overstated and net income will be overstated.

Correct Answer

verified

Correct Answer

verified

True/False

One of the purposes of the closing entries is to bring the balances in all asset,liability,revenue,and expense accounts down to zero to start the next accounting period.

Correct Answer

verified

Correct Answer

verified

True/False

If a company forgot to record depreciation on equipment for a period,Total Assets would be overstated and Total Stockholders' Equity would be overstated on the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the adjustments have been completed,the adjusted balance in the Accumulated Depreciation account represents the:

A) depreciation for the current period.

B) total depreciation that has been recorded on the long-lived assets since their purchase.

C) carrying value of the long-lived assets.

D) decline in the market value of the long-lived assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an expense has been incurred but will be paid later,then:

A) nothing is recorded on the financial statements.

B) a liability account is created or increased and an expense is recorded.

C) an asset account is decreased or eliminated and an expense is recorded.

D) a revenue and an expense are accrued.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Accrual Adjustment

A) Also known as balance sheet accounts.

B) Lists the balances of all temporary and permanent accounts to provide a check on the equality of the debits and credits.

C) Lists the balances of all accounts to check that revenues equal expenses.

D) The level of profit prior to considering income tax.

E) An account that is paired with another account and acts to reduce its book value.

F) Converts some of an asset's or a liability's book value into an expense or a revenue.

G) An account that must have a zero balance after closing entries have been made.

H) Adds new values into the balance sheet and income statement accounts.

I) The amount at which an asset or liability is reported in the financial statements.

J) Lists the balances of all permanent accounts to check that debits equal credits.

K) A journal entry that transfers net income or loss to the Retained Earnings account.

L) When revenue minus expenses is a negative number.

M) Entries made to update existing accounts and record new events.

Correct Answer

verified

Correct Answer

verified

True/False

The adjustment for corporate income taxes is generally the first adjustment prepared.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A deferral adjusting entry that adjusts assets (such as prepaids and supplies) :

A) decreases total assets because cash is paid at the time of the adjustment.

B) expenses the amount used during the period.

C) increases total assets because costs are incurred.

D) increases total assets because cash will be received in the future.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 252

Related Exams